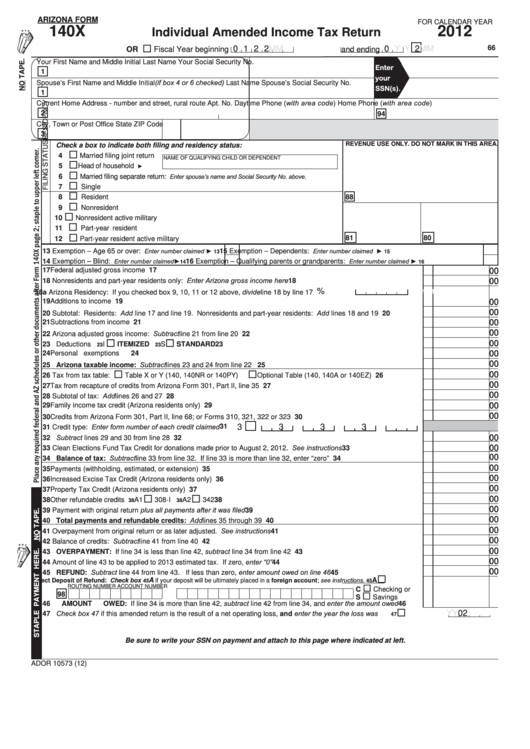

ARIZONA FORM

FOR CALENDAR YEAR

140X

2012

Individual Amended Income Tax Return

M

M

2

0 1 2

M

M

2

0

Y Y

66

OR

Fiscal Year beginning

and ending

Your First Name and Middle Initial

Last Name

Your Social Security No.

Enter

1

your

Spouse’s First Name and Middle Initial (if box 4 or 6 checked)

Last Name

Spouse’s Social Security No.

SSN(s).

1

Daytime Phone (with area code)

Home Phone (with area code)

Current Home Address - number and street, rural route

Apt. No.

2

94

City, Town or Post Office

State ZIP Code

3

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

Check a box to indicate both filing and residency status:

4

Married filing joint return

NAME OF QUALIFYING CHILD OR DEPENDENT

5

Head of household .........

►

Enter spouse’s name and Social Security No. above.

6

Married filing separate return:

7

Single

8

Resident

88

9

Nonresident

10

Nonresident active military

11

Part-year resident

81

80

12

Part-year resident active military

Enter number claimed ►

Enter number claimed ........................................ ►

13 Exemption – Age 65 or over:

15 Exemption – Dependents:

13

15

Enter number claimed

►

Enter number claimed ►

14 Exemption – Blind:

.................

16 Exemption – Qualifying parents or grandparents:

14

16

00

17 Federal adjusted gross income .........................................................................................................................................

17

18 Nonresidents and part-year residents only: Enter Arizona gross income here ................................................................

00

18

%

18a Arizona Residency: If you checked box 9, 10, 11 or 12 above, divide line 18 by line 17 ........

Do not type decimal

00

19 Additions to income ...........................................................................................................................................................

19

20 Subtotal: Residents: Add line 17 and line 19. Nonresidents and part-year residents: Add lines 18 and 19 ..................

00

20

00

21 Subtractions from income ..................................................................................................................................................

21

22 Arizona adjusted gross income: Subtract line 21 from line 20 ..........................................................................................

00

22

I

S

00

23 Deductions .........................................................................................................

ITEMIZED

STANDARD

23

23

23

00

24 Personal exemptions .........................................................................................................................................................

24

25 Arizona taxable income: Subtract lines 23 and 24 from line 22 .....................................................................................

00

25

00

26 Tax from tax table:

Table X or Y (140, 140NR or 140PY)

Optional Table (140, 140A or 140EZ) ......................

26

00

27 Tax from recapture of credits from Arizona Form 301, Part II, line 35 ...............................................................................

27

00

28 Subtotal of tax: Add lines 26 and 27 .................................................................................................................................

28

00

29 Family income tax credit (Arizona residents only) .............................................................................................................

29

00

30 Credits from Arizona Form 301, Part II, line 68; or Forms 310, 321, 322 or 323 ...............................................................

30

31 Credit type: Enter form number of each credit claimed .......... 31

3

3

3

3

32 Subtract lines 29 and 30 from line 28 ................................................................................................................................

00

32

33 Clean Elections Fund Tax Credit for donations made prior to August 2, 2012. See instructions ......................................

00

33

34 Balance of tax: Subtract line 33 from line 32. If line 33 is more than line 32, enter “zero” .............................................

00

34

00

35 Payments (withholding, estimated, or extension) ..............................................................................................................

35

00

36 Increased Excise Tax Credit (Arizona residents only) .......................................................................................................

36

00

37 Property Tax Credit (Arizona residents only) .....................................................................................................................

37

A1

A2

00

38 Other refundable credits ....................................................................................................

308-I

342

38

38

38

00

39 Payment with original return plus all payments after it was filed .......................................................................................

39

40 Total payments and refundable credits: Add lines 35 through 39 ................................................................................

00

40

41 Overpayment from original return or as later adjusted. See instructions ..........................................................................

00

41

42 Balance of credits: Subtract line 41 from line 40 ..............................................................................................................

00

42

43 OVERPAYMENT: If line 34 is less than line 42, subtract line 34 from line 42 ..................................................................

00

43

44 Amount of line 43 to be applied to 2013 estimated tax. If zero, enter “0” .........................................................................

00

44

45 REFUND: Subtract line 44 from line 43. If less than zero, enter amount owed on line 46 .............................................

00

45

if your deposit will be ultimately placed in a foreign account; see instructions.

A

A

Direct Deposit of Refund: Check box

45

45

ROUTING NUMBER

ACCOUNT NUMBER

C

Checking or

98

S

Savings

46 AMOUNT OWED: If line 34 is more than line 42, subtract line 42 from line 34, and enter the amount owed .................

46

47 Check box 47 if this amended return is the result of a net operating loss, and enter the year the loss was incurred.......

2

0

Y

Y

47

Be sure to write your SSN on payment and attach to this page where indicated at left.

ADOR 10573 (12)

1

1 2

2