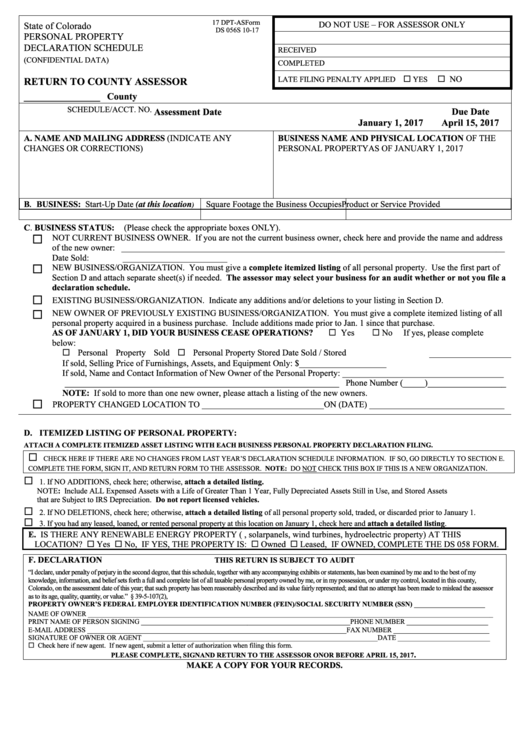

17 DPT-AS Form

DO NOT USE – FOR ASSESSOR ONLY

State of Colorado

DS 056S 10-17

PERSONAL PROPERTY

DECLARATION SCHEDULE

RECEIVED

(CONFIDENTIAL DATA)

COMPLETED

NO

LATE FILING PENALTY APPLIED

YES

RETURN TO COUNTY ASSESSOR

________________ County

B.A. CODE

T.A. CODE

SCHEDULE/ACCT. NO.

Assessment Date

Due Date

January 1, 2017

April 15, 2017

A. NAME AND MAILING ADDRESS (INDICATE ANY

BUSINESS NAME AND PHYSICAL LOCATION OF THE

CHANGES OR CORRECTIONS)

PERSONAL PROPERTY AS OF JANUARY 1, 2017

B

BUSINESS: Start-Up Date (at this location

Square Footage the Business Occupies

Product or Service Provided

.

)

C. BUSINESS STATUS:

(Please check the appropriate boxes ONLY).

NOT CURRENT BUSINESS OWNER. If you are not the current business owner, check here and provide the name and address

of the new owner: ________________________________________________________________________________________

Date Sold:

________________________

NEW BUSINESS/ORGANIZATION. You must give a complete itemized listing of all personal property. Use the first part of

Section D and attach separate sheet(s) if needed. The assessor may select your business for an audit whether or not you file a

declaration schedule.

EXISTING BUSINESS/ORGANIZATION. Indicate any additions and/or deletions to your listing in Section D.

NEW OWNER OF PREVIOUSLY EXISTING BUSINESS/ORGANIZATION. You must give a complete itemized listing of all

personal property acquired in a business purchase. Include additions made prior to Jan. 1 since that purchase.

AS OF JANUARY 1, DID YOUR BUSINESS CEASE OPERATIONS?

Yes

No

If yes, please complete

below:

Personal Property Sold

Personal Property Stored

Date Sold / Stored

If sold, Selling Price of Furnishings, Assets, and Equipment Only: $____________________

If sold, Name and Contact Information of New Owner of the Personal Property: _____________________________________

_______________________________________________________________ Phone Number (_____)__________________

NOTE: If sold to more than one new owner, please attach a listing of the new owners.

PROPERTY CHANGED LOCATION TO ____________________________ ON (DATE) _______________________________

D. ITEMIZED LISTING OF PERSONAL PROPERTY:

ATTACH A COMPLETE ITEMIZED ASSET LISTING WITH EACH BUSINESS PERSONAL PROPERTY DECLARATION FILING.

CHECK HERE IF THERE ARE NO CHANGES FROM LAST YEAR’S DECLARATION SCHEDULE INFORMATION. IF SO, GO DIRECTLY TO SECTION E.

.

COMPLETE THE FORM, SIGN IT, AND RETURN FORM TO THE ASSESSOR. NOTE: DO NOT CHECK THIS BOX IF THIS IS A NEW ORGANIZATION

1. If NO ADDITIONS, check here; otherwise, attach a detailed listing.

NOTE: Include ALL Expensed Assets with a Life of Greater Than 1 Year, Fully Depreciated Assets Still in Use, and Stored Assets

that are Subject to IRS Depreciation. Do not report licensed vehicles.

2. If NO DELETIONS, check here; otherwise, attach a detailed listing of all personal property sold, traded, or discarded prior to January 1.

3. If you had any leased, loaned, or rented personal property at this location on January 1, check here and attach a detailed listing.

E. IS THERE ANY RENEWABLE ENERGY PROPERTY (e.g., solar panels, wind turbines, hydroelectric property) AT THIS

LOCATION? Yes No, IF YES, THE PROPERTY IS: Owned Leased, IF OWNED, COMPLETE THE DS 058 FORM.

F. DECLARATION

THIS RETURN IS SUBJECT TO AUDIT

“I declare, under penalty of perjury in the second degree, that this schedule, together with any accompanying exhibits or statements, has been examined by me and to the best of my

knowledge, information, and belief sets forth a full and complete list of all taxable personal property owned by me, or in my possession, or under my control, located in this county,

Colorado, on the assessment date of this year; that such property has been reasonably described and its value fairly represented; and that no attempt has been made to mislead the assessor

as to its age, quality, quantity, or value.” § 39-5-107(2), C.R.S.

PROPERTY OWNER’S FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN)/SOCIAL SECURITY NUMBER (SSN) ____________________

NAME OF OWNER __________________________________________________________________________________________________________________

PRINT NAME OF PERSON SIGNING ___________________________________________________________PHONE NUMBER _______________________

E-MAIL ADDRESS _________________________________________________________________________FAX NUMBER ___________________________

SIGNATURE OF OWNER OR AGENT __________________________________________________________________DATE __________________________

Check here if new agent. If new agent, submit a letter of authorization when filing this form.

.

PLEASE COMPLETE, SIGN AND RETURN TO THE ASSESSOR ON OR BEFORE APRIL 15, 2017

MAKE A COPY FOR YOUR RECORDS.

1

1