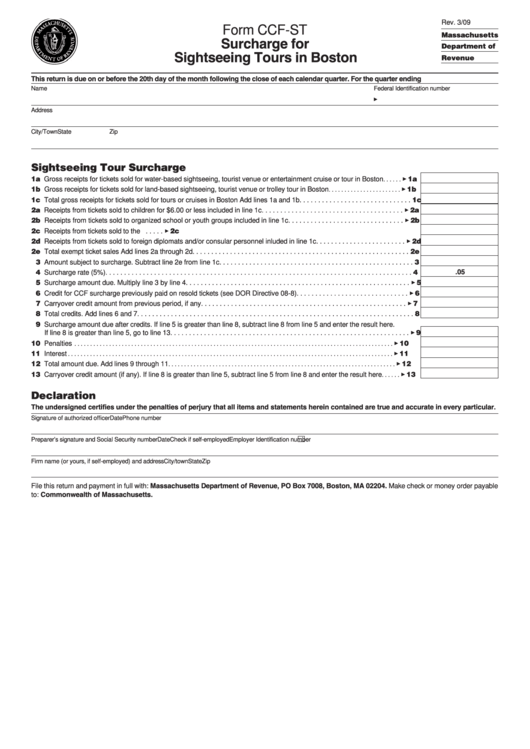

Rev. 3/09

Form CCF-ST

Massachusetts

Surcharge for

Department of

Sightseeing Tours in Boston

Revenue

This return is due on or before the 20th day of the month following the close of each calendar quarter. For the quarter ending

Name

Federal Identification number

3

Address

City/Town

State

Zip

Sightseeing Tour Surcharge

1a Gross receipts for tickets sold for water-based sightseeing, tourist venue or entertainment cruise or tour in Boston

3 1a

. . . . . .

1b Gross receipts for tickets sold for land-based sightseeing, tourist venue or trolley tour in Boston

3 1b

. . . . . . . . . . . . . . . . . . . . . . .

1c Total gross receipts for tickets sold for tours or cruises in Boston Add lines 1a and 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c

2a Receipts from tickets sold to children for $6.00 or less included in line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2a

2b Receipts from tickets sold to organized school or youth groups included in line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2b

2c Receipts from tickets sold to the U.S. government and/or its instrumentalities included in line 1c. . . . . . . . . . . . . . . . . . . . 3 2c

2d Receipts from tickets sold to foreign diplomats and/or consular personnel inluded in line 1c. . . . . . . . . . . . . . . . . . . . . . . . 3 2d

2e Total exempt ticket sales Add lines 2a through 2d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2e

03 Amount subject to surcharge. Subtract line 2e from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.05

04 Surcharge rate (5%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

05 Surcharge amount due. Multiply line 3 by line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

06 Credit for CCF surcharge previously paid on resold tickets (see DOR Directive 08-8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

07 Carryover credit amount from previous period, if any . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 7

08 Total credits. Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

09 Surcharge amount due after credits. If line 5 is greater than line 8, subtract line 8 from line 5 and enter the result here.

If line 8 is greater than line 5, go to line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 9

10 Penalties

3 10

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Interest

3 11

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Total amount due. Add lines 9 through 11

3 12

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 Carryover credit amount (if any). If line 8 is greater than line 5, subtract line 5 from line 8 and enter the result here

3 13

. . . . . .

Declaration

The undersigned certifies under the penalties of perjury that all items and statements herein contained are true and accurate in every particular.

Signature of authorized officer

Date

Phone number

Preparer’s signature and Social Security number

Date

Check if self-employed

Employer Identification number

Firm name (or yours, if self-employed) and address

City/town

State

Zip

File this return and payment in full with: Massachusetts Department of Revenue, PO Box 7008, Boston, MA 02204. Make check or money order payable

to: Commonwealth of Massachusetts.

1

1