l

2012

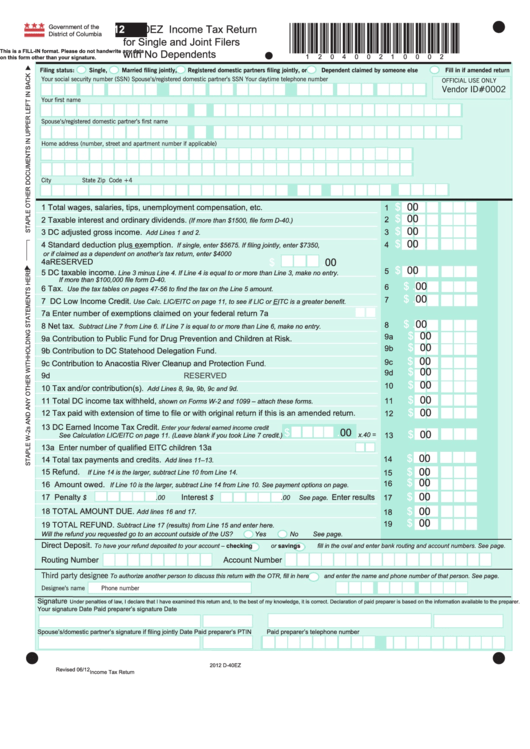

D-40EZ Income Tax Return

Government of the

*120400210002*

District of Columbia

for Single and Joint Filers

This is a FILL-IN format. Please do not handwrite any data

with No Dependents

l

on this form other than your signature.

s

Filing status:

Single,

Married filing jointly,

Registered domestic partners filing jointly, or

Dependent claimed by someone else

Fill in if amended return

Your social security number (SSN)

Spouse’s/registered domestic partner’s SSN

Your daytime telephone number

OFFICIAL USE ONLY

Vendor ID#0002

Your first name

M.I.

Last name

Spouse’s/registered domestic partner’s first name

M.I.

Last name

Home address (number, street and apartment number if applicable)

City

State

Zip Code +4

.

$

00

1

Total wages, salaries, tips, unemployment compensation, etc.

1

.

$

00

2

Taxable interest and ordinary dividends.

2

(If more than $1500, file form D-40.)

.

$

00

3

DC adjusted gross income.

3

Add Lines 1 and 2.

.

$

00

4

Standard deduction plus exemption.

4

If single, enter $5675. If filing jointly, enter $7350,

or if claimed as a dependent on another’s tax return, enter $4000

.

$

00

4a

RESERVED

.

$

00

s

5

5

DC taxable income.

Line 3 minus Line 4. If Line 4 is equal to or more than Line 3, make no entry.

If more than $100,000 file form D-40.

.

$

00

6

6

Tax.

Use the tax tables on pages 47-56 to find the tax on the Line 5 amount.

.

$

00

7

7

DC Low Income Credit.

Use Calc. LIC/EITC on page 11, to see if LIC or EITC is a greater benefit.

7a

Enter number of exemptions claimed on your federal return

7a

.

$

00

8

8

Net tax.

Subtract Line 7 from Line 6. If Line 7 is equal to or more than Line 6, make no entry.

.

$

00

9a

9a

Contribution to Public Fund for Drug Prevention and Children at Risk.

.

$

00

9b

9b

Contribution to DC Statehood Delegation Fund.

.

$

00

9c

9c

Contribution to Anacostia River Cleanup and Protection Fund

.

.

$

00

9d

9d

RESERVED

.

$

00

10

10

Tax and/or contribution(s).

Add Lines 8, 9a, 9b, 9c and 9d.

.

$

00

11

Total DC income tax withheld,

11

shown on Forms W-2 and 1099 – attach these forms.

.

$

00

12

Tax paid with extension of time to file or with original return if this is an amended return.

12

13

DC Earned Income Tax Credit.

Enter your federal earned income credit

.

$

00

.

$

00

13

x.40 =

See Calculation LIC/EITC on page 11. (Leave blank if you took Line 7 credit.)

13a Enter number of qualified EITC children

13a

.

$

00

14

14

Total tax payments and credits.

Add lines 11–13.

.

$

00

15

Refund.

15

If Line 14 is the larger, subtract Line 10 from Line 14.

.

$

00

16

16

Amount owed.

If Line 10 is the larger, subtract Line 14 from Line 10. See payment options on page.

.

$

00

17

Penalty

Interest

Enter results

17

$

.00

$

.00 See page.

.

$

00

18

TOTAL AMOUNT DUE.

18

Add lines 16 and 17.

.

$

00

19

19

TOTAL REFUND.

Subtract Line 17 (results) from Line 15 and enter here.

Will the refund you requested go to an account outside of the US?

Yes

No

See page.

Direct Deposit.

To have your refund deposited to your account – checking

or savings

fill in the oval and enter bank routing and account numbers. See page.

Routing Number

Account Number

Third party designee

To authorize another person to discuss this return with the OTR, fill in here

and enter the name and phone number of that person. See page.

Designee’s name

Phone number

Signature

Under penalties of law, I declare that I have examined this return and, to the best of my knowledge, it is correct. Declaration of paid preparer is based on the information available to the preparer.

Your signature

Date

Paid preparer’s signature

Date

Spouse’s/domestic partner’s signature if filing jointly

Date

Paid preparer’s PTIN

Paid preparer’s telephone number

l

l

2012 D-40EZ

Revised 06/12

Income Tax Return

1

1 2

2