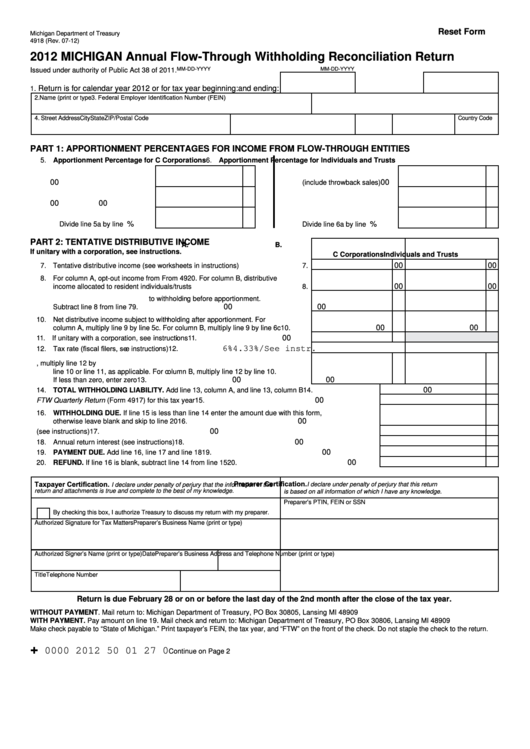

Reset Form

Michigan Department of Treasury

4918 (Rev. 07-12)

2012 MICHIGAN Annual Flow-Through Withholding Reconciliation Return

MM-DD-YYYY

MM-DD-YYYY

Issued under authority of Public Act 38 of 2011.

Return is for calendar year 2012 or for tax year beginning:

and ending:

1.

3. Federal Employer Identification Number (FEIN)

2. Name (print or type

4. Street Address

City

State

ZIP/Postal Code

Country Code

PART 1: APPORTIONMENT PERCENTAGES FOR INCOME FROM FlOW-THROuGH ENTITIES

5. Apportionment Percentage for C Corporations

6. Apportionment Percentage for Individuals and Trusts

a. Michigan sales

00

00

a. Michigan sales .........................

(include throwback sales) ........

00

00

b. Total sales................................

b. Total sales................................

c. Apportionment percentage.

c. Apportionment percentage.

%

%

Divide line 5a by line 5b...........

Divide line 6a by line 6b...........

PART 2: TENTATIvE DISTRIBuTIvE INCOME

A.

B.

If unitary with a corporation, see instructions.

C Corporations

Individuals and Trusts

00

00

7. Tentative distributive income (see worksheets in instructions) ............................

7.

8. For column A, opt-out income from From 4920. For column B, distributive

00

00

income allocated to resident individuals/trusts ....................................................

8.

9. Net distributive income subject to withholding before apportionment.

00

00

Subtract line 8 from line 7 ...................................................................................

9.

10. Net distributive income subject to withholding after apportionment. For

00

00

column A, multiply line 9 by line 5c. For column B, multiply line 9 by line 6c .......

10.

00

11. If unitary with a corporation, see instructions .....................................................

11.

12. Tax rate (fiscal filers, see instructions) ................................................................

6%

4.33%/See instr.

12.

13. Withholding amount to be distributed. For column A, multiply line 12 by

line 10 or line 11, as applicable. For column B, multiply line 12 by line 10.

00

00

If less than zero, enter zero ................................................................................

13.

00

14. TOTAl WITHHOlDING lIABIlITy. Add line 13, column A, and line 13, column B ................................ 14.

00

15. Withholding paid on FTW Quarterly Return (Form 4917) for this tax year ............................................. 15.

16. WITHHOlDING DuE. If line 15 is less than line 14 enter the amount due with this form,

00

otherwise leave blank and skip to line 20 ............................................................................................... 16.

00

17. Annual return penalty (see instructions) ................................................................................................. 17.

00

18. Annual return interest (see instructions) ................................................................................................. 18.

00

19. PAyMENT DuE. Add line 16, line 17 and line 18 ................................................................................... 19.

00

20. REFuND. If line 16 is blank, subtract line 14 from line 15 ...................................................................... 20.

Taxpayer Certification.

Preparer Certification.

I declare under penalty of perjury that the information in this

I declare under penalty of perjury that this return

return and attachments is true and complete to the best of my knowledge.

is based on all information of which I have any knowledge.

Preparer’s PTIN, FEIN or SSN

By checking this box, I authorize Treasury to discuss my return with my preparer.

Authorized Signature for Tax Matters

Preparer’s Business Name (print or type)

Authorized Signer’s Name (print or type)

Date

Preparer’s Business Address and Telephone Number (print or type)

Title

Telephone Number

Return is due February 28 or on or before the last day of the 2nd month after the close of the tax year.

WITHOuT PAyMENT. Mail return to: Michigan Department of Treasury, PO Box 30805, Lansing MI 48909

WITH PAyMENT. Pay amount on line 19. Mail check and return to: Michigan Department of Treasury, PO Box 30806, Lansing MI 48909

Make check payable to “State of Michigan.” Print taxpayer’s FEIN, the tax year, and “FTW” on the front of the check. Do not staple the check to the return.

+

0000 2012 50 01 27 0

Continue on Page 2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8