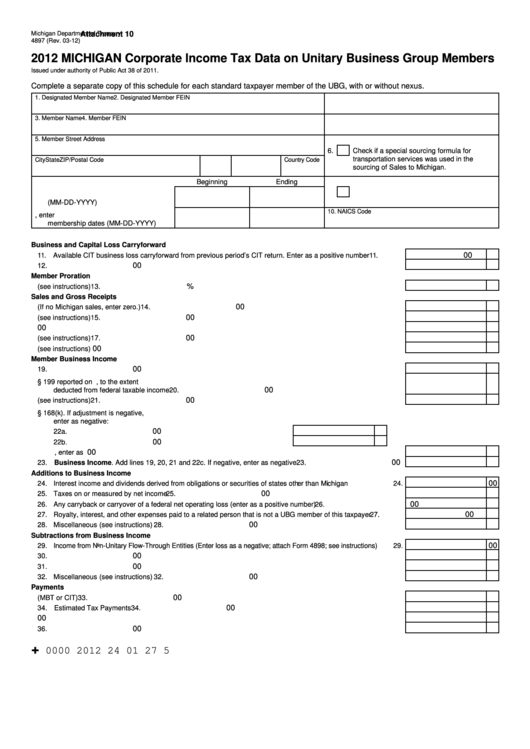

Form 4897 - Corporate Income Tax Data On Unitary Business Group Members - 2012

ADVERTISEMENT

Michigan Department of Treasury

Attachment 10

4897 (Rev. 03-12)

2012 MICHIGAN Corporate Income Tax Data on Unitary Business Group Members

Issued under authority of Public Act 38 of 2011.

Complete a separate copy of this schedule for each standard taxpayer member of the UBG, with or without nexus.

1. Designated Member Name

2. Designated Member FEIN

3. Member Name

4. Member FEIN

5. Member Street Address

6.

Check if a special sourcing formula for

transportation services was used in the

City

State

ZIP/Postal Code Country Code

sourcing of Sales to Michigan.

Beginning

Ending

9.

Check if Nexus with Michigan.

7. Federal tax period Included in return

(MM-DD-YYYY) ........................................

10. NAICS Code

8. If part-year member, enter

membership dates (MM-DD-YYYY) .........

Business and Capital Loss Carryforward

00

11. Available CIT business loss carryforward from previous period’s CIT return. Enter as a positive number ......... 11.

00

12. Carryback or carryover of capital loss ................................................................................................................. 12.

Member Proration

%

13. Proration Percentage (see instructions) .............................................................................................................. 13.

Sales and Gross Receipts

00

14. Michigan sales. (If no Michigan sales, enter zero.) ............................................................................................. 14.

00

15. Michigan sales eliminations (see instructions) .................................................................................................... 15.

00

16. Total sales............................................................................................................................................................ 16.

00

17. Total sales eliminations (see instructions) ........................................................................................................... 17.

00

18. Gross Receipts (see instructions)........................................................................................................................ 18.

Member Business Income

00

19. Federal taxable income from U.S. Form 1120 ..................................................................................................... 19.

20. Domestic production activities deduction based on IRC § 199 reported on U.S. Form 8903, to the extent

00

deducted from federal taxable income ................................................................................................................ 20.

00

21. Miscellaneous (see instructions) ......................................................................................................................... 21.

22. Adjustments due to decoupling of Michigan depreciation from IRC § 168(k). If adjustment is negative,

enter as negative:

00

a. Net bonus depreciation adjustment .................................................... 22a.

00

b. Gain/loss adjustment on sale of an eligible depreciable asset ........... 22b.

00

c. Add lines 22a and 22b. If negative, enter as negative................................................................................. 22c.

00

23. Business Income. Add lines 19, 20, 21 and 22c. If negative, enter as negative ............................................... 23.

Additions to Business Income

00

24. Interest income and dividends derived from obligations or securities of states other than Michigan ...................

24.

00

25. Taxes on or measured by net income .................................................................................................................. 25.

00

26. Any carryback or carryover of a federal net operating loss (enter as a positive number) ..................................... 26.

00

27. Royalty, interest, and other expenses paid to a related person that is not a UBG member of this taxpayer ........ 27.

00

28. Miscellaneous (see instructions) ......................................................................................................................... 28.

Subtractions from Business Income

00

29. Income from Non-Unitary Flow-Through Entities (Enter loss as a negative; attach Form 4898; see instructions) ..... 29.

00

30. Dividends and royalties received from persons other than U.S. persons and foreign operating entities ............ 30.

00

31. Interest income derived from United States obligations ...................................................................................... 31.

00

32. Miscellaneous (see instructions) ......................................................................................................................... 32.

Payments

00

33. Overpayment credited from prior period return (MBT or CIT) ............................................................................. 33.

00

34. Estimated Tax Payments ..................................................................................................................................... 34.

00

35. Flow-Through Withholding Payments.................................................................................................................. 35.

00

36. Tax Paid with Request for Extension ................................................................................................................... 36.

+

0000 2012 24 01 27 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6