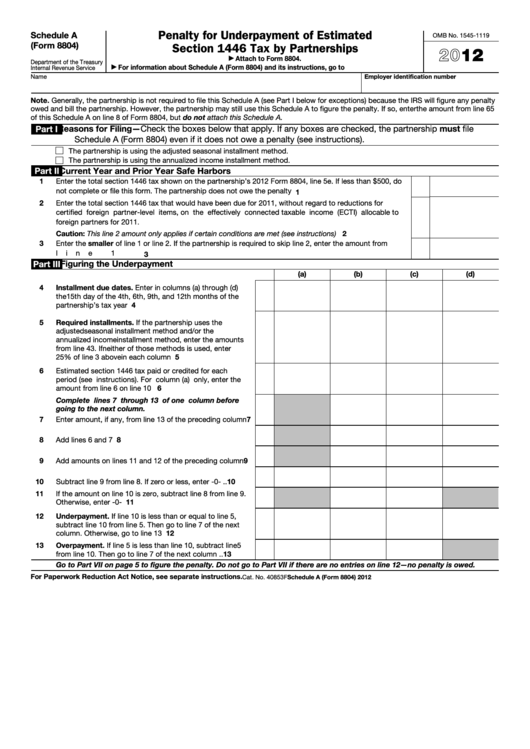

Penalty for Underpayment of Estimated

Schedule A

OMB No. 1545-1119

(Form 8804)

Section 1446 Tax by Partnerships

2012

Attach to Form 8804.

▶

Department of the Treasury

For information about Schedule A (Form 8804) and its instructions, go to

Internal Revenue Service

▶

Name

Employer identification number

Note. Generally, the partnership is not required to file this Schedule A (see Part I below for exceptions) because the IRS will figure any penalty

owed and bill the partnership. However, the partnership may still use this Schedule A to figure the penalty. If so, enter the amount from line 65

of this Schedule A on line 8 of Form 8804, but do not attach this Schedule A.

Reasons for Filing—Check the boxes below that apply. If any boxes are checked, the partnership must file

Part I

Schedule A (Form 8804) even if it does not owe a penalty (see instructions).

The partnership is using the adjusted seasonal installment method.

The partnership is using the annualized income installment method.

Part II

Current Year and Prior Year Safe Harbors

1

Enter the total section 1446 tax shown on the partnership’s 2012 Form 8804, line 5e. If less than $500, do

not complete or file this form. The partnership does not owe the penalty

.

.

.

.

.

.

.

.

.

.

1

2

Enter the total section 1446 tax that would have been due for 2011, without regard to reductions for

certified foreign partner-level items, on the effectively connected taxable income (ECTI) allocable to

foreign partners for 2011.

Caution: This line 2 amount only applies if certain conditions are met (see instructions) .

.

.

.

.

.

2

3

Enter the smaller of line 1 or line 2. If the partnership is required to skip line 2, enter the amount from

line 1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Figuring the Underpayment

Part III

(a)

(b)

(c)

(d)

4

Installment due dates. Enter in columns (a) through (d)

the 15th day of the 4th, 6th, 9th, and 12th months of the

4

partnership’s tax year .

.

.

.

.

.

.

.

.

.

.

5

Required installments. If the partnership uses the

adjusted

seasonal

installment

method

and/or

the

annualized income installment method, enter the amounts

from line 43. If neither of those methods is used, enter

25% of line 3 above in each column .

.

.

.

.

.

.

5

6

Estimated section 1446 tax paid or credited for each

period (see instructions). For column (a) only, enter the

amount from line 6 on line 10 .

.

.

.

.

.

.

.

.

6

Complete lines 7 through 13 of one column before

going to the next column.

7

Enter amount, if any, from line 13 of the preceding column

7

8

8

Add lines 6 and 7

.

.

.

.

.

.

.

.

.

.

.

.

9

Add amounts on lines 11 and 12 of the preceding column

9

10

10

Subtract line 9 from line 8. If zero or less, enter -0- .

.

11

If the amount on line 10 is zero, subtract line 8 from line 9.

Otherwise, enter -0- .

.

.

.

.

.

.

.

.

.

.

.

11

12

Underpayment. If line 10 is less than or equal to line 5,

subtract line 10 from line 5. Then go to line 7 of the next

column. Otherwise, go to line 13 .

.

.

.

.

.

.

.

12

13

Overpayment. If line 5 is less than line 10, subtract line 5

from line 10. Then go to line 7 of the next column

.

.

13

Go to Part VII on page 5 to figure the penalty. Do not go to Part VII if there are no entries on line 12—no penalty is owed.

For Paperwork Reduction Act Notice, see separate instructions.

Schedule A (Form 8804) 2012

Cat. No. 40853F

1

1 2

2 3

3 4

4 5

5