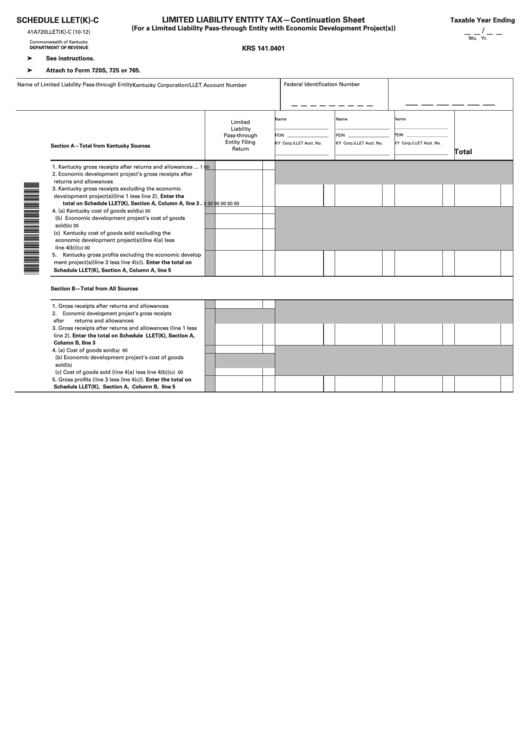

Schedule Llet(K)-C - Limited Liability Entity Tax-Continuation Sheet (For A Limited Liability Pass-Through Entity With Economic Development Project(S))

ADVERTISEMENT

LIMITED LIABILITY ENTITY TAX—Continuation Sheet

SCHEDULE LLET(K)-C

Taxable Year Ending

_ _

_ _

(For a Limited Liability Pass-through Entity with Economic Development Project(s))

/

41A720LLET(K)-C (10-12)

Mo.

Yr.

Commonwealth of Kentucky

KRS 141.0401

DEPARTMENT OF REVENUE

➤ See instructions.

➤ Attach to Form 720S, 725 or 765.

Name of Limited Liability Pass-through Entity

Federal Identification Number

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

_ _ _ _ _ _ _ _ _

Name

Name

Name

Limited

__________________________

__________________________

__________________________

Liability

Pass-through

FEIN ____________________

FEIN ____________________

FEIN ____________________

Entity Filing

KY Corp./LLET Acct. No.

KY Corp./LLET Acct. No.

KY Corp./LLET Acct. No.

Section A—Total from Kentucky Sources

Return

Total

__________________________

__________________________

__________________________

1. Kentucky gross receipts after returns and allowances ...

1

00

2. Economic development project’s gross receipts after

returns and allowances

.............................................................

2

00

3. Kentucky gross receipts excluding the economic

development project(s)(line 1 less line 2). Enter the

total on Schedule LLET(K), Section A, Column A, line 3

..

3

00

00

00

00

00

4. (a) Kentucky cost of goods sold

.......................................... 4(a)

00

(b) Economic development project’s cost of goods

sold

......................................................................................... 4(b)

00

(c)

Kentucky cost of goods sold excluding the

economic development project(s)(line 4(a) less

line 4(b))

................................................................................ 4(c)

00

5. Kentucky gross profits excluding the economic develop-

ment project(s)(line 3 less line 4(c)). Enter the total on

Schedule LLET(K), Section A, Column A, line 5

................

5

00

00

00

00

00

Section B—Total from All Sources

1. Gross receipts after returns and allowances

......................

1

00

2. Economic development project’s gross receipts

after returns and allowances

....................................................

2

3. Gross receipts after returns and allowances (line 1 less

line 2). Enter the total on Schedule LLET(K), Section A,

Column B, line 3

..........................................................................

3

00

00

00

00

00

4. (a) Cost of goods sold

............................................................. 4(a)

00

(b) Economic development project’s cost of goods

sold

......................................................................................... 4(b)

(c)

Cost of goods sold (line 4(a) less line 4(b))

................ 4(c)

00

5. Gross profits (line 3 less line 4(c)). Enter the total on

Schedule LLET(K), Section A, Column B, line 5

.............

5

00

00

00

00

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3