Form Acd-31050 - Application For Nontaxable Transaction Certificates

ADVERTISEMENT

ACD--31050

New Mexico Taxation and Revenue Department

REV. 4-2013

P.O Box 5557

Santa Fe, New Mexico 87502-5557

INSTRUCTIONS FOR NONTAXABLE TRANSACTION CERTIFICATES

REQUIREMENTS: All New Mexico sellers/lessors who wish to execute NTTCs are required to: 1) register with the Taxation and Revenue Department, 2)

complete the Application for Nontaxable Transaction Certificates, and 3) be in compliance with the department. Sellers/lessors are in compliance with the

Department when: 1) all required returns have been filed: 2) they are not a delinquent taxpayer, and 3) their CRS business registration is complete.

CAUTION: Fraudulent statements made to obtain certificates, or fraudulent use of certificates received pursuant to this application with intent to evade or

defeat the tax may subject the person or business to a fine of not more than ten thousand dollars ($10,000) or imprisonment for not more than five (5) years

or both (Sections 7-1-72 NMSA 1978 and 7-1-73 NMSA 1978). In addition, misuse of these certificates may result in loss of the privilege to execute NTTCs

for up to one (1) year (Section 7-9-43 NMSA 1978).

NTTC DESCRIPTIONS AND AUTHORIZED USES: See reverse for complete descriptions of NTTC types.

•

Type 2: for tangibles for resale, lease or re-lease, or for purchase by manufacturer

•

Type 5: for services for resale, for export, or for services performed on manufactured products

•

Type 6: for construction contractor’s purchase of construction materials, construction services, construction-related services or for the lease of

construction equipment

•

Type 9: for purchase of tangible personal property by New Mexico or United States governments, 501(c)(3) organization, or credit unions

•

Type 10: for purchase or lease of tangible personal property or services by a person who holds an interest in a qualified generating facility

•

Type 11: for purchase of tangible personal property that is consumed in the manufacturing process

1

•

Type 12: for purchase of utilities that are consumed in the manufacturing process

1

•

Type 15: for tangible personal property purchased by qualified federal contractors

•

Type 16: for sales of property, services and leases to qualified film production companies, accredited foreign missions, and their accredited members

•

Type OSB NTTCs are issued to registered New Mexico sellers/lessors to execute to Out-of-State Buyers who are not registered with the Depart-

ment, but who will resell tangible personal property outside of New Mexico

An alternative application form must be completed to request the Type 11 and 12 NTTCs. Please complete Form RPD-41378, Application for Type 11 or

1

12 Nontaxable Transaction Certificates, available online at or from your local district office.

NTTC-NET: The Department has developed NTTC-NET, a paperless system on the web, to expedite the processing of Nontaxable Transaction Certificates

(NTTCs). The Department encourages all taxpayers to use NTTC-NET to apply for, execute, record, and request additional NTTCs online. If you know the

seller’s/lessor’s CRS identification number to whom you wish to execute a NTTC, you may immediately execute the NTTC online. When the recipient’s

CRS identification number is known, there is no limit to executing NTTCs on NTTC-NET, but you may request up to five (5) NTTCs to be executed at a

later date if the seller’s/lessor’s name and CRS identification number is not known. You must first record executed NTTC information before applying for

additional NTTCs to be executed at a later date.

For instructions on how to use NTTC-NET, go to

IF YOU DO NOT HAVE ACCESS TO NTTC-NET COMPLETE THE APPLICATION FORM BELOW:

HOW TO APPLY OR REORDER: If you do not yet have the name and CRS identification number of the vendor to whom you wish to execute the NTTC,

complete the application below, providing all information requested. Mail the application to the New Mexico Taxation and Revenue Department, P.O. Box

5557, Santa Fe, New Mexico 87502-5557, or you may deliver it to your local district office.

NOTE: You may reorder additional NTTCs ONLY after your executed NTTCs have been recorded with the Department. To record your executed NTTCs,

submit the Nontaxable Transaction Certificate Report or record them online. The Department will only issue a maximum of five (5) NTTCs to be

executed at a later date.

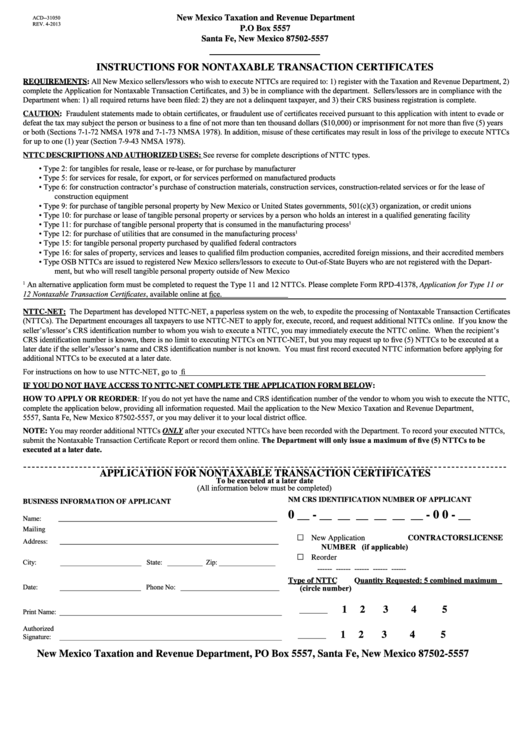

APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES

To be executed at a later date

(All information below must be completed)

NM CRS IDENTIFICATION NUMBER OF APPLICANT

BUSINESS INFORMATION OF APPLICANT

0 __ - __ __ __ __ __ __ - 0 0 - __

Name:

______________________________________________________________

Mailing

… New Application

CONTRACTORS LICENSE

Address:

______________________________________________________________

NUMBER (if applicable)

… Reorder

City:

_______________________ State: __________ Zip: ________________

------ ------ ------ ------ ------

Quantity Requested: 5 combined maximum

Type of NTTC

Date:

_______________________ Phone No: ____________________________

(circle number)

1

2

3

4

5

Print Name: _______________________________________________________________

________

Authorized

1

2

3

4

5

Signature:

_______________________________________________________________

________

New Mexico Taxation and Revenue Department, PO Box 5557, Santa Fe, New Mexico 87502-5557

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2