Instructions For Form 1550 - Idaho Cigarette Tax Return

ADVERTISEMENT

EIN00014

11-22-13

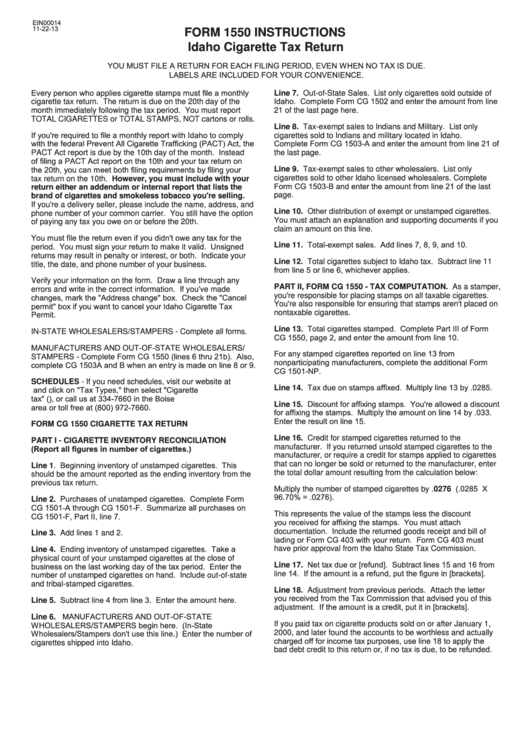

FORM 1550 INSTRUCTIONS

Idaho Cigarette Tax Return

YOU MUST FILE A RETURN FOR EACH FILING PERIOD, EVEN WHEN NO TAX IS DUE.

LABELS ARE INCLUDED FOR YOUR CONVENIENCE.

Every person who applies cigarette stamps must file a monthly

Line 7. Out-of-State Sales. List only cigarettes sold outside of

Idaho. Complete Form CG 1502 and enter the amount from line

cigarette tax return. The return is due on the 20th day of the

month immediately following the tax period. You must report

21 of the last page here.

TOTAL CIGARETTES or TOTAL STAMPS, NOT cartons or rolls.

Line 8. Tax-exempt sales to Indians and Military. List only

If you're required to file a monthly report with Idaho to comply

cigarettes sold to Indians and military located in Idaho.

with the federal Prevent All Cigarette Trafficking (PACT) Act, the

Complete Form CG 1503-A and enter the amount from line 21 of

PACT Act report is due by the 10th day of the month. Instead

the last page.

of filing a PACT Act report on the 10th and your tax return on

the 20th, you can meet both filing requirements by filing your

Line 9. Tax-exempt sales to other wholesalers. List only

cigarettes sold to other Idaho licensed wholesalers. Complete

tax return on the 10th. However, you must include with your

Form CG 1503-B and enter the amount from line 21 of the last

return either an addendum or internal report that lists the

page.

brand of cigarettes and smokeless tobacco you're selling.

If you're a delivery seller, please include the name, address, and

Line 10. Other distribution of exempt or unstamped cigarettes.

phone number of your common carrier. You still have the option

You must attach an explanation and supporting documents if you

of paying any tax you owe on or before the 20th.

claim an amount on this line.

You must file the return even if you didn't owe any tax for the

Line 11. Total-exempt sales. Add lines 7, 8, 9, and 10.

period. You must sign your return to make it valid. Unsigned

returns may result in penalty or interest, or both. Indicate your

Line 12. Total cigarettes subject to Idaho tax. Subtract line 11

title, the date, and phone number of your business.

from line 5 or line 6, whichever applies.

Verify your information on the form. Draw a line through any

PART II, FORM CG 1550 - TAX COMPUTATION. As a stamper,

errors and write in the correct information. If you've made

changes, mark the "Address change" box. Check the "Cancel

you're responsible for placing stamps on all taxable cigarettes.

You're also responsible for ensuring that stamps aren't placed on

permit" box if you want to cancel your Idaho Cigarette Tax

nontaxable cigarettes.

Permit.

Line 13. Total cigarettes stamped. Complete Part III of Form

IN-STATE WHOLESALERS/STAMPERS - Complete all forms.

CG 1550, page 2, and enter the amount from line 10.

MANUFACTURERS AND OUT-OF-STATE WHOLESALERS/

For any stamped cigarettes reported on line 13 from

STAMPERS - Complete Form CG 1550 (lines 6 thru 21b). Also,

nonparticipating manufacturers, complete the additional Form

complete CG 1503A and B when an entry is made on line 8 or 9.

CG 1501-NP.

SCHEDULES - If you need schedules, visit our website at

Line 14. Tax due on stamps affixed. Multiply line 13 by .0285.

tax.idaho.gov and click on "Tax Types," then select "Cigarette

tax" (tax.idaho.gov/i-1047), or call us at 334-7660 in the Boise

Line 15. Discount for affixing stamps. You're allowed a discount

area or toll free at (800) 972-7660.

for affixing the stamps. Multiply the amount on line 14 by .033.

Enter the result on line 15.

FORM CG 1550 CIGARETTE TAX RETURN

Line 16. Credit for stamped cigarettes returned to the

PART I - CIGARETTE INVENTORY RECONCILIATION

(Report all figures in number of cigarettes.)

manufacturer. If you returned unsold stamped cigarettes to the

manufacturer, or require a credit for stamps applied to cigarettes

Line 1. Beginning inventory of unstamped cigarettes. This

that can no longer be sold or returned to the manufacturer, enter

the total dollar amount resulting from the calculation below:

should be the amount reported as the ending inventory from the

previous tax return.

Multiply the number of stamped cigarettes by .0276 (.0285 X

96.70% = .0276).

Line 2. Purchases of unstamped cigarettes. Complete Form

CG 1501-A through CG 1501-F. Summarize all purchases on

CG 1501-F, Part II, line 7.

This represents the value of the stamps less the discount

you received for affixing the stamps. You must attach

documentation. Include the returned goods receipt and bill of

Line 3. Add lines 1 and 2.

lading or Form CG 403 with your return. Form CG 403 must

Line 4. Ending inventory of unstamped cigarettes. Take a

have prior approval from the Idaho State Tax Commission.

physical count of your unstamped cigarettes at the close of

Line 17. Net tax due or [refund]. Subtract lines 15 and 16 from

business on the last working day of the tax period. Enter the

line 14. If the amount is a refund, put the figure in [brackets].

number of unstamped cigarettes on hand. Include out-of-state

and tribal-stamped cigarettes.

Line 18. Adjustment from previous periods. Attach the letter

Line 5. Subtract line 4 from line 3. Enter the amount here.

you received from the Tax Commission that advised you of this

adjustment. If the amount is a credit, put it in [brackets].

Line 6. MANUFACTURERS AND OUT-OF-STATE

WHOLESALERS/STAMPERS begin here. (In-State

If you paid tax on cigarette products sold on or after January 1,

Wholesalers/Stampers don't use this line.) Enter the number of

2000, and later found the accounts to be worthless and actually

charged off for income tax purposes, use line 18 to apply the

cigarettes shipped into Idaho.

bad debt credit to this return or, if no tax is due, to be refunded.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3