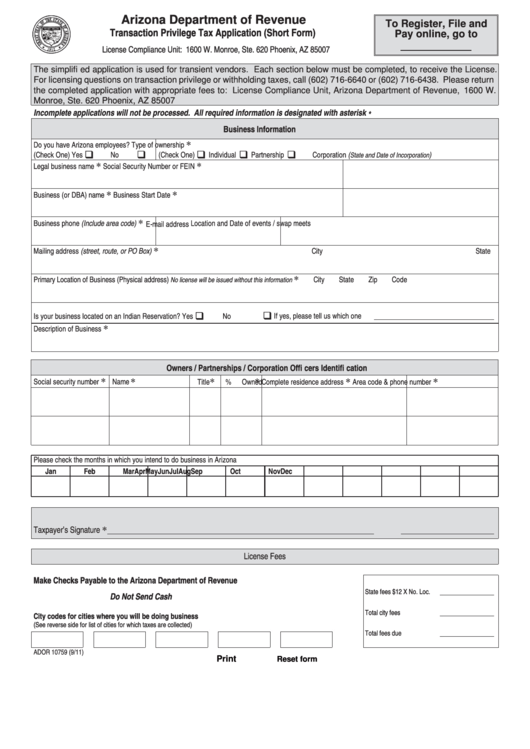

Arizona Department of Revenue

Arizona Department of Revenue

To Register, File and

Transaction Privilege Tax Application (Short Form)

Transaction Privilege Tax Application (Short Form)

Pay online, go to

License Compliance Unit: 1600 W. Monroe, Ste. 620 Phoenix, AZ 85007

License Compliance Unit: 1600 W. Monroe, Ste. 620 Phoenix, AZ 85007

The simplifi ed application is used for transient vendors. Each section below must be completed, to receive the License.

For licensing questions on transaction privilege or withholding taxes, call (602) 716-6640 or (602) 716-6438. Please return

the completed application with appropriate fees to: License Compliance Unit, Arizona Department of Revenue, 1600 W.

1600 W.

Monroe, Ste. 620 Phoenix, AZ 85007

Monroe, Ste. 620 Phoenix, AZ 85007

Incomplete applications will not be processed. All required information is designated with asterisk *

Business Information

Business Information

Do you have Arizona employees?

Type of ownership

*

(Check One)

Yes

No

(Check One)

Individual

Partnership

Corporation (

)

State and Date of Incorporation

Legal business name

Social Security Number or FEIN

*

*

Business (or DBA) name

Business Start Date

*

*

Business phone (Include area code)

Location and Date of events / swap meets

*

E-mail address

Mailing address (street, route, or PO Box)

City

State

Zip Code

*

Primary Location of Business (Physical address)

City

State

Zip Code

No license will be issued without this information

*

Is your business located on an Indian Reservation?

Yes

No

If yes, please tell us which one

Description of Business

*

Owners / Partnerships / Corporation Offi cers Identifi cation

Owners / Partnerships / Corporation Offi cers Identifi cation

Social security number

Name

Title

% Owned

Complete residence address

Area code & phone number

*

*

*

*

*

*

Please check the months in which you intend to do business in Arizona

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Taxpayer’s Signature

Date

*

License Fees

License Fees

Make Checks Payable to the Arizona Department of Revenue

Make Checks Payable to the Arizona Department of Revenue

State fees $12 X No. Loc.

State fees $12 X No. Loc.

Do Not Send Cash

Do Not Send Cash

Total city fees

Total city fees

City codes for cities where you will be doing business

City codes for cities where you will be doing business

(See reverse side for list of cities for which taxes are collected)

(See reverse side for list of cities for which taxes are collected)

Total fees due

Total fees due

ADOR 10759 (9/11)

Print

Reset form

1

1 2

2