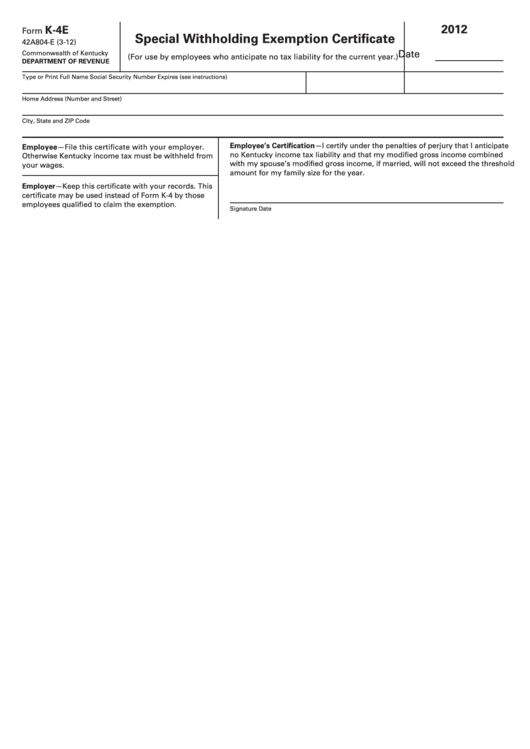

Form K-4e - Special Withholding Exemption Certificate - 2012

ADVERTISEMENT

2012

K-4E

Form

Special Withholding Exemption Certificate

42A804-E (3-12)

Date

Commonwealth of Kentucky

(For use by employees who anticipate no tax liability for the current year.)

DEPARTMENT OF REVENUE

Type or Print Full Name

Social Security Number

Expires (see instructions)

Home Address (Number and Street)

City, State and ZIP Code

Employee’s Certification—I certify under the penalties of perjury that I anticipate

Employee—File this certificate with your employer.

no Kentucky income tax liability and that my modified gross income combined

Otherwise Kentucky income tax must be withheld from

with my spouse’s modified gross income, if married, will not exceed the threshold

your wages.

amount for my family size for the year.

Employer—Keep this certificate with your records. This

certificate may be used instead of Form K-4 by those

employees qualified to claim the exemption.

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2