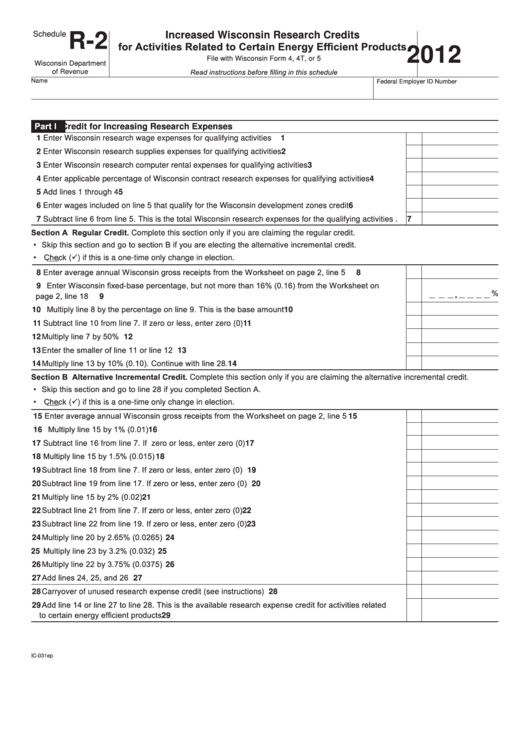

Schedule

Increased Wisconsin Research Credits

R-2

for Activities Related to Certain Energy Efficient Products

2012

File with Wisconsin Form 4, 4T, or 5

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Name

Federal Employer ID Number

Part I

Credit for Increasing Research Expenses

1 Enter Wisconsin research wage expenses for qualifying activities . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Enter Wisconsin research supplies expenses for qualifying activities . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Enter Wisconsin research computer rental expenses for qualifying activities . . . . . . . . . . . . . . . . . . . .

3

4 Enter applicable percentage of Wisconsin contract research expenses for qualifying activities . . . . . .

4

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Enter wages included on line 5 that qualify for the Wisconsin development zones credit . . . . . . . . . . .

6

7 Subtract line 6 from line 5 . This is the total Wisconsin research expenses for the qualifying activities .

7

Section A Regular Credit. Complete this section only if you are claiming the regular credit .

• Skip this section and go to section B if you are electing the alternative incremental credit.

•

Check (ü) if this is a one-time only change in election .

8 Enter average annual Wisconsin gross receipts from the Worksheet on page 2, line 5 . . . . . . . . . . . .

8

9 Enter Wisconsin fixed-base percentage, but not more than 16% (0.16) from the Worksheet on

.

%

page 2, line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Multiply line 8 by the percentage on line 9. This is the base amount . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Subtract line 10 from line 7 . If zero or less, enter zero (0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Multiply line 7 by 50% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Enter the smaller of line 11 or line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Multiply line 13 by 10% (0.10). Continue with line 28. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

Section B Alternative Incremental Credit. Complete this section only if you are claiming the alternative incremental credit .

• Skip this section and go to line 28 if you completed Section A.

•

Check (ü) if this is a one-time only change in election .

15 Enter average annual Wisconsin gross receipts from the Worksheet on page 2, line 5 . . . . . . . . . . . .

15

16 Multiply line 15 by 1% (0.01) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Subtract line 16 from line 7 . If zero or less, enter zero (0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18 Multiply line 15 by 1.5% (0.015) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19 Subtract line 18 from line 7. If zero or less, enter zero (0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20 Subtract line 19 from line 17. If zero or less, enter zero (0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21 Multiply line 15 by 2% (0.02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22 Subtract line 21 from line 7. If zero or less, enter zero (0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23 Subtract line 22 from line 19. If zero or less, enter zero (0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24 Multiply line 20 by 2.65% (0.0265) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 Multiply line 23 by 3.2% (0.032) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26 Multiply line 22 by 3.75% (0.0375) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

27 Add lines 24, 25, and 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28 Carryover of unused research expense credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

29 Add line 14 or line 27 to line 28. This is the available research expense credit for activities related

to certain energy efficient products . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

IC-031ep

1

1 2

2