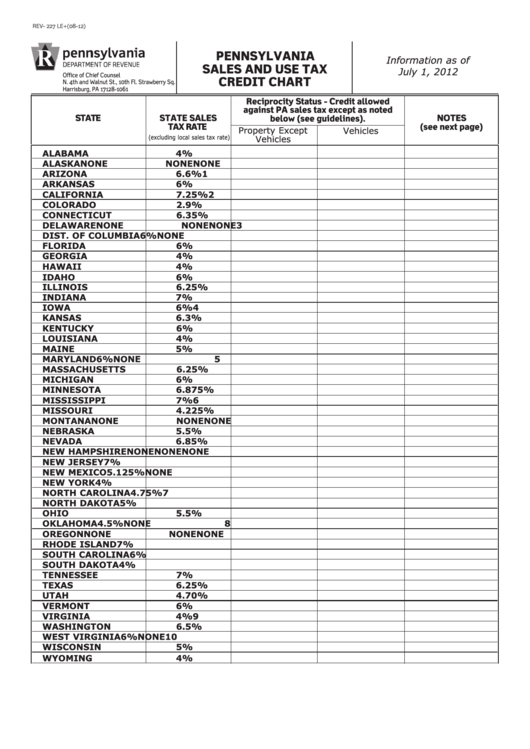

Pennsylvania Sales And Use Tax Credit Chart - 2012

ADVERTISEMENT

REV- 227 LE+(08-12)

PENNSYLVANIA

Information as of

SALES AND USE TAX

July 1, 2012

Office of Chief Counsel

CREDIT CHART

N. 4th and Walnut St., 10th Fl. Strawberry Sq.

Harrisburg, PA 17128-1061

Reciprocity Status - Credit allowed

against PA sales tax except as noted

STATE

STATE SALES

NOTES

below (see guidelines).

TAX RATE

(see next page)

Property Except

Vehicles

(excluding local sales tax rate)

Vehicles

ALABAMA

4%

ALASKA

NONE

NONE

NONE

ARIZONA

6.6%

1

ARKANSAS

6%

CALIFORNIA

7.25%

2

COLORADO

2.9%

CONNECTICUT

6.35%

DELAWARE

NONE

NONE

NONE

3

DIST. OF COLUMBIA

6%

NONE

FLORIDA

6%

GEORGIA

4%

HAWAII

4%

IDAHO

6%

ILLINOIS

6.25%

INDIANA

7%

IOWA

6%

4

KANSAS

6.3%

KENTUCKY

6%

LOUISIANA

4%

MAINE

5%

MARYLAND

6%

NONE

5

MASSACHUSETTS

6.25%

MICHIGAN

6%

MINNESOTA

6.875%

MISSISSIPPI

7%

6

MISSOURI

4.225%

MONTANA

NONE

NONE

NONE

NEBRASKA

5.5%

NEVADA

6.85%

NEW HAMPSHIRE

NONE

NONE

NONE

NEW JERSEY

7%

NEW MEXICO

5.125%

NONE

NEW YORK

4%

NORTH CAROLINA

4.75%

7

NORTH DAKOTA

5%

OHIO

5.5%

OKLAHOMA

4.5%

NONE

8

OREGON

NONE

NONE

NONE

RHODE ISLAND

7%

SOUTH CAROLINA

6%

SOUTH DAKOTA

4%

TENNESSEE

7%

TEXAS

6.25%

UTAH

4.70%

VERMONT

6%

VIRGINIA

4%

9

WASHINGTON

6.5%

WEST VIRGINIA

6%

NONE

10

WISCONSIN

5%

WYOMING

4%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2