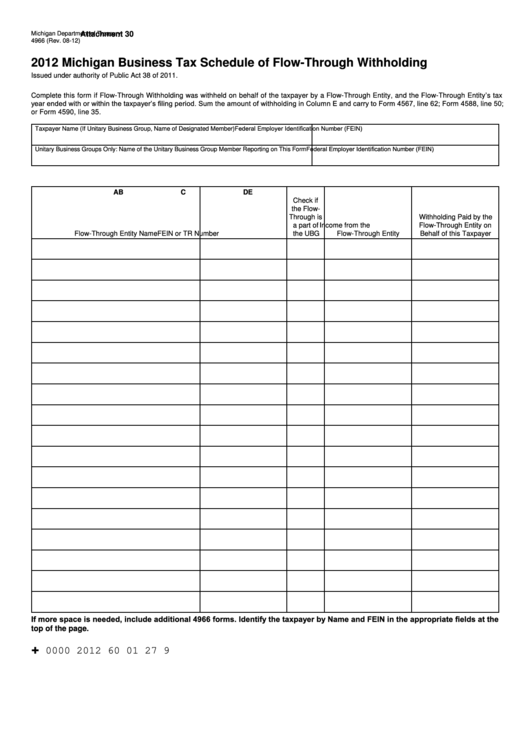

Form 4966 - Michigan Business Tax Schedule Of Flow-Through Withholding - 2012

ADVERTISEMENT

Michigan Department of Treasury

Attachment 30

4966 (Rev. 08-12)

2012 Michigan Business Tax Schedule of Flow-Through Withholding

Issued under authority of Public Act 38 of 2011.

Complete this form if Flow-Through Withholding was withheld on behalf of the taxpayer by a Flow-Through Entity, and the Flow-Through Entity’s tax

year ended with or within the taxpayer’s filing period. Sum the amount of withholding in Column E and carry to Form 4567, line 62; Form 4588, line 50;

or Form 4590, line 35.

Federal Employer Identification Number (FEIN)

Taxpayer Name (If Unitary Business Group, Name of Designated Member)

Federal Employer Identification Number (FEIN)

Unitary Business Groups Only: Name of the Unitary Business Group Member Reporting on This Form

A

B

C

D

E

Check if

the Flow-

Through is

Withholding Paid by the

a part of

Income from the

Flow-Through Entity on

Flow-Through Entity Name

FEIN or TR Number

the UBG

Flow-Through Entity

Behalf of this Taxpayer

If more space is needed, include additional 4966 forms. Identify the taxpayer by Name and FEIN in the appropriate fields at the

top of the page.

+

0000 2012 60 01 27 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3