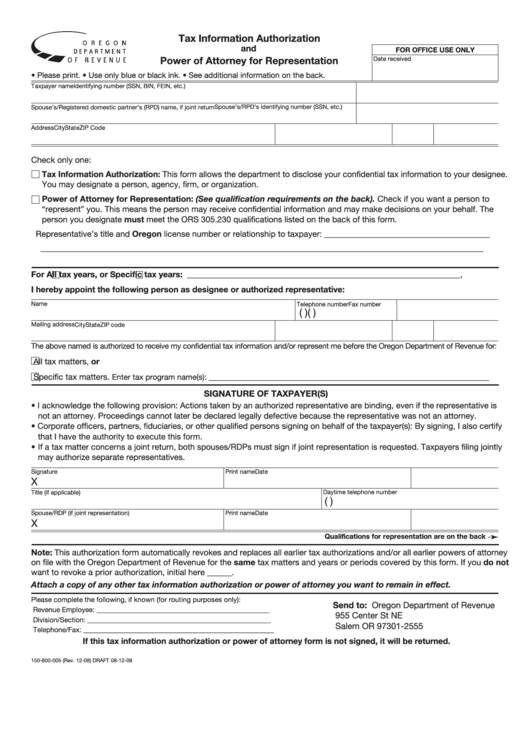

Form 150-800-005 Draft - Tax Information Authorization And Power Of Attorney For Representation

ADVERTISEMENT

Tax Information Authorization

and

FOR OFFICE USE ONLY

Power of Attorney for Representation

Date received

• Please print. • Use only blue or black ink. • See additional information on the back.

Taxpayer name

Identifying number (SSN, BIN, FEIN, etc.)

Spouse’s/RPD’s identifying number (SSN, etc.)

Spouse’s/Registered domestic partner’s (RPD) name, if joint return

Address

City

State

ZIP Code

Check only one:

Tax Information Authorization: This form allows the department to disclose your confidential tax information to your designee.

You may designate a person, agency, firm, or organization.

Power of Attorney for Representation: (See qualification requirements on the back). Check if you want a person to

“represent” you. This means the person may receive confidential information and may make decisions on your behalf. The

person you designate must meet the ORS 305.230 qualifications listed on the back of this form.

Representative’s title and Oregon license number or relationship to taxpayer: ________________________________________

___________________________________________________________________________________________________________

For

All tax years, or

Specific tax years: __________________________________________________________________ ,

I hereby appoint the following person as designee or authorized representative:

Name

Telephone number

Fax number

(

)

(

)

Mailing address

City

State

ZIP code

The above named is authorized to receive my confidential tax information and/or represent me before the Oregon Department of Revenue for:

All tax matters, or

Specific tax matters.

Enter tax program name(s): ________________________________________________________________________

SIGNATURE OF TAXPAYER(S)

• I acknowledge the following provision: Actions taken by an authorized representative are binding, even if the representative is

not an attorney. Proceedings cannot later be declared legally defective because the representative was not an attorney.

• Corporate officers, partners, fiduciaries, or other qualified persons signing on behalf of the taxpayer(s): By signing, I also certify

that I have the authority to execute this form.

• If a tax matter concerns a joint return, both spouses/RDPs must sign if joint representation is requested. Taxpayers filing jointly

may authorize separate representatives.

Signature

Print name

Date

X

Daytime telephone number

Title (if applicable)

(

)

Spouse/RDP (if joint representation)

Print name

Date

X

➛

Qualifications for representation are on the back

Note: This authorization form automatically revokes and replaces all earlier tax authorizations and/or all earlier powers of attorney

on file with the Oregon Department of Revenue for the same tax matters and years or periods covered by this form. If you do not

want to revoke a prior authorization, initial here ______.

Attach a copy of any other tax information authorization or power of attorney you want to remain in effect.

Please complete the following, if known (for routing purposes only):

Send to: Oregon Department of Revenue

Revenue Employee: _________________________________________________

955 Center St NE

Division/Section: ____________________________________________________

Salem OR 97301-2555

Telephone/Fax: ______________________________________________________

If this tax information authorization or power of attorney form is not signed, it will be returned.

150-800-005 (Rev. 12-08) DRAFT 08-12-08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2