Form 3240 - Michigan Supplemental Motor Carrier Tax Return

ADVERTISEMENT

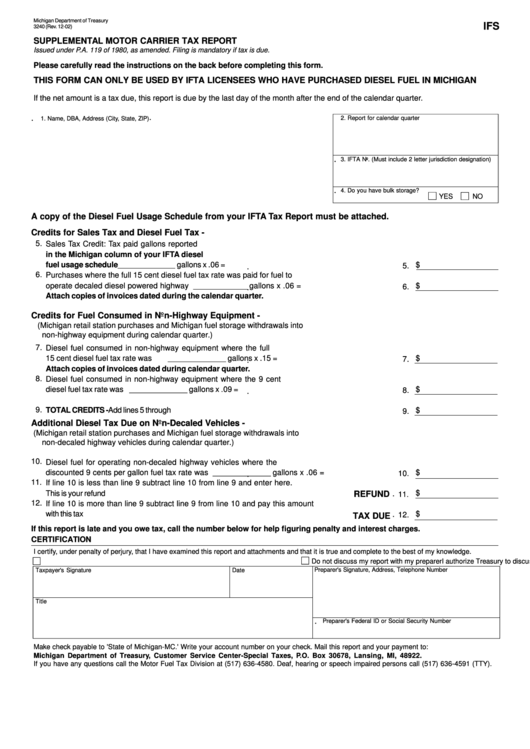

Michigan Department of Treasury

IFS

3240 (Rev. 12-02)

SUPPLEMENTAL MOTOR CARRIER TAX REPORT

Issued under P.A. 119 of 1980, as amended. Filing is mandatory if tax is due.

Please carefully read the instructions on the back before completing this form.

THIS FORM CAN ONLY BE USED BY IFTA LICENSEES WHO HAVE PURCHASED DIESEL FUEL IN MICHIGAN

If the net amount is a tax due, this report is due by the last day of the month after the end of the calendar quarter.

.

.

2. Report for calendar quarter

1. Name, DBA, Address (City, State, ZIP)

.

3. IFTA No. (Must include 2 letter jurisdiction designation)

.

4. Do you have bulk storage?

YES

NO

A copy of the Diesel Fuel Usage Schedule from your IFTA Tax Report must be attached.

Credits for Sales Tax and Diesel Fuel Tax -

5.

Sales Tax Credit: Tax paid gallons reported

in the Michigan column of your IFTA diesel

fuel usage schedule...........................................................

gallons x .06 =

$

.

_______________

5.

6.

Purchases where the full 15 cent diesel fuel tax rate was paid for fuel to

operate decaled diesel powered highway vehicles...........

gallons x .06 =

$

.

______________

6.

Attach copies of invoices dated during the calendar quarter.

Credits for Fuel Consumed in Non-Highway Equipment -

(Michigan retail station purchases and Michigan fuel storage withdrawals into

non-highway equipment during calendar quarter.)

7.

Diesel fuel consumed in non-highway equipment where the full

15 cent diesel fuel tax rate was paid..................................

gallons x .15 =

$

.

_______________

7.

Attach copies of invoices dated during calendar quarter.

8.

Diesel fuel consumed in non-highway equipment where the 9 cent

$

diesel fuel tax rate was paid...............................................

gallons x .09 =

.

_______________

8.

9.

TOTAL CREDITS - Add lines 5 through 8..........................................................................................

$

9.

Additional Diesel Tax Due on Non-Decaled Vehicles -

(Michigan retail station purchases and Michigan fuel storage withdrawals into

non-decaled highway vehicles during calendar quarter.)

10.

Diesel fuel for operating non-decaled highway vehicles where the

discounted 9 cents per gallon fuel tax rate was paid.........

gallons x .06 =

$

.

_______________

10.

11.

If line 10 is less than line 9 subtract line 10 from line 9 and enter here.

.

This is your refund ......................................................................................................

$

REFUND

11.

12.

If line 10 is more than line 9 subtract line 9 from line 10 and pay this amount

.

with this tax report.......................................................................................................

$

12.

TAX DUE

If this report is late and you owe tax, call the number below for help figuring penalty and interest charges.

CERTIFICATION

I certify, under penalty of perjury, that I have examined this report and attachments and that it is true and complete to the best of my knowledge.

I authorize Treasury to discuss my report and attachments with my preparer.

Do not discuss my report with my preparer

Taxpayer's Signature

Preparer's Signature, Address, Telephone Number

Date

Title

.

Preparer's Federal ID or Social Security Number

Make check payable to 'State of Michigan-MC.' Write your account number on your check. Mail this report and your payment to:

Michigan Department of Treasury, Customer Service Center-Special Taxes, P.O. Box 30678, Lansing, MI, 48922.

If you have any questions call the Motor Fuel Tax Division at (517) 636-4580. Deaf, hearing or speech impaired persons call (517) 636-4591 (TTY).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2