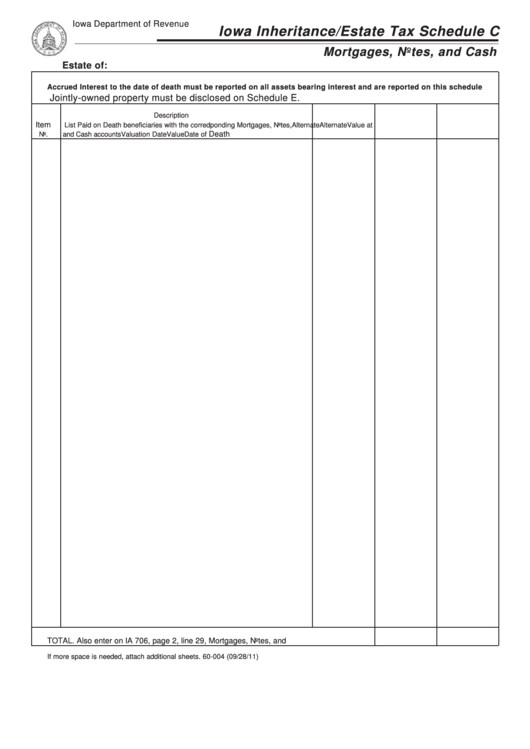

Mortgages, Notes, And Cash - Iowa Inheritance/estate Tax Schedule C

ADVERTISEMENT

Iowa Department of Revenue

Iowa Inheritance/Estate Tax Schedule C

Mortgages, Notes, and Cash

Estate of:

Accrued Interest to the date of death must be reported on all assets bearing interest and are reported on this schedule

Jointly-owned property must be disclosed on Schedule E.

Description

Item

List Paid on Death beneficiaries with the corredponding Mortgages, Notes,

Alternate

Alternate

Value at

Death

No.

and Cash accounts

Valuation Date

Value

Date of

TOTAL. Also enter on IA 706, page 2, line 29, Mortgages, Notes, and Cash. ...................

If more space is needed, attach additional sheets.

60-004 (09/28/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1