Form 150-310-059 - Pollution Control Facilities Exemption

ADVERTISEMENT

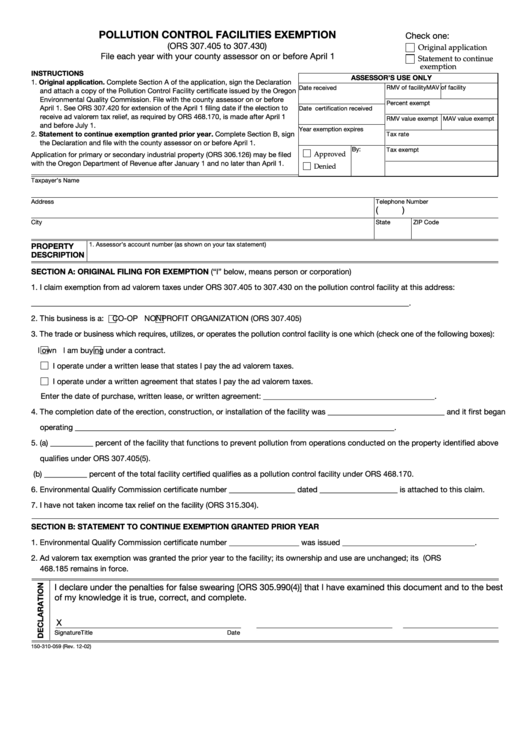

POLLUTION CONTROL FACILITIES EXEMPTION

Check one:

(ORS 307.405 to 307.430)

Original application

File each year with your county assessor on or before April 1

Statement to continue

exemption

INSTRUCTIONS

ASSESSOR’S USE ONLY

1. Original application. Complete Section A of the application, sign the Declaration

Date received

RMV of facility

MAV of facility

and attach a copy of the Pollution Control Facility certificate issued by the Oregon

Environmental Quality Commission. File with the county assessor on or before

Percent exempt

April 1. See ORS 307.420 for extension of the April 1 filing date if the election to

Date certification received

receive ad valorem tax relief, as required by ORS 468.170, is made after April 1

RMV value exempt

MAV value exempt

and before July 1.

Year exemption expires

2. Statement to continue exemption granted prior year. Complete Section B, sign

Tax rate

the Declaration and file with the county assessor on or before April 1.

By:

Tax exempt

Approved

Application for primary or secondary industrial property (ORS 306.126) may be filed

with the Oregon Department of Revenue after January 1 and no later than April 1.

J.V. number

Denied

Taxpayer’s Name

Address

Telephone Number

(

)

City

State

ZIP Code

1. Assessor’s account number (as shown on your tax statement)

PROPERTY

DESCRIPTION

SECTION A: ORIGINAL FILING FOR EXEMPTION (“I” below, means person or corporation)

1. I claim exemption from ad valorem taxes under ORS 307.405 to 307.430 on the pollution control facility at this address:

_________________________________________________________________________________________________.

2. This business is a:

CO-OP

NONPROFIT ORGANIZATION (ORS 307.405)

3. The trade or business which requires, utilizes, or operates the pollution control facility is one which (check one of the following boxes):

I own

I am buying under a contract.

I operate under a written lease that states I pay the ad valorem taxes.

I operate under a written agreement that states I pay the ad valorem taxes.

Enter the date of purchase, written lease, or written agreement: ____________________________________________.

4. The completion date of the erection, construction, or installation of the facility was ______________________________ and it first began

operating __________________________________________________________________________________.

5. (a) ___________ percent of the facility that functions to prevent pollution from operations conducted on the property identified above

qualifies under ORS 307.405(5).

(b) ___________ percent of the total facility certified qualifies as a pollution control facility under ORS 468.170.

6. Environmental Qualify Commission certificate number _________________ dated ____________________ is attached to this claim.

7. I have not taken income tax relief on the facility (ORS 315.304).

SECTION B: STATEMENT TO CONTINUE EXEMPTION GRANTED PRIOR YEAR

1. Environmental Qualify Commission certificate number __________________ was issued __________________________________.

2. Ad valorem tax exemption was granted the prior year to the facility; its ownership and use are unchanged; its E.Q.C. certificate (ORS

468.185 remains in force.

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document and to the best

of my knowledge it is true, correct, and complete.

X

Signature

Title

Date

150-310-059 (Rev. 12-02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2