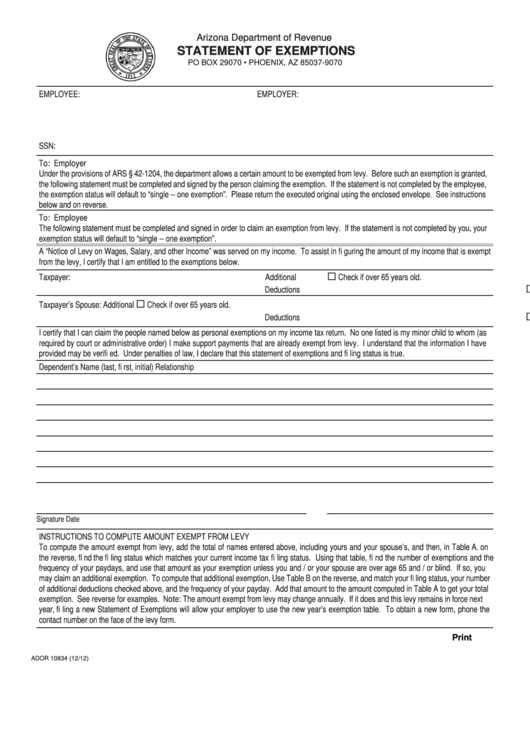

Arizona Department of Revenue

Arizona Department of Revenue

STATEMENT OF EXEMPTIONS

STATEMENT OF EXEMPTIONS

PO BOX 29070 • PHOENIX, AZ 85037-9070

EMPLOYEE:

EMPLOYER:

SSN:

To: Employer

Under the provisions of ARS § 42-1204, the department allows a certain amount to be exempted from levy. Before such an exemption is granted,

the following statement must be completed and signed by the person claiming the exemption. If the statement is not completed by the employee,

the exemption status will default to “single -- one exemption”. Please return the executed original using the enclosed envelope. See instructions

below and on reverse.

To: Employee

The following statement must be completed and signed in order to claim an exemption from levy. If the statement is not completed by you, your

exemption status will default to “single -- one exemption”.

A “Notice of Levy on Wages, Salary, and other Income” was served on my income. To assist in fi guring the amount of my income that is exempt

from the levy, I certify that I am entitled to the exemptions below.

Taxpayer:

Additional

Check if over 65 years old.

Deductions

Check if blind

Taxpayer’s Spouse:

Additional

Check if over 65 years old.

Deductions

Check if blind

I certify that I can claim the people named below as personal exemptions on my income tax return. No one listed is my minor child to whom (as

required by court or administrative order) I make support payments that are already exempt from levy. I understand that the information I have

provided may be verifi ed. Under penalties of law, I declare that this statement of exemptions and fi ling status is true.

Dependent’s Name (last, fi rst, initial)

Relationship

Signature

Date

INSTRUCTIONS TO COMPUTE AMOUNT EXEMPT FROM LEVY

To compute the amount exempt from levy, add the total of names entered above, including yours and your spouse’s, and then, in Table A. on

the reverse, fi nd the fi ling status which matches your current income tax fi ling status. Using that table, fi nd the number of exemptions and the

frequency of your paydays, and use that amount as your exemption unless you and / or your spouse are over age 65 and / or blind. If so, you

may claim an additional exemption. To compute that additional exemption, Use Table B on the reverse, and match your fi ling status, your number

of additional deductions checked above, and the frequency of your payday. Add that amount to the amount computed in Table A to get your total

exemption. See reverse for examples. Note: The amount exempt from levy may change annually. If it does and this levy remains in force next

year, fi ling a new Statement of Exemptions will allow your employer to use the new year’s exemption table. To obtain a new form, phone the

contact number on the face of the levy form.

Print

ADOR 10834 (12/12)

1

1 2

2