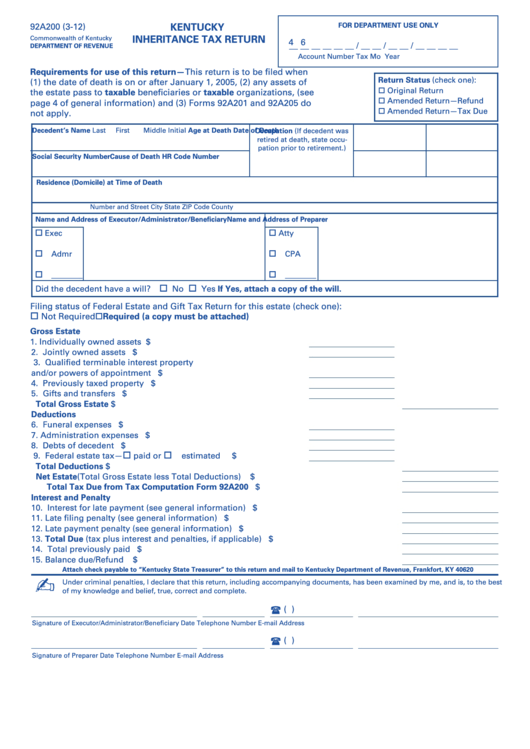

Form 92a200 - Kentucky Inheritance Tax Return

ADVERTISEMENT

FOR DEPARTMENT USE ONLY

92A200 (3-12)

KENTUCKY

INHERITANCE TAX RETURN

Commonwealth of Kentucky

4 6

__ __ __ __ __ __ / __ __ / __ __ / __ __ __ __

DEPARTMENT OF REVENUE

Account Number

Tax

Mo

Year

Requirements for use of this return—This return is to be filed when

Return Status (check one):

(1) the date of death is on or after January 1, 2005, (2) any assets of

Original Return

the estate pass to taxable beneficiaries or taxable organizations, (see

Amended Return—Refund

page 4 of general information) and (3) Forms 92A201 and 92A205 do

Amended Return—Tax Due

not apply.

Decedent’s Name Last

First

Middle Initial

Occupation (If decedent was

Age at Death

Date of Death

retired at death, state occu-

pation prior to retirement.)

Social Security Number

Cause of Death

HR Code Number

Residence (Domicile) at Time of Death

Number and Street

City

State

ZIP Code

County

Name and Address of Executor/Administrator/Beneficiary

Name and Address of Preparer

Exec

Atty

Admr

CPA

________

________

Did the decedent have a will?

No

Yes If Yes, attach a copy of the will.

Filing status of Federal Estate and Gift Tax Return for this estate (check one):

Not Required

Required (a copy must be attached)

Gross Estate

1. Individually owned assets ..................................................................... $

2. Jointly owned assets ............................................................................. $

3. Qualified terminable interest property

and/or powers of appointment ............................................................. $

4. Previously taxed property ..................................................................... $

5. Gifts and transfers ................................................................................. $

Total Gross Estate ............................................................................................ $

Deductions

6. Funeral expenses ................................................................................... $

7. Administration expenses ...................................................................... $

8. Debts of decedent .................................................................................. $

9. Federal estate tax—

paid or

estimated ................................... $

Total Deductions ............................................................................................... $

Net Estate (Total Gross Estate less Total Deductions) ................................... $

Total Tax Due from Tax Computation Form 92A200 ....................................... $

Interest and Penalty

10. Interest for late payment (see general information) .................................................................... $

11. Late filing penalty (see general information) ............................................................................... $

12. Late payment penalty (see general information) ......................................................................... $

13. Total Due (tax plus interest and penalties, if applicable) ............................................................ $

14. Total previously paid ...................................................................................................................... $

15. Balance due/Refund ....................................................................................................................... $

Attach check payable to “Kentucky State Treasurer” to this return and mail to Kentucky Department of Revenue, Frankfort, KY 40620

✍

Under criminal penalties, I declare that this return, including accompanying documents, has been examined by me, and is, to the best

of my knowledge and belief, true, correct and complete.

(

)

Signature of Executor/Administrator/Beneficiary

Date

Telephone Number

E-mail Address

(

)

Signature of Preparer

Date

Telephone Number

E-mail Address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17