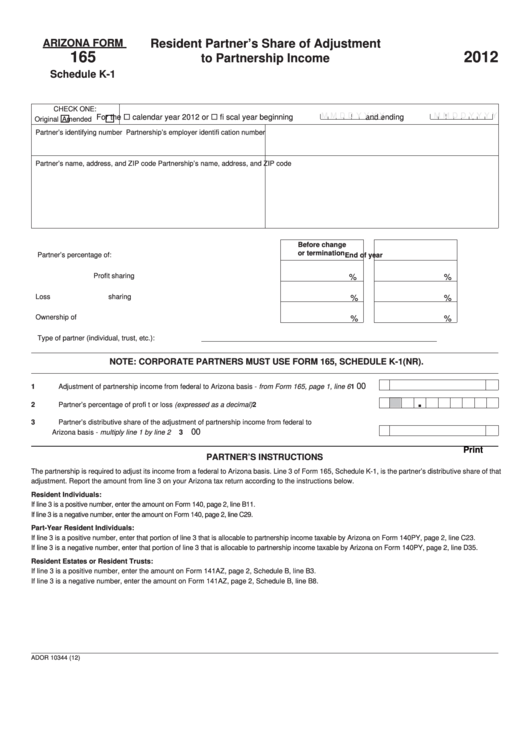

ARIZONA FORM

Resident Partner’s Share of Adjustment

165

2012

to Partnership Income

Schedule K-1

CHECK ONE:

M M D D Y Y Y Y

M M D D Y Y Y Y

For the

calendar year 2012 or

fi scal year beginning

and ending

.

Original

Amended

Partner’s identifying number

Partnership’s employer identifi cation number

Partner’s name, address, and ZIP code

Partnership’s name, address, and ZIP code

Before change

or termination

Partner’s percentage of:

End of year

Profi t sharing ........................................................................

%

%

Loss sharing .........................................................................

%

%

Ownership of capital.............................................................

%

%

Type of partner (individual, trust, etc.):

NOTE: CORPORATE PARTNERS MUST USE FORM 165, SCHEDULE K-1(NR).

00

1

Adjustment of partnership income from federal to Arizona basis - from Form 165, page 1, line 6 ................

1

.

2

Partner’s percentage of profi t or loss (expressed as a decimal) ...................................................................

2

3

Partner’s distributive share of the adjustment of partnership income from federal to

00

Arizona basis - multiply line 1 by line 2 ..........................................................................................................

3

Print

PARTNER’S INSTRUCTIONS

The partnership is required to adjust its income from a federal to Arizona basis. Line 3 of Form 165, Schedule K-1, is the partner’s distributive share of that

adjustment. Report the amount from line 3 on your Arizona tax return according to the instructions below.

Resident Individuals:

If line 3 is a positive number, enter the amount on Form 140, page 2, line B11.

If line 3 is a negative number, enter the amount on Form 140, page 2, line C29.

Part-Year Resident Individuals:

If line 3 is a positive number, enter that portion of line 3 that is allocable to partnership income taxable by Arizona on Form 140PY, page 2, line C23.

If line 3 is a negative number, enter that portion of line 3 that is allocable to partnership income taxable by Arizona on Form 140PY, page 2, line D35.

Resident Estates or Resident Trusts:

If line 3 is a positive number, enter the amount on Form 141AZ, page 2, Schedule B, line B3.

If line 3 is a negative number, enter the amount on Form 141AZ, page 2, Schedule B, line B8.

ADOR 10344 (12)

1

1