Form 2350 - Michigan Bus Schedule

Download a blank fillable Form 2350 - Michigan Bus Schedule in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 2350 - Michigan Bus Schedule with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

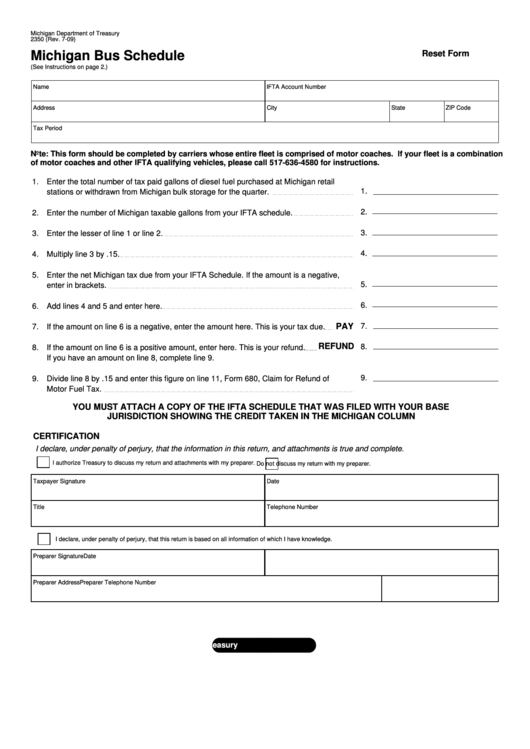

Michigan Department of Treasury

2350 (Rev. 7-09)

Michigan Bus Schedule

Reset Form

(See Instructions on page 2.)

Name

IFTA Account Number

Address

City

State

ZIP Code

Tax Period

Note: This form should be completed by carriers whose entire fleet is comprised of motor coaches. If your fleet is a combination

of motor coaches and other IFTA qualifying vehicles, please call 517-636-4580 for instructions.

1.

Enter the total number of tax paid gallons of diesel fuel purchased at Michigan retail

1.

stations or withdrawn from Michigan bulk storage for the quarter.

2.

2.

Enter the number of Michigan taxable gallons from your IFTA schedule.

3.

3.

Enter the lesser of line 1 or line 2.

4.

4.

Multiply line 3 by .15.

5.

Enter the net Michigan tax due from your IFTA Schedule. If the amount is a negative,

5.

enter in brackets.

6.

6.

Add lines 4 and 5 and enter here.

PAY

7.

7.

If the amount on line 6 is a negative, enter the amount here. This is your tax due.

REFUND

8.

8.

If the amount on line 6 is a positive amount, enter here. This is your refund.

If you have an amount on line 8, complete line 9.

9.

9.

Divide line 8 by .15 and enter this figure on line 11, Form 680, Claim for Refund of

Motor Fuel Tax.

YOU MUST ATTACH A COPY OF THE IFTA SCHEDULE THAT WAS FILED WITH YOUR BASE

JURISDICTION SHOWING THE CREDIT TAKEN IN THE MICHIGAN COLUMN

CERTIFICATION

I declare, under penalty of perjury, that the information in this return, and attachments is true and complete.

I authorize Treasury to discuss my return and attachments with my preparer.

Do not discuss my return with my preparer.

Taxpayer Signature

Date

Title

Telephone Number

I declare, under penalty of perjury, that this return is based on all information of which I have knowledge.

Preparer Signature

Date

Preparer Address

Preparer Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2