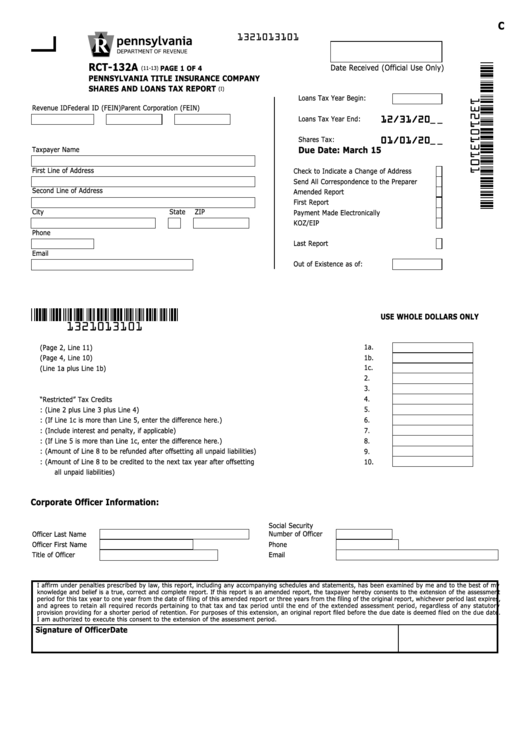

Form Rct-132a - Pennsylvania Title Insurance Company Shares And Loans Tax Report

ADVERTISEMENT

C

1321013101

RCT-132A

Date Received (Official Use Only)

(11-13)

PAGE 1 OF 4

PENNSYLVANIA TITLE INSURANCE COMPANY

SHARES AND LOANS TAX REPORT

(I)

Loans Tax Year Begin:

Revenue ID

Federal ID (FEIN)

Parent Corporation (FEIN)

12/31/20

Loans Tax Year End:

_ _

01/01/20

Shares Tax:

_ _

Taxpayer Name

Due Date: March 15

First Line of Address

Check to Indicate a Change of Address

Send All Correspondence to the Preparer

Second Line of Address

Amended Report

First Report

City

State

ZIP

Payment Made Electronically

KOZ/EIP

Phone

Last Report

Email

Out of Existence as of:

USE WHOLE DOLLARS ONLY

1a.

1a. Shares Tax (Page 2, Line 11)

1b.

1b. Loans Tax (Page 4, Line 10)

1c.

1c. Total Shares/Loans Tax (Line 1a plus Line 1b)

2.

2.

Total Estimated Payments

3.

3.

Total Payments Carried Forward From Prior Year Return

4.

4.

Total “Restricted” Tax Credits

5.

Total Credit: (Line 2 plus Line 3 plus Line 4)

5.

6.

Tax Due: (If Line 1c is more than Line 5, enter the difference here.)

6.

7.

Remittance: (Include interest and penalty, if applicable)

7.

8.

OVERPAYMENT: (If Line 5 is more than Line 1c, enter the difference here.)

8.

9.

Refund: (Amount of Line 8 to be refunded after offsetting all unpaid liabilities)

9.

10. Transfer: (Amount of Line 8 to be credited to the next tax year after offsetting

10.

all unpaid liabilities)

Corporate Officer Information:

Social Security

Number of Officer

Officer Last Name

Officer First Name

Phone

Title of Officer

Email

I affirm under penalties prescribed by law, this report, including any accompanying schedules and statements, has been examined by me and to the best of my

knowledge and belief is a true, correct and complete report. If this report is an amended report, the taxpayer hereby consents to the extension of the assessment

period for this tax year to one year from the date of filing of this amended report or three years from the filing of the original report, whichever period last expires,

and agrees to retain all required records pertaining to that tax and tax period until the end of the extended assessment period, regardless of any statutory

provision providing for a shorter period of retention. For purposes of this extension, an original report filed before the due date is deemed filed on the due date.

I am authorized to execute this consent to the extension of the assessment period.

Signature of Officer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4