Form D-1040(Nr) - City Of Detroit Income Tax - Non-Resident Instructions - 2014

ADVERTISEMENT

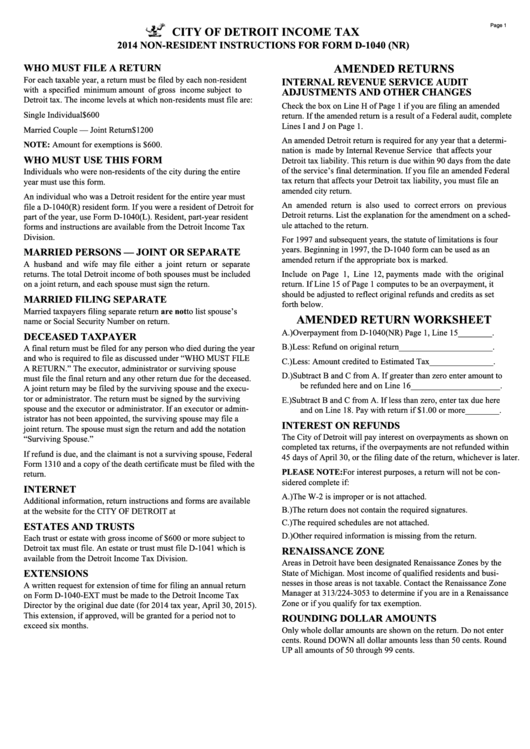

CITY OF DETROIT INCOME TAX

Page 1

2014 NON-RESIDENT INSTRUCTIONS FOR FORM D-1040 (NR)

AMENDED RETURNS

WHO MUST FILE A RETURN

INTERNAL REVENUE SERVICE AUDIT

For each taxable year, a return must be filed by each non-resident

ADJUSTMENTS AND OTHER CHANGES

with a specified minimum amount of gross income subject to

Detroit tax. The income levels at which non-residents must file are:

Check the box on Line H of Page 1 if you are filing an amended

Single Individual

$600

return. If the amended return is a result of a Federal audit, complete

Lines I and J on Page 1.

Married Couple — Joint Return

$1200

An amended Detroit return is required for any year that a determi-

NOTE: Amount for exemptions is $600.

nation is made by Internal Revenue Service that affects your

WHO MUST USE THIS FORM

Detroit tax liability. This return is due within 90 days from the date

of the service’s final determination. If you file an amended Federal

Individuals who were non-residents of the city during the entire

tax return that affects your Detroit tax liability, you must file an

year must use this form.

amended city return.

An individual who was a Detroit resident for the entire year must

An amended return is also used to correct errors on previous

file a D-1040(R) resident form. If you were a resident of Detroit for

Detroit returns. List the explanation for the amendment on a sched-

part of the year, use Form D-1040(L). Resident, part-year resident

ule attached to the return.

forms and instructions are available from the Detroit Income Tax

Division.

For 1997 and subsequent years, the statute of limitations is four

MARRIED PERSONS — JOINT OR SEPARATE

years. Beginning in 1997, the D-1040 form can be used as an

amended return if the appropriate box is marked.

A husband and wife may file either a joint return or separate

returns. The total Detroit income of both spouses must be included

Include on Page 1, Line 12, payments made with the original

on a joint return, and each spouse must sign the return.

return. If Line 15 of Page 1 computes to be an overpayment, it

should be adjusted to reflect original refunds and credits as set

MARRIED FILING SEPARATE

forth below.

Married taxpayers filing separate return are not to list spouse’s

AMENDED RETURN WORKSHEET

name or Social Security Number on return.

A.) Overpayment from D-1040(NR) Page 1, Line 15 ________.

DECEASED TAXPAYER

B.) Less: Refund on original return ______________________.

A final return must be filed for any person who died during the year

and who is required to file as discussed under “WHO MUST FILE

C.) Less: Amount credited to Estimated Tax _______________.

A RETURN.” The executor, administrator or surviving spouse

D.) Subtract B and C from A. If greater than zero enter amount to

must file the final return and any other return due for the deceased.

be refunded here and on Line 16 _____________________.

A joint return may be filed by the surviving spouse and the execu-

tor or administrator. The return must be signed by the surviving

E.) Subtract B and C from A. If less than zero, enter tax due here

spouse and the executor or administrator. If an executor or admin-

and on Line 18. Pay with return if $1.00 or more ________.

istrator has not been appointed, the surviving spouse may file a

INTEREST ON REFUNDS

joint return. The spouse must sign the return and add the notation

The City of Detroit will pay interest on overpayments as shown on

“Surviving Spouse.”

completed tax returns, if the overpayments are not refunded within

If refund is due, and the claimant is not a surviving spouse, Federal

45 days of April 30, or the filing date of the return, whichever is later.

Form 1310 and a copy of the death certificate must be filed with the

PLEASE NOTE: For interest purposes, a return will not be con-

return.

sidered complete if:

INTERNET

A.) The W-2 is improper or is not attached.

Additional information, return instructions and forms are available

B.) The return does not contain the required signatures.

at the website for the CITY OF DETROIT at

C.) The required schedules are not attached.

ESTATES AND TRUSTS

D.) Other required information is missing from the return.

Each trust or estate with gross income of $600 or more subject to

RENAISSANCE ZONE

Detroit tax must file. An estate or trust must file D-1041 which is

available from the Detroit Income Tax Division.

Areas in Detroit have been designated Renaissance Zones by the

EXTENSIONS

State of Michigan. Most income of qualified residents and busi-

nesses in those areas is not taxable. Contact the Renaissance Zone

A written request for extension of time for filing an annual return

Manager at 313/224-3053 to determine if you are in a Renaissance

on Form D-1040-EXT must be made to the Detroit Income Tax

Zone or if you qualify for tax exemption.

Director by the original due date (for 2014 tax year, April 30, 2015).

This extension, if approved, will be granted for a period not to

ROUNDING DOLLAR AMOUNTS

exceed six months.

Only whole dollar amounts are shown on the return. Do not enter

cents. Round DOWN all dollar amounts less than 50 cents. Round

UP all amounts of 50 through 99 cents.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4