Form 150-310-089 - Application For Property Tax Exemption For Rural Health Care Facility

ADVERTISEMENT

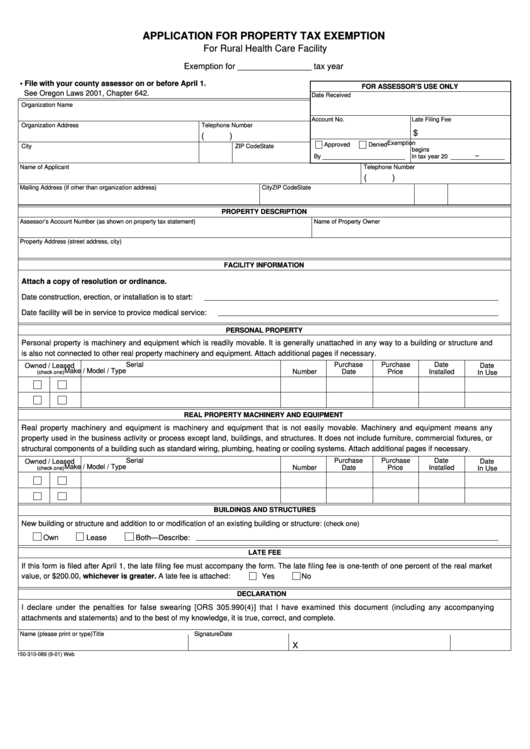

APPLICATION FOR PROPERTY TAX EXEMPTION

For Rural Health Care Facility

Exemption for ________________ tax year

• File with your county assessor on or before April 1.

FOR ASSESSOR’S USE ONLY

See Oregon Laws 2001, Chapter 642.

Date Received

Organization Name

Account No.

Late Filing Fee

Organization Address

Telephone Number

$

(

)

Exemption

Approved

Denied

City

State

ZIP Code

begins

–

By

in tax year 20

Name of Applicant

Telephone Number

(

)

Mailing Address (if other than organization address)

City

State

ZIP Code

PROPERTY DESCRIPTION

Assessor’s Account Number (as shown on property tax statement)

Name of Property Owner

Property Address (street address, city)

FACILITY INFORMATION

Attach a copy of resolution or ordinance.

Date construction, erection, or installation is to start:

Date facility will be in service to provice medical service:

PERSONAL PROPERTY

Personal property is machinery and equipment which is readily movable. It is generally unattached in any way to a building or structure and

is also not connected to other real property machinery and equipment. Attach additional pages if necessary.

Serial

Purchase

Purchase

Date

Owned / Leased

Date

Make / Model / Type

Number

Date

Price

Installed

In Use

(check one)

REAL PROPERTY MACHINERY AND EQUIPMENT

Real property machinery and equipment is machinery and equipment that is not easily movable. Machinery and equipment means any

property used in the business activity or process except land, buildings, and structures. It does not include furniture, commercial fixtures, or

structural components of a building such as standard wiring, plumbing, heating or cooling systems. Attach additional pages if necessary.

Serial

Purchase

Purchase

Date

Owned / Leased

Date

Make / Model / Type

Number

Date

Price

Installed

In Use

(check one)

BUILDINGS AND STRUCTURES

New building or structure and addition to or modification of an existing building or structure:

(check one)

Own

Lease

Both—Describe:

LATE FEE

If this form is filed after April 1, the late filing fee must accompany the form. The late filing fee is one-tenth of one percent of the real market

value, or $200.00, whichever is greater. A late fee is attached:

Yes

No

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document (including any accompanying

attachments and statements) and to the best of my knowledge, it is true, correct, and complete.

Name (please print or type)

Title

Signature

Date

X

150-310-089 (9-01) Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1