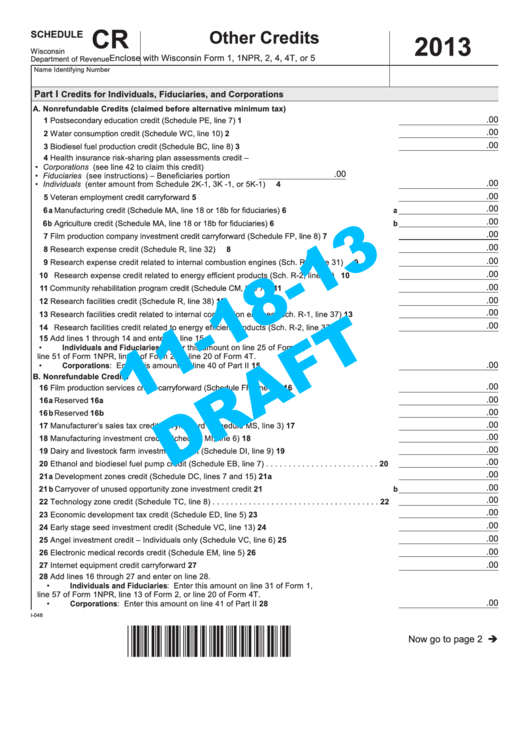

Form I-048 - Schedule Cr Draft - Other Credits - 2013

ADVERTISEMENT

CR

Other Credits

SCHEDULE

2013

Wisconsin

Enclose with Wisconsin Form 1, 1NPR, 2, 4, 4T, or 5

Department of Revenue

Name

Identifying Number

Part I

Credits for Individuals, Fiduciaries, and Corporations

A. Nonrefundable Credits (claimed before alternative minimum tax)

.00

1 Postsecondary education credit (Schedule PE, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

.00

2 Water consumption credit (Schedule WC, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

.00

3 Biodiesel fuel production credit (Schedule BC, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Health insurance risk-sharing plan assessments credit –

• Corporations (see line 42 to claim this credit)

.00

• Fiduciaries (see instructions) – Beneficiaries portion

.00

• Individuals (enter amount from Schedule 2K-1, 3K -1, or 5K-1) . . . . . . . . . . . . . . . . . . .

4

.00

5 Veteran employment credit carryforward . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.00

6a Manufacturing credit (Schedule MA, line 18 or 18b for fiduciaries) . . . . . . . . . . . . . . . . . . . . . . .

6a

.00

6b Agriculture credit (Schedule MA, line 18 or 18b for fiduciaries) . . . . . . . . . . . . . . . . . . . . . . . . . .

6b

.00

7 Film production company investment credit carryforward (Schedule FP, line 8) . . . . . . . . . . . . .

7

.00

8 Research expense credit (Schedule R, line 32) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

.00

9 Research expense credit related to internal combustion engines (Sch . R-1, line 31) . . . . . . .

9

.00

10 Research expense credit related to energy efficient products (Sch. R‑2, line 31) . . . . . . . . . . 10

.00

11 Community rehabilitation program credit (Schedule CM, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . 11

.00

12 Research facilities credit (Schedule R, line 38) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

.00

13 Research facilities credit related to internal combustion engines (Sch . R-1, line 37) . . . . . . . 13

.00

14 Research facilities credit related to energy efficient products (Sch. R‑2, line 37) . . . . . . . . . . 14

15 Add lines 1 through 14 and enter on line 15 .

• Individuals and Fiduciaries: Enter this amount on line 25 of Form 1,

line 51 of Form 1NPR, line 8 of Form 2, or line 20 of Form 4T .

.00

• Corporations: Enter this amount on line 40 of Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

B. Nonrefundable Credits

.00

16 Film production services credit carryforward (Schedule FP, line 7) . . . . . . . . . . . . . . . . . . . . . 16

.00

16a Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16a

.00

16b Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16b

.00

17 Manufacturer’s sales tax credit carryforward (Schedule MS, line 3) . . . . . . . . . . . . . . . . . . . . 17

.00

18 Manufacturing investment credit (Schedule MI, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

.00

19 Dairy and livestock farm investment credit (Schedule DI, line 9) . . . . . . . . . . . . . . . . . . . . . . 19

.00

20 Ethanol and biodiesel fuel pump credit (Schedule EB, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . 20

.00

21a Development zones credit (Schedule DC, lines 7 and 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . 21a

.00

21b Carryover of unused opportunity zone investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21b

.00

22 Technology zone credit (Schedule TC, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

.00

23 Economic development tax credit (Schedule ED, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

.00

24 Early stage seed investment credit (Schedule VC, line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . 24

.00

25 Angel investment credit – Individuals only (Schedule VC, line 6) . . . . . . . . . . . . . . . . . . . . . . 25

.00

26 Electronic medical records credit (Schedule EM, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

.00

27 Internet equipment credit carryforward . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Add lines 16 through 27 and enter on line 28 .

• Individuals and Fiduciaries: Enter this amount on line 31 of Form 1,

line 57 of Form 1NPR, line 13 of Form 2, or line 20 of Form 4T .

.00

• Corporations: Enter this amount on line 41 of Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

I-048

Now go to page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2