Reset Form

Print Form

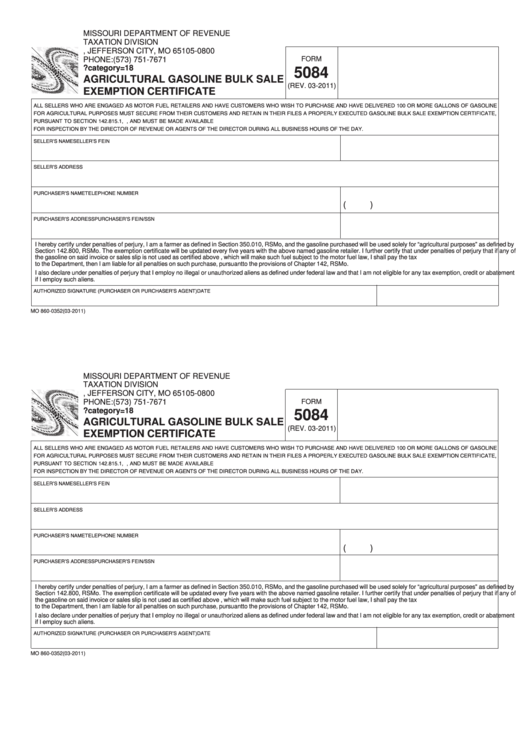

MISSOURI DEPARTMENT OF REVENUE

TAXATION DIVISION

P.O. BOX 800, JEFFERSON CITY, MO 65105-0800

PHONE: (573) 751-7671

FORM

5084

AGRICULTURAL GASOLINE BULK SALE

(REV. 03-2011)

EXEMPTION CERTIFICATE

ALL SELLERS WHO ARE ENGAGED AS MOTOR FUEL RETAILERS AND HAVE CUSTOMERS WHO WISH TO PURCHASE AND HAVE DELIVERED 100 OR MORE GALLONS OF GASOLINE

FOR AGRICULTURAL PURPOSES MUST SECURE FROM THEIR CUSTOMERS AND RETAIN IN THEIR FILES A PROPERLY EXECUTED GASOLINE BULK SALE EXEMPTION CERTIFICATE,

PURSUANT TO SECTION 142.815.1, RSMo. SUCH CERTIFICATES MUST BE UPDATED EVERY FIVE YEARS TO SUBSTANTIATE THE EXEMPT SALES, AND MUST BE MADE AVAILABLE

FOR INSPECTION BY THE DIRECTOR OF REVENUE OR AGENTS OF THE DIRECTOR DURING ALL BUSINESS HOURS OF THE DAY.

SELLER’S NAME

SELLER’S FEIN

SELLER’S ADDRESS

PURCHASER’S NAME

TELEPHONE NUMBER

(

)

PURCHASER’S ADDRESS

PURCHASER’S FEIN/SSN

I hereby certify under penalties of perjury, I am a farmer as defined in Section 350.010, RSMo, and the gasoline purchased will be used solely for “agricultural purposes” as defined by

Section 142.800, RSMo. The exemption certificate will be updated every five years with the above named gasoline retailer. I further certify that under penalties of perjury that if any of

the gasoline on said invoice or sales slip is not used as certified above , which will make such fuel subject to the motor fuel law, I shall pay the tax thereon. Should I not so pay the tax

to the Department, then I am liable for all penalties on such purchase, pursuant to the provisions of Chapter 142, RSMo.

I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption, credit or abatement

if I employ such aliens.

AUTHORIZED SIGNATURE (PURCHASER OR PURCHASER’S AGENT)

DATE

MO 860-0352 (03-2011)

MISSOURI DEPARTMENT OF REVENUE

TAXATION DIVISION

P.O. BOX 800, JEFFERSON CITY, MO 65105-0800

PHONE: (573) 751-7671

FORM

5084

AGRICULTURAL GASOLINE BULK SALE

(REV. 03-2011)

EXEMPTION CERTIFICATE

ALL SELLERS WHO ARE ENGAGED AS MOTOR FUEL RETAILERS AND HAVE CUSTOMERS WHO WISH TO PURCHASE AND HAVE DELIVERED 100 OR MORE GALLONS OF GASOLINE

FOR AGRICULTURAL PURPOSES MUST SECURE FROM THEIR CUSTOMERS AND RETAIN IN THEIR FILES A PROPERLY EXECUTED GASOLINE BULK SALE EXEMPTION CERTIFICATE,

PURSUANT TO SECTION 142.815.1, RSMo. SUCH CERTIFICATES MUST BE UPDATED EVERY FIVE YEARS TO SUBSTANTIATE THE EXEMPT SALES, AND MUST BE MADE AVAILABLE

FOR INSPECTION BY THE DIRECTOR OF REVENUE OR AGENTS OF THE DIRECTOR DURING ALL BUSINESS HOURS OF THE DAY.

SELLER’S NAME

SELLER’S FEIN

SELLER’S ADDRESS

PURCHASER’S NAME

TELEPHONE NUMBER

(

)

PURCHASER’S ADDRESS

PURCHASER’S FEIN/SSN

I hereby certify under penalties of perjury, I am a farmer as defined in Section 350.010, RSMo, and the gasoline purchased will be used solely for “agricultural purposes” as defined by

Section 142.800, RSMo. The exemption certificate will be updated every five years with the above named gasoline retailer. I further certify that under penalties of perjury that if any of

the gasoline on said invoice or sales slip is not used as certified above , which will make such fuel subject to the motor fuel law, I shall pay the tax thereon. Should I not so pay the tax

to the Department, then I am liable for all penalties on such purchase, pursuant to the provisions of Chapter 142, RSMo.

I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption, credit or abatement

if I employ such aliens.

AUTHORIZED SIGNATURE (PURCHASER OR PURCHASER’S AGENT)

DATE

MO 860-0352 (03-2011)

1

1