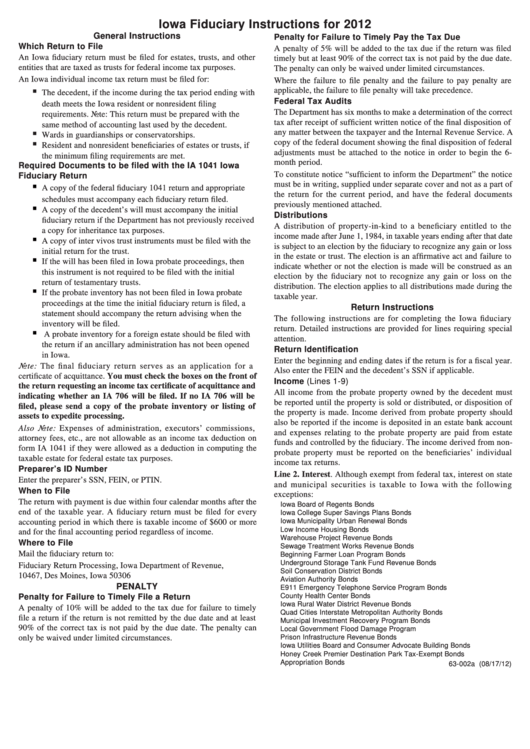

Iowa Fiduciary Instructions For 2012

ADVERTISEMENT

Iowa Fiduciary Instructions for 2012

General Instructions

Penalty for Failure to Timely Pay the Tax Due

Which Return to File

A penalty of 5% will be added to the tax due if the return was filed

An Iowa fiduciary return must be filed for estates, trusts, and other

timely but at least 90% of the correct tax is not paid by the due date.

entities that are taxed as trusts for federal income tax purposes.

The penalty can only be waived under limited circumstances.

An Iowa individual income tax return must be filed for:

Where the failure to file penalty and the failure to pay penalty are

applicable, the failure to file penalty will take precedence.

The decedent, if the income during the tax period ending with

Federal Tax Audits

death meets the Iowa resident or nonresident filing

The Department has six months to make a determination of the correct

requirements. Note: This return must be prepared with the

tax after receipt of sufficient written notice of the final disposition of

same method of accounting last used by the decedent.

any matter between the taxpayer and the Internal Revenue Service. A

Wards in guardianships or conservatorships.

copy of the federal document showing the final disposition of federal

Resident and nonresident beneficiaries of estates or trusts, if

adjustments must be attached to the notice in order to begin the 6-

the minimum filing requirements are met.

month period.

Required Documents to be filed with the IA 1041 Iowa

To constitute notice “sufficient to inform the Department” the notice

Fiduciary Return

must be in writing, supplied under separate cover and not as a part of

A copy of the federal fiduciary 1041 return and appropriate

the return for the current period, and have the federal documents

schedules must accompany each fiduciary return filed.

previously mentioned attached.

A copy of the decedent’s will must accompany the initial

Distributions

fiduciary return if the Department has not previously received

A distribution of property-in-kind to a beneficiary entitled to the

a copy for inheritance tax purposes.

income made after June 1, 1984, in taxable years ending after that date

A copy of inter vivos trust instruments must be filed with the

is subject to an election by the fiduciary to recognize any gain or loss

initial return for the trust.

in the estate or trust. The election is an affirmative act and failure to

If the will has been filed in Iowa probate proceedings, then

indicate whether or not the election is made will be construed as an

this instrument is not required to be filed with the initial

election by the fiduciary not to recognize any gain or loss on the

return of testamentary trusts.

distribution. The election applies to all distributions made during the

If the probate inventory has not been filed in Iowa probate

taxable year.

proceedings at the time the initial fiduciary return is filed, a

Return Instructions

statement should accompany the return advising when the

The following instructions are for completing the Iowa fiduciary

inventory will be filed.

return. Detailed instructions are provided for lines requiring special

A probate inventory for a foreign estate should be filed with

attention.

the return if an ancillary administration has not been opened

Return Identification

in Iowa.

Enter the beginning and ending dates if the return is for a fiscal year.

Note: The final fiduciary return serves as an application for a

Also enter the FEIN and the decedent’s SSN if applicable.

certificate of acquittance. You must check the boxes on the front of

Income (Lines 1-9)

the return requesting an income tax certificate of acquittance and

All income from the probate property owned by the decedent must

indicating whether an IA 706 will be filed. If no IA 706 will be

be reported until the property is sold or distributed, or disposition of

filed, please send a copy of the probate inventory or listing of

the property is made. Income derived from probate property should

assets to expedite processing.

also be reported if the income is deposited in an estate bank account

Also Note: Expenses of administration, executors’ commissions,

and expenses relating to the probate property are paid from estate

attorney fees, etc., are not allowable as an income tax deduction on

funds and controlled by the fiduciary. The income derived from non-

form IA 1041 if they were allowed as a deduction in computing the

probate property must be reported on the beneficiaries’ individual

taxable estate for federal estate tax purposes.

income tax returns.

Preparer’s ID Number

Line 2. Interest. Although exempt from federal tax, interest on state

Enter the preparer’s SSN, FEIN, or PTIN.

and municipal securities is taxable to Iowa with the following

When to File

exceptions:

The return with payment is due within four calendar months after the

Iowa Board of Regents Bonds

end of the taxable year. A fiduciary return must be filed for every

Iowa College Super Savings Plans Bonds

accounting period in which there is taxable income of $600 or more

Iowa Municipality Urban Renewal Bonds

Low Income Housing Bonds

and for the final accounting period regardless of income.

Warehouse Project Revenue Bonds

Where to File

Sewage Treatment Works Revenue Bonds

Mail the fiduciary return to:

Beginning Farmer Loan Program Bonds

Underground Storage Tank Fund Revenue Bonds

Fiduciary Return Processing, Iowa Department of Revenue, P.O. Box

Soil Conservation District Bonds

10467, Des Moines, Iowa 50306

Aviation Authority Bonds

PENALTY

E911 Emergency Telephone Service Program Bonds

Penalty for Failure to Timely File a Return

County Health Center Bonds

Iowa Rural Water District Revenue Bonds

A penalty of 10% will be added to the tax due for failure to timely

Quad Cities Interstate Metropolitan Authority Bonds

file a return if the return is not remitted by the due date and at least

Municipal Investment Recovery Program Bonds

90% of the correct tax is not paid by the due date. The penalty can

Local Government Flood Damage Program

only be waived under limited circumstances.

Prison Infrastructure Revenue Bonds

Iowa Utilities Board and Consumer Advocate Building Bonds

Honey Creek Premier Destination Park Tax-Exempt Bonds

Appropriation Bonds

63-002a (08/17/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2