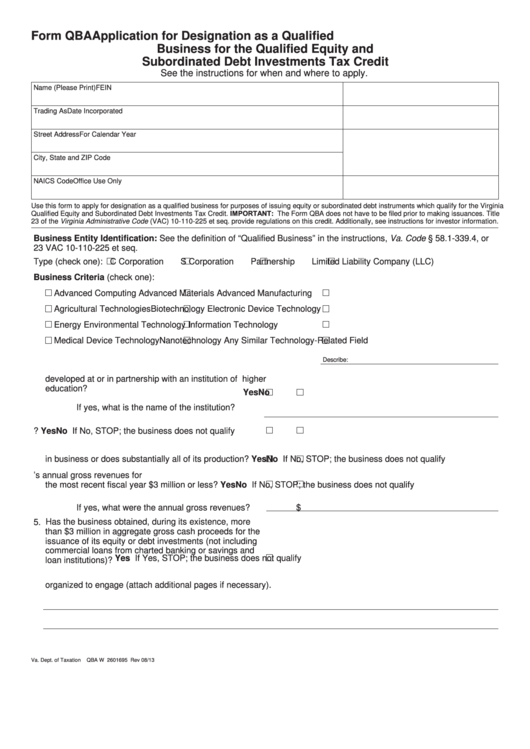

Form QBA

Application for Designation as a Qualified

Business for the Qualified Equity and

Subordinated Debt Investments Tax Credit

See the instructions for when and where to apply.

Name (Please Print)

FEIN

Trading As

Date Incorporated

Street Address

For Calendar Year

City, State and ZIP Code

NAICS Code

Office Use Only

Use this form to apply for designation as a qualified business for purposes of issuing equity or subordinated debt instruments which qualify for the Virginia

Qualified Equity and Subordinated Debt Investments Tax Credit. IMPORTANT: The Form QBA does not have to be filed prior to making issuances. Title

23 of the Virginia Administrative Code (VAC) 10-110-225 et seq. provide regulations on this credit. Additionally, see instructions for investor information.

Business Entity Identification: See the definition of “Qualified Business” in the instructions, Va. Code § 58.1-339.4, or

23 VAC 10-110-225 et seq.

Type (check one):

C Corporation

S Corporation

Partnership

Limited Liability Company (LLC)

Business Criteria (check one):

Advanced Computing

Advanced Materials

Advanced Manufacturing

Agricultural Technologies

Biotechnology

Electronic Device Technology

Energy

Environmental Technology

Information Technology

Medical Device Technology

Nanotechnology

Any Similar Technology-Related Field

Describe:

1. Was your business created to commercialize research

developed at or in partnership with an institution of higher

education?

Yes

No

If yes, what is the name of the institution?

2. Is its principal office or facility in Virginia?

Yes

No If No, STOP; the business does not qualify

3. Is Virginia where the business entity is primarily engaged

in business or does substantially all of its production?

Yes

No If No, STOP; the business does not qualify

4. Were the business entity’s annual gross revenues for

the most recent fiscal year $3 million or less?

Yes

No If No, STOP; the business does not qualify

If yes, what were the annual gross revenues?

$

5. Has the business obtained, during its existence, more

than $3 million in aggregate gross cash proceeds for the

issuance of its equity or debt investments (not including

commercial loans from charted banking or savings and

Yes If Yes, STOP; the business does not qualify

loan institutions)?

6. Provide a detailed description of the type of business or activities in which the entity is primarily engaged or primarily

organized to engage (attach additional pages if necessary).

Va. Dept. of Taxation

QBA W 2601695 Rev 08/13

1

1 2

2 3

3 4

4