Reset Form

Print Form

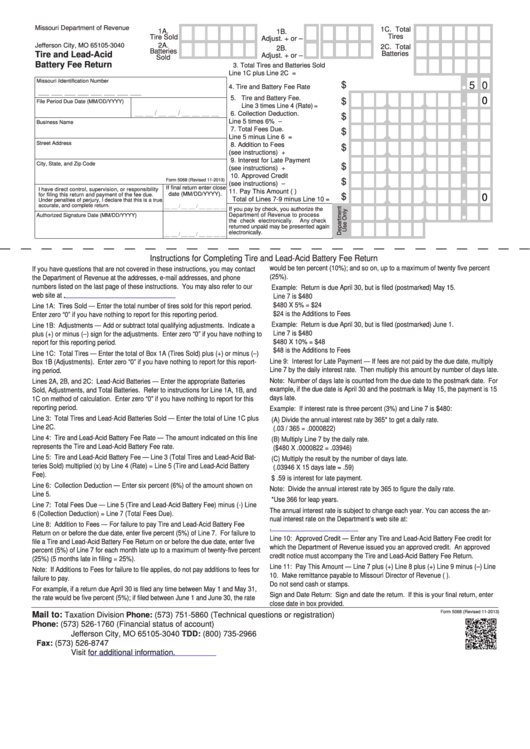

Missouri Department of Revenue

1C. Total

1A.

1B.

Tires

P.O. Box 3040

Tire Sold

Adjust. + or –

2A.

Jefferson City, MO 65105-3040

2C. Total

2B.

Batteries

Batteries

Tire and Lead-Acid

Adjust. + or –

Sold

Battery Fee Return

3. Total Tires and Batteries Sold

Line 1C plus Line 2C ........... =

Missouri iIdentification Number

.50

$

5 0

4. Tire and Battery Fee Rate ...X

__ __ __ __ __ __ __ __

0

5. Tire and Battery Fee.

$

File Period

Due Date (MM/DD/YYYY)

Line 3 times Line 4 (Rate) .... =

__ __ / __ __ / __ __ __ __

6. Collection Deduction.

$

Line 5 times 6% ................... –

Business Name

7. Total Fees Due.

$

Line 5 minus Line 6 ............. =

Street Address

8. Addition to Fees

$

(see instructions) ................ +

9. Interest for Late Payment

City, State, and Zip Code

$

(see instructions) ................. +

10. Approved Credit

$

Form 5068 (Revised 11-2013)

(see instructions) ................ –

If final return enter close

I have direct control, supervision, or responsibility

11. Pay This Amount (U.S. Funds)

0

date (MM/DD/YYYY).

for filing this return and payment of the fee due.

$

Total of Lines 7-9 minus Line 10 =

Under penalties of perjury, I declare that this is a true,

accurate, and complete return.

__ __ / __ __ / __ __ __ __

If you pay by check, you authorize the

Department of Revenue to process

Authorized Signature

Date (MM/DD/YYYY)

the check electronically.

Any check

returned unpaid may be presented again

electronically.

__ __ / __ __ / __ __ __ __

Instructions for Completing Tire and Lead-Acid Battery Fee Return

would be ten percent (10%); and so on, up to a maximum of twenty five percent

If you have questions that are not covered in these instructions, you may contact

(25%).

the Department of Revenue at the addresses, e-mail addresses, and phone

numbers listed on the last page of these instructions. You may also refer to our

Example: Return is due April 30, but is filed (postmarked) May 15.

web site at

Line 7 is $480

$480 X 5% = $24

Line 1A: Tires Sold — Enter the total number of tires sold for this report period.

$24 is the Additions to Fees

Enter zero “0” if you have nothing to report for this reporting period.

Example: Return is due April 30, but is filed (postmarked) June 1.

Line 1B: Adjustments — Add or subtract total qualifying adjustments. Indicate a

Line 7 is $480

plus (+) or minus (–) sign for the adjustments. Enter zero “0” if you have nothing to

$480 X 10% = $48

report for this reporting period.

$48 is the Additions to Fees

Line 1C: Total Tires — Enter the total of Box 1A (Tires Sold) plus (+) or minus (–)

Line 9: Interest for Late Payment — If fees are not paid by the due date, multiply

Box 1B (Adjustments). Enter zero “0” if you have nothing to report for this report-

Line 7 by the daily interest rate. Then multiply this amount by number of days late.

ing period.

Note: Number of days late is counted from the due date to the postmark date. For

Lines 2A, 2B, and 2C: Lead-Acid Batteries — Enter the appropriate Batteries

example, if the due date is April 30 and the postmark is May 15, the payment is 15

Sold, Adjustments, and Total Batteries. Refer to instructions for Line 1A, 1B, and

days late.

1C on method of calculation. Enter zero “0” if you have nothing to report for this

reporting period.

Example: If interest rate is three percent (3%) and Line 7 is $480:

Line 3: Total Tires and Lead-Acid Batteries Sold — Enter the total of Line 1C plus

(A) Divide the annual interest rate by 365* to get a daily rate.

Line 2C.

(.03 / 365 = .0000822)

Line 4: Tire and Lead-Acid Battery Fee Rate — The amount indicated on this line

(B) Multiply Line 7 by the daily rate.

represents the Tire and Lead-Acid Battery Fee rate.

($480 X .0000822 = .03946)

Line 5: Tire and Lead-Acid Battery Fee — Line 3 (Total Tires and Lead-Acid Bat-

(C) Multiply the result by the number of days late.

teries Sold) multiplied (x) by Line 4 (Rate) = Line 5 (Tire and Lead-Acid Battery

(.03946 X 15 days late = .59)

Fee).

$ .59 is interest for late payment.

Line 6: Collection Deduction — Enter six percent (6%) of the amount shown on

Note: Divide the annual interest rate by 365 to figure the daily rate.

Line 5.

*Use 366 for leap years.

Line 7: Total Fees Due — Line 5 (Tire and Lead-Acid Battery Fee) minus (-) Line

The annual interest rate is subject to change each year. You can access the an-

6 (Collection Deduction) = Line 7 (Total Fees Due).

nual interest rate on the Department’s web site at:

Line 8: Addition to Fees — For failure to pay Tire and Lead-Acid Battery Fee

Return on or before the due date, enter five percent (5%) of Line 7. For failure to

Line 10: Approved Credit — Enter any Tire and Lead-Acid Battery Fee credit for

file a Tire and Lead-Acid Battery Fee Return on or before the due date, enter five

which the Department of Revenue issued you an approved credit. An approved

percent (5%) of Line 7 for each month late up to a maximum of twenty-five percent

credit notice must accompany the Tire and Lead-Acid Battery Fee Return.

(25%) (5 months late in filing = 25%).

Line 11: Pay This Amount — Line 7 plus (+) Line 8 plus (+) Line 9 minus (–) Line

Note: If Additions to Fees for failure to file applies, do not pay additions to fees for

10. Make remittance payable to Missouri Director of Revenue (U.S. Funds Only).

failure to pay.

Do not send cash or stamps.

For example, if a return due April 30 is filed any time between May 1 and May 31,

Sign and Date Return: Sign and date the return. If this is your final return, enter

the rate would be five percent (5%); if filed between June 1 and June 30, the rate

close date in box provided.

Form 5068 (Revised 11-2013)

Mail to:

Taxation Division

Phone: (573) 751-5860 (Technical questions or registration)

P.O. Box 3040

Phone: (573) 526-1760 (Financial status of account)

Jefferson City, MO 65105-3040

TDD: (800) 735-2966

Fax: (573) 526-8747

Visit

for additional information.

1

1