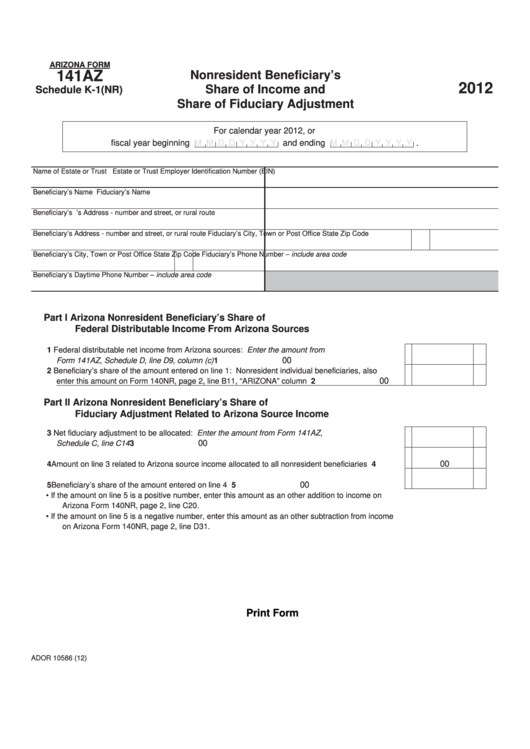

ARIZONA FORM

141AZ

Nonresident Beneficiary’s

2012

Share of Income and

Schedule K-1(NR)

Share of Fiduciary Adjustment

For calendar year 2012, or

fiscal year beginning

M M D D Y Y Y Y

and ending

M M D D Y Y Y Y

.

Name of Estate or Trust

Estate or Trust Employer Identification Number (EIN)

Beneficiary’s Name

Fiduciary’s Name

Beneficiary’s I.D. Number

Fiduciary’s Address - number and street, or rural route

Beneficiary’s Address - number and street, or rural route

Fiduciary’s City, Town or Post Office

State Zip Code

Beneficiary’s City, Town or Post Office

State Zip Code

Fiduciary’s Phone Number – include area code

Beneficiary’s Daytime Phone Number – include area code

Part I Arizona Nonresident Beneficiary’s Share of

Federal Distributable Income From Arizona Sources

1 Federal distributable net income from Arizona sources: Enter the amount from

00

Form 141AZ, Schedule D, line D9, column (c) .....................................................................................

1

2 Beneficiary’s share of the amount entered on line 1: Nonresident individual beneficiaries, also

00

enter this amount on Form 140NR, page 2, line B11, “ARIZONA” column ..........................................

2

Part II Arizona Nonresident Beneficiary’s Share of

Fiduciary Adjustment Related to Arizona Source Income

3 Net fiduciary adjustment to be allocated: Enter the amount from Form 141AZ,

00

Schedule C, line C14 ............................................................................................................................

3

00

4 Amount on line 3 related to Arizona source income allocated to all nonresident beneficiaries ............

4

00

5 Beneficiary’s share of the amount entered on line 4 ............................................................................

5

• If the amount on line 5 is a positive number, enter this amount as an other addition to income on

Arizona Form 140NR, page 2, line C20.

• If the amount on line 5 is a negative number, enter this amount as an other subtraction from income

on Arizona Form 140NR, page 2, line D31.

Print Form

ADOR 10586 (12)

1

1