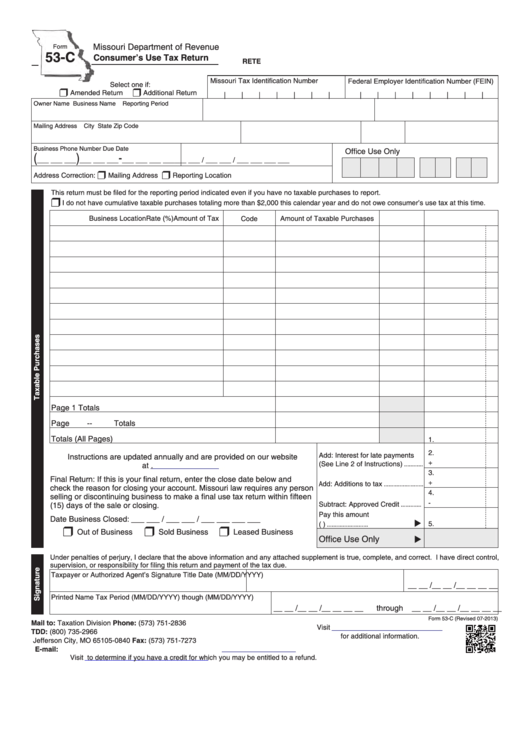

Missouri Department of Revenue

Form

53-C

Consumer’s Use Tax Return

RETE

Missouri Tax Identification Number

Federal Employer Identification Number (FEIN)

Select one if:

r

r

Amended Return

Additional Return

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner Name

Business Name

Reporting Period

Mailing Address

City

State

Zip Code

Business Phone Number

Due Date

Office Use Only

(

)

-

___ ___ ___

___ ___ ___

___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

r

r

Address Correction:

Mailing Address

Reporting Location

This return must be filed for the reporting period indicated even if you have no taxable purchases to report.

r

I do not have cumulative taxable purchases totaling more than $2,000 this calendar year and do not owe consumer’s use tax at this time.

Business Location

Code

Amount of Taxable Purchases

Rate (%)

Amount of Tax

Page 1 Totals .............................................................................

Page

--

Totals ............................................................

Totals (All Pages) .......................................................................

1.

2.

Add: Interest for late payments

Instructions are updated annually and are provided on our website

+

(See Line 2 of Instructions).............

at dor.mo.gov/forms/.

3.

.

Final Return: If this is your final return, enter the close date below and

.

+

Add: Additions to tax. . ........................

check the reason for closing your account. Missouri law requires any person

4.

selling or discontinuing business to make a final use tax return within fifteen

-

Subtract: Approved Credit..............

(15) days of the sale or closing.

Pay this amount

Date Business Closed:.___ ___ / ___ ___ / ___ ___ ___ ___

5.

(U.S.Funds only). . .........................

r

r

r

.......

Out of Business.

Sold Business......

Leased Business

Office Use Only

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I have direct control,

supervision, or responsibility for filing this return and payment of the tax due.

Taxpayer or Authorized Agent’s Signature

Title

Date (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

Printed Name

Tax Period (MM/DD/YYYY) though (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

through

__ __ /__ __ /__ __ __ __

Form 53-C (Revised 07-2013)

Mail to:

Taxation Division

Phone: (573) 751-2836

Visit

P.O. Box 840

TDD: (800) 735-2966

for additional information.

Jefferson City, MO 65105-0840

Fax: (573) 751-7273

E-mail:

salesuse@dor.mo.gov

Visit

dor.mo.gov/tax/business//creditinquiry

to determine if you have a credit for which you may be entitled to a refund.

1

1 2

2 3

3