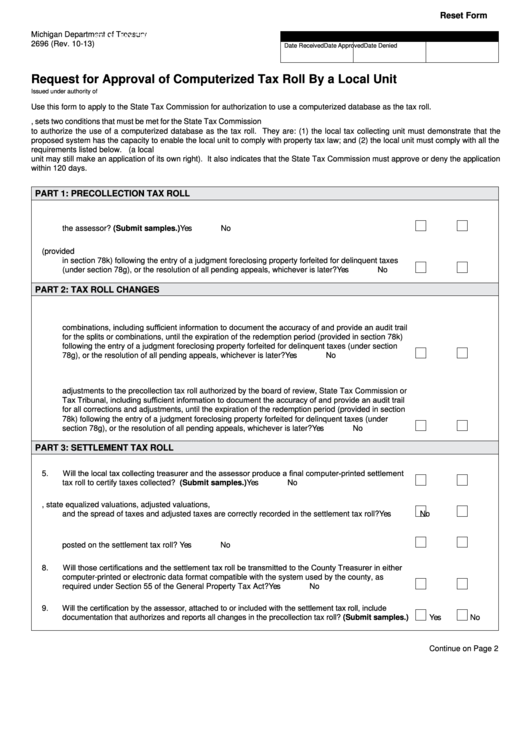

Reset Form

Michigan Department of Treasury

State tax CommiSSion USe only

2696 (Rev. 10-13)

Date Received

Date Approved

Date Denied

Request for approval of Computerized tax Roll By a local Unit

Issued under authority of P.A. 112 of 1990. Filing is voluntary.

Use this form to apply to the State Tax Commission for authorization to use a computerized database as the tax roll.

P.A. 112 of 1990 as amended by P.A. 415 of 1994 and P.A. 505 of 2002, sets two conditions that must be met for the State Tax Commission

to authorize the use of a computerized database as the tax roll. They are: (1) the local tax collecting unit must demonstrate that the

proposed system has the capacity to enable the local unit to comply with property tax law; and (2) the local unit must comply with all the

requirements listed below. P.A. 505 of 2002 authorizes the County Treasurer to make the application on behalf of the local units (a local

unit may still make an application of its own right). It also indicates that the State Tax Commission must approve or deny the application

within 120 days.

PaRt 1: PReColleCtion tax Roll

1.

Will an original precollection tax roll be printed from the computerized data base and warranted by

the assessor? (Submit samples.) .........................................................................................................

Yes

No

2.

Will the assessor maintain the printed precollection tax roll until the redemption period (provided

in section 78k) following the entry of a judgment foreclosing property forfeited for delinquent taxes

(under section 78g), or the resolution of all pending appeals, whichever is later? .................................

Yes

No

PaRt 2: tax Roll CHanGeS

3.

Will the assessor prepare and maintain a separate computer printout of all parcel splits and

combinations, including sufficient information to document the accuracy of and provide an audit trail

for the splits or combinations, until the expiration of the redemption period (provided in section 78k)

following the entry of a judgment foreclosing property forfeited for delinquent taxes (under section

78g), or the resolution of all pending appeals, whichever is later? .........................................................

Yes

No

4.

Will the assessor prepare and maintain a separate computer printout of all corrections and

adjustments to the precollection tax roll authorized by the board of review, State Tax Commission or

Tax Tribunal, including sufficient information to document the accuracy of and provide an audit trail

for all corrections and adjustments, until the expiration of the redemption period (provided in section

78k) following the entry of a judgment foreclosing property forfeited for delinquent taxes (under

section 78g), or the resolution of all pending appeals, whichever is later? ............................................

Yes

No

PaRt 3: Settlement tax Roll

Will the local tax collecting treasurer and the assessor produce a final computer-printed settlement

5.

tax roll to certify taxes collected? (Submit samples.)...........................................................................

Yes

No

6.

Will the assessor certify that taxable valuations, state equalized valuations, adjusted valuations,

and the spread of taxes and adjusted taxes are correctly recorded in the settlement tax roll? ..............

Yes

No

7.

Will the local tax collecting treasurer certify the delinquent taxes and that all tax collections are

posted on the settlement tax roll?...........................................................................................................

Yes

No

Will those certifications and the settlement tax roll be transmitted to the County Treasurer in either

8.

computer-printed or electronic data format compatible with the system used by the county, as

required under Section 55 of the General Property Tax Act? .................................................................

Yes

No

Will the certification by the assessor, attached to or included with the settlement tax roll, include

9.

documentation that authorizes and reports all changes in the precollection tax roll? (Submit samples.)

Yes

No

Continue on Page 2

1

1 2

2 3

3