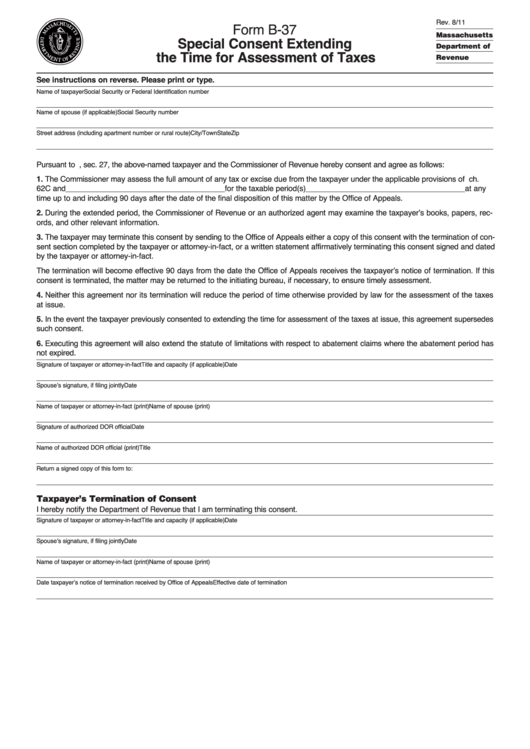

Form B-37 - Special Consent Extending The Time For Assessment Of Taxes

ADVERTISEMENT

Rev. 8/11

Form B-37

Massachusetts

Special Consent Extending

Department of

the Time for Assessment of Taxes

Revenue

See instructions on reverse. Please print or type.

Name of taxpayer

Social Security or Federal Identification number

Name of spouse (if applicable)

Social Security number

Street address (including apartment number or rural route)

City/Town

State

Zip

Pursuant to G.L. ch. 62C, sec. 27, the above-named taxpayer and the Commissioner of Revenue hereby consent and agree as follows:

1. The Commissioner may assess the full amount of any tax or excise due from the taxpayer under the applicable provisions of G.L. ch.

62C and _____________________________________ for the taxable period(s)_____________________________________ at any

time up to and including 90 days after the date of the final disposition of this matter by the Office of Appeals.

2. During the extended period, the Commissioner of Revenue or an authorized agent may examine the taxpayer’s books, papers, rec-

ords, and other relevant information.

3. The taxpayer may terminate this consent by sending to the Office of Appeals either a copy of this consent with the termination of con-

sent section completed by the taxpayer or attorney-in-fact, or a written statement affirmatively terminating this consent signed and dated

by the taxpayer or attorney-in-fact.

The termination will become effective 90 days from the date the Office of Appeals receives the taxpayer’s notice of termination. If this

consent is terminated, the matter may be returned to the initiating bureau, if necessary, to ensure timely assessment.

4. Neither this agreement nor its termination will reduce the period of time otherwise provided by law for the assessment of the taxes

at issue.

5. In the event the taxpayer previously consented to extending the time for assessment of the taxes at issue, this agreement supersedes

such consent.

6. Executing this agreement will also extend the statute of limitations with respect to abatement claims where the abatement period has

not expired.

Signature of taxpayer or attorney-in-fact

Title and capacity (if applicable)

Date

Spouse’s signature, if filing jointly

Date

Name of taxpayer or attorney-in-fact (print)

Name of spouse (print)

Signature of authorized DOR official

Date

Name of authorized DOR official (print)

Title

Return a signed copy of this form to:

Taxpayer’s Termination of Consent

I hereby notify the Department of Revenue that I am terminating this consent.

Signature of taxpayer or attorney-in-fact

Title and capacity (if applicable)

Date

Spouse’s signature, if filing jointly

Date

Name of taxpayer or attorney-in-fact (print)

Name of spouse (print)

Date taxpayer’s notice of termination received by Office of Appeals

Effective date of termination

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2