Instructions For Certificate Of Exemption Form - Streamlined Sales And Use Tax Agreement

ADVERTISEMENT

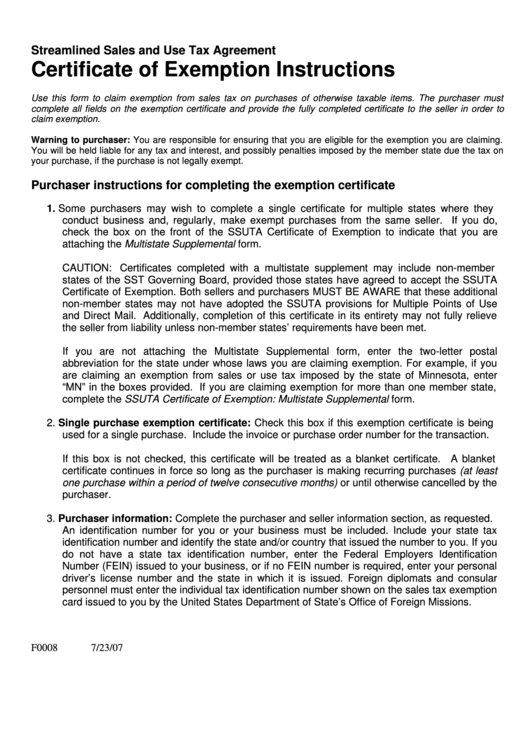

Streamlined Sales and Use Tax Agreement

Certificate of Exemption Instructions

Use this form to claim exemption from sales tax on purchases of otherwise taxable items. The purchaser must

complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to

claim exemption.

Warning to purchaser: You are responsible for ensuring that you are eligible for the exemption you are claiming.

You will be held liable for any tax and interest, and possibly penalties imposed by the member state due the tax on

your purchase, if the purchase is not legally exempt.

Purchaser instructions for completing the exemption certificate

1. Some purchasers may wish to complete a single certificate for multiple states where they

conduct business and, regularly, make exempt purchases from the same seller. If you do,

check the box on the front of the SSUTA Certificate of Exemption to indicate that you are

attaching the Multistate Supplemental form.

CAUTION: Certificates completed with a multistate supplement may include non-member

states of the SST Governing Board, provided those states have agreed to accept the SSUTA

Certificate of Exemption. Both sellers and purchasers MUST BE AWARE that these additional

non-member states may not have adopted the SSUTA provisions for Multiple Points of Use

and Direct Mail. Additionally, completion of this certificate in its entirety may not fully relieve

the seller from liability unless non-member states’ requirements have been met.

If you are not attaching the Multistate Supplemental form, enter the two-letter postal

abbreviation for the state under whose laws you are claiming exemption. For example, if you

are claiming an exemption from sales or use tax imposed by the state of Minnesota, enter

“MN” in the boxes provided. If you are claiming exemption for more than one member state,

complete the SSUTA Certificate of Exemption: Multistate Supplemental form.

2. Single purchase exemption certificate: Check this box if this exemption certificate is being

used for a single purchase. Include the invoice or purchase order number for the transaction.

If this box is not checked, this certificate will be treated as a blanket certificate.

A blanket

certificate continues in force so long as the purchaser is making recurring purchases (at least

one purchase within a period of twelve consecutive months) or until otherwise cancelled by the

purchaser.

3. Purchaser information: Complete the purchaser and seller information section, as requested.

An identification number for you or your business must be included. Include your state tax

identification number and identify the state and/or country that issued the number to you. If you

do not have a state tax identification number, enter the Federal Employers Identification

Number (FEIN) issued to your business, or if no FEIN number is required, enter your personal

driver’s license number and the state in which it is issued. Foreign diplomats and consular

personnel must enter the individual tax identification number shown on the sales tax exemption

card issued to you by the United States Department of State’s Office of Foreign Missions.

F0008

7/23/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3