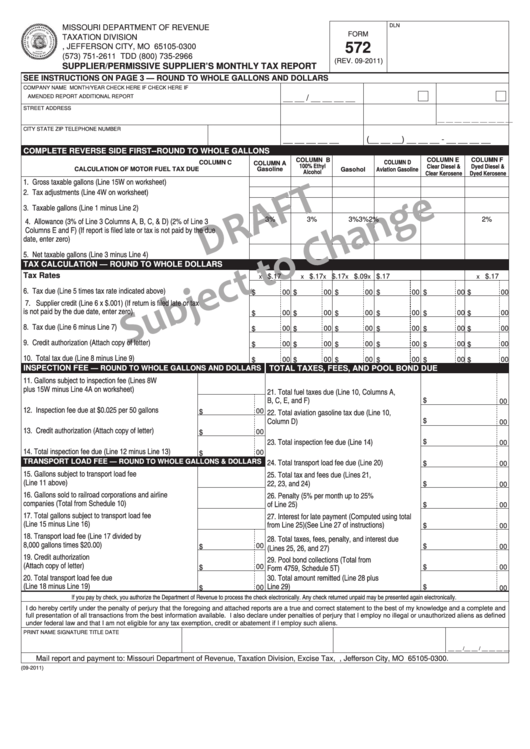

Form 572 Draft - Supplier/permissive Supplier'S Monthly Tax Report - 2011

ADVERTISEMENT

DLN

MISSOURI DEPARTMENT OF REVENUE

FORM

TAXATION DIVISION

572

P.O. BOX 300, JEFFERSON CITY, MO 65105-0300

(573) 751-2611 TDD (800) 735-2966

(REV. 09-2011)

SUPPLIER/PERMISSIVE SUPPLIER’S MONTHLY TAX REPORT

SEE INSTRUCTIONS ON PAGE 3 — ROUND TO WHOLE GALLONS AND DOLLARS

COMPANY NAME

MONTH/YEAR

CHECK HERE IF

CHECK HERE IF

AMENDED REPORT

ADDITIONAL REPORT

__ __ / __ __ __ __

STREET ADDRESS

P.O. BOX

LICENSE NUMBER

FEIN

__ __ __ __ __ __ __ __ __

CITY

STATE

ZIP

TELEPHONE NUMBER

__ __ __ __ __

(__ __ __) __ __ __ - __ __ __ __

CO

COMPLETE REVERSE SIDE FIRST--ROUND TO WHOLE GALLONS

COLUMN E

COLUMN F

COLUMN B

COLUMN D

COLUMN C

COLUMN A

100% Ethyl

Clear Diesel &

Dyed Diesel &

Aviation Gasoline

CALCULATION OF MOTOR FUEL TAX DUE

Gasoline

Gasohol

Alcohol

Clear Kerosene

Dyed Kerosene

1. Gross taxable gallons (Line 15W on worksheet) .........................................

2. Tax adjustments (Line 4W on worksheet) ...................................................

3. Taxable gallons (Line 1 minus Line 2) ........................................................

3%

3%

3%

3%

2%

2%

4. Allowance (3% of Line 3 Columns A, B, C, & D) (2% of Line 3

Columns E and F) (If report is filed late or tax is not paid by the due

date, enter zero) ..........................................................................................

5. Net taxable gallons (Line 3 minus Line 4) ..................................................

TAX CALCULATION — ROUND TO WHOLE DOLLARS

Tax Rates

$.17

$.17

$.17

$.09

$.17

$.17

x

x

x

x

x

x

6. Tax due (Line 5 times tax rate indicated above) ........................................

00

00

00

00

00

00

$

$

$

$

$

$

7. Supplier credit (Line 6 x $.001) (If return is filed late or tax

is not paid by the due date, enter zero) ......................................................

$

00

$

00

$

00

$

00

$

00

$

00

8. Tax due (Line 6 minus Line 7) ....................................................................

00

00

00

00

00

00

$

$

$

$

$

$

9. Credit authorization (Attach copy of letter) .................................................

00

00

00

00

00

00

$

$

$

$

$

$

10. Total tax due (Line 8 minus Line 9) ............................................................

00

00

00

00

00

00

$

$

$

$

$

$

INSPECTION FEE

— ROUND TO WHOLE GALLONS AND DOLLARS

TOTAL TAXES, FEES, AND POOL BOND DUE

11. Gallons subject to inspection fee (Lines 8W

plus 15W minus Line 4A on worksheet) .........................

21. Total fuel taxes due (Line 10, Columns A,

B, C, E, and F) ...................................................

$

00

12. Inspection fee due at $0.025 per 50 gallons ..................

00

22. Total aviation gasoline tax due (Line 10,

$

Column D) ..........................................................

$

00

13. Credit authorization (Attach copy of letter) .....................

00

$

23. Total inspection fee due (Line 14) ......................

$

00

14. Total inspection fee due (Line 12 minus Line 13) ...........

00

$

TRANSPORT LOAD FEE

24. Total transport load fee due (Line 20) ................

— ROUND TO WHOLE GALLONS & DOLLARS

$

00

15. Gallons subject to transport load fee

25. Total tax and fees due (Lines 21,

(Line 11 above) ..............................................................

22, 23, and 24) ...................................................

$

00

16. Gallons sold to railroad corporations and airline

26. Penalty (5% per month up to 25%

companies (Total from Schedule 10) .............................

of Line 25) ..........................................................

$

00

17. Total gallons subject to transport load fee

27. Interest for late payment (Computed using total

(Line 15 minus Line 16) ..................................................

from Line 25)(See Line 27 of instructions) .........

$

00

18. Transport load fee (Line 17 divided by

28. Total taxes, fees, penalty, and interest due

8,000 gallons times $20.00) ...........................................

00

$

$

(Lines 25, 26, and 27) .........................................

00

19. Credit authorization

29. Pool bond collections (Total from

(Attach copy of letter) .....................................................

00

Form 4759, Schedule 5T) ..................................

$

$

00

20. Total transport load fee due

30. Total amount remitted (Line 28 plus

(Line 18 minus Line 19) ..................................................

Line 29) ...............................................................

$

00

00

$

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned unpaid may be presented again electronically.

I do hereby certify under the penalty of perjury that the foregoing and attached reports are a true and correct statement to the best of my knowledge and a complete and

full presentation of all transactions from the best information available. I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined

under federal law and that I am not eligible for any tax exemption, credit or abatement if I employ such aliens.

PRINT NAME

SIGNATURE

TITLE

DATE

__ __ /__ __ / __ __ __ __

Mail report and payment to: Missouri Department of Revenue, Taxation Division, Excise Tax, P.O. Box 300, Jefferson City, MO 65105-0300.

(09-2011)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4