Instructions For Form 1350 - Tobacco Tax Return

ADVERTISEMENT

EIN00012

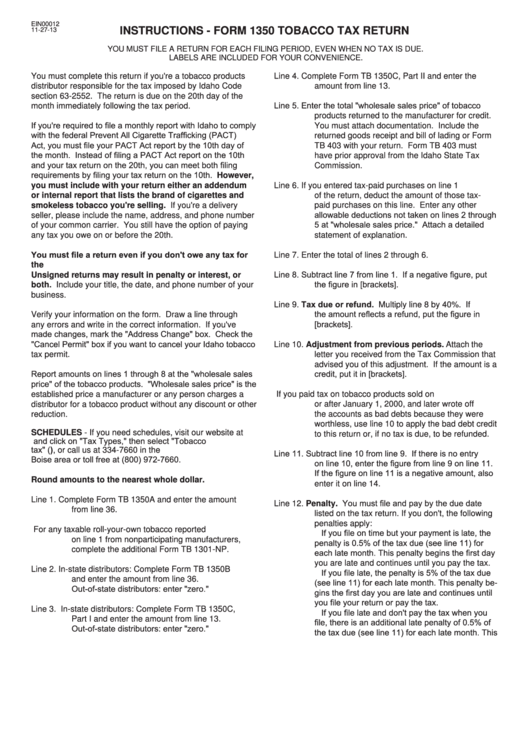

INSTRUCTIONS - FORM 1350 TOBACCO TAX RETURN

11-27-13

YOU MUST FILE A RETURN FOR EACH FILING PERIOD, EVEN WHEN NO TAX IS DUE.

LABELS ARE INCLUDED FOR YOUR CONVENIENCE.

You must complete this return if you're a tobacco products

Line 4.

Complete Form TB 1350C, Part II and enter the

distributor responsible for the tax imposed by Idaho Code

amount from line 13.

section 63-2552. The return is due on the 20th day of the

Line 5.

Enter the total "wholesale sales price" of tobacco

month immediately following the tax period.

products returned to the manufacturer for credit.

If you're required to file a monthly report with Idaho to comply

You must attach documentation. Include the

with the federal Prevent All Cigarette Trafficking (PACT)

returned goods receipt and bill of lading or Form

Act, you must file your PACT Act report by the 10th day of

TB 403 with your return. Form TB 403 must

the month. Instead of filing a PACT Act report on the 10th

have prior approval from the Idaho State Tax

and your tax return on the 20th, you can meet both filing

Commission.

requirements by filing your tax return on the 10th. However,

you must include with your return either an addendum

Line 6.

If you entered tax-paid purchases on line 1

or internal report that lists the brand of cigarettes and

of the return, deduct the amount of those tax-

smokeless tobacco you're selling. If you're a delivery

paid purchases on this line. Enter any other

allowable deductions not taken on lines 2 through

seller, please include the name, address, and phone number

5 at "wholesale sales price." Attach a detailed

of your common carrier. You still have the option of paying

any tax you owe on or before the 20th.

statement of explanation.

You must file a return even if you don't owe any tax for

Line 7.

Enter the total of lines 2 through 6.

the period. You must sign your return to make it valid.

Line 8.

Subtract line 7 from line 1. If a negative figure, put

Unsigned returns may result in penalty or interest, or

the figure in [brackets].

both. Include your title, the date, and phone number of your

business.

Tax due or refund. Multiply line 8 by 40%. If

Line 9.

the amount reflects a refund, put the figure in

Verify your information on the form. Draw a line through

[brackets].

any errors and write in the correct information. If you've

made changes, mark the "Address Change" box. Check the

"Cancel Permit" box if you want to cancel your Idaho tobacco

Line 10.

Adjustment from previous periods. Attach the

tax permit.

letter you received from the Tax Commission that

advised you of this adjustment. If the amount is a

Report amounts on lines 1 through 8 at the "wholesale sales

credit, put it in [brackets].

price" of the tobacco products. "Wholesale sales price" is the

established price a manufacturer or any person charges a

If you paid tax on tobacco products sold on

distributor for a tobacco product without any discount or other

or after January 1, 2000, and later wrote off

reduction.

the accounts as bad debts because they were

worthless, use line 10 to apply the bad debt credit

SCHEDULES - If you need schedules, visit our website at

to this return or, if no tax is due, to be refunded.

tax.idaho.gov and click on "Tax Types," then select "Tobacco

tax" (tax.idaho.gov/i-1048), or call us at 334-7660 in the

Line 11.

Subtract line 10 from line 9. If there is no entry

Boise area or toll free at (800) 972-7660.

on line 10, enter the figure from line 9 on line 11.

If the figure on line 11 is a negative amount, also

Round amounts to the nearest whole dollar.

enter it on line 14.

Line 1.

Complete Form TB 1350A and enter the amount

Penalty. You must file and pay by the due date

Line 12.

from line 36.

listed on the tax return. If you don't, the following

penalties apply:

For any taxable roll-your-own tobacco reported

If you file on time but your payment is late, the

on line 1 from nonparticipating manufacturers,

penalty is 0.5% of the tax due (see line 11) for

complete the additional Form TB 1301-NP.

each late month. This penalty begins the first day

you are late and continues until you pay the tax.

Line 2.

In-state distributors: Complete Form TB 1350B

If you file late, the penalty is 5% of the tax due

and enter the amount from line 36.

(see line 11) for each late month. This penalty be-

Out-of-state distributors: enter "zero."

gins the first day you are late and continues until

you file your return or pay the tax.

Line 3.

In-state distributors: Complete Form TB 1350C,

If you file late and don't pay the tax when you

Part I and enter the amount from line 13.

file, there is an additional late penalty of 0.5% of

Out-of-state distributors: enter "zero."

the tax due (see line 11) for each late month. This

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2