Income-Tax Notification - India Ministry Of Finance

ADVERTISEMENT

7

II

(i)

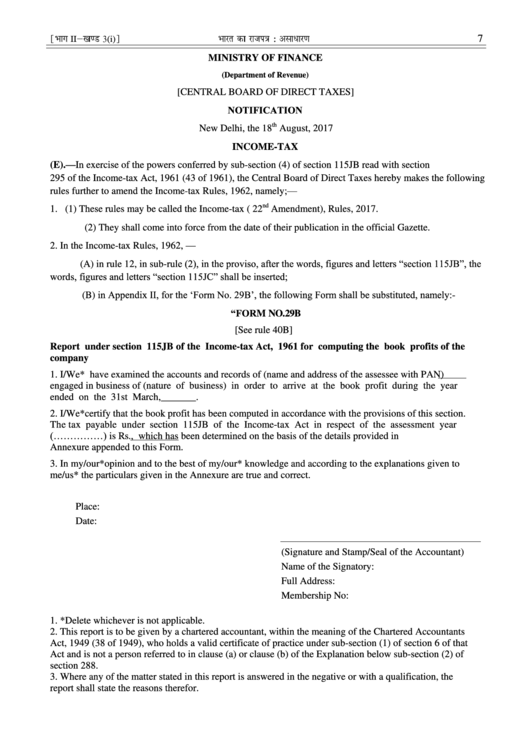

MINISTRY OF FINANCE

(Department of Revenue)

[CENTRAL BOARD OF DIRECT TAXES]

NOTIFICATION

th

New Delhi, the 18

August, 2017

INCOME-TAX

G.S.R. 1028(E).—In exercise of the powers conferred by sub-section (4) of section 115JB read with section

295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following

rules further to amend the Income-tax Rules, 1962, namely;—

nd

1.

(1) These rules may be called the Income-tax ( 22

Amendment), Rules, 2017.

(2) They shall come into force from the date of their publication in the official Gazette.

In the Income-tax Rules, 1962, —

2.

(A) in rule 12, in sub-rule (2), in the proviso, after the words, figures and letters “section 115JB”, the

words, figures and letters “section 115JC” shall be inserted;

(B) in Appendix II, for the ‘Form No. 29B’, the following Form shall be substituted, namely:-

“FORM NO.29B

[See rule 40B]

Report under section 115JB of the Income-tax Act, 1961 for computing the book profits of the

company

1. I/We* have examined the accounts and records of (name and address of the assessee with PAN)

engaged in business of (nature of business) in order to arrive at the book profit during the year

ended on the 31st March,_______.

2. I/We*certify that the book profit has been computed in accordance with the provisions of this section.

The tax payable under section 115JB of the Income-tax Act in respect of the assessment year

(……………) is Rs.,

which has been determined on the basis of the details provided in

Annexure appended to this Form.

3. In my/our*opinion and to the best of my/our* knowledge and according to the explanations given to

me/us* the particulars given in the Annexure are true and correct.

Place:

Date:

(Signature and Stamp/Seal of the Accountant)

Name of the Signatory:

Full Address:

Membership No:

1. *Delete whichever is not applicable.

2. This report is to be given by a chartered accountant, within the meaning of the Chartered Accountants

Act, 1949 (38 of 1949), who holds a valid certificate of practice under sub-section (1) of section 6 of that

Act and is not a person referred to in clause (a) or clause (b) of the Explanation below sub-section (2) of

section 288.

3. Where any of the matter stated in this report is answered in the negative or with a qualification, the

report shall state the reasons therefor.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5