Form IT-9

1998 Application for Automatic Extension

Revised 9/98

of Time to File Indiana Form IT-40 or Form IT-40PNR

SF 21006

Note: Form IT-9 is an automatic extension of time to file until June 15, 1999.

This IS NOT an extension of time to pay any state and/or county taxes due.

The purpose of Form IT-9: The IT-9 will allow you an automatic 60 day

Penalty and Interest: Indiana will accept the federal extension date, plus

extension for filing your IT-40, Indiana Individual Income Tax Return, or the

allow an additional 30 days. However, you must still pay 90% of your Indiana

IT-40PNR, Indiana Part-Year Nonresident Individual Income Tax Return.

taxes by April 15, 1999. If you don't, the extension is not valid and penalty

and interest will be charged on the balance due. Note: Interest is due on any

Who should file Form IT-9: You should file this form and pay your tax if you

amount not paid by the April 15, 1999 due date.

can't file your income tax return (IT-40 or IT-40PNR) by the due date of April

15, 1999 and you expect to owe additional tax. Form IT-9 does not allow you

How to File: You can complete the worksheet below to figure 90% of your

an extension of time to pay your taxes.

estimated income. Complete all information regarding your name(s), address

and social security number(s). You must also be aware of your (and your

The IT-9 does not extend the time for paying your income tax. The filing

spouse's) county of principal residence and county of principal work activity

extension is automatic if you pay at least 90% of your state and county taxes

as of January 1, 1998.

by April 15, 1999.

!

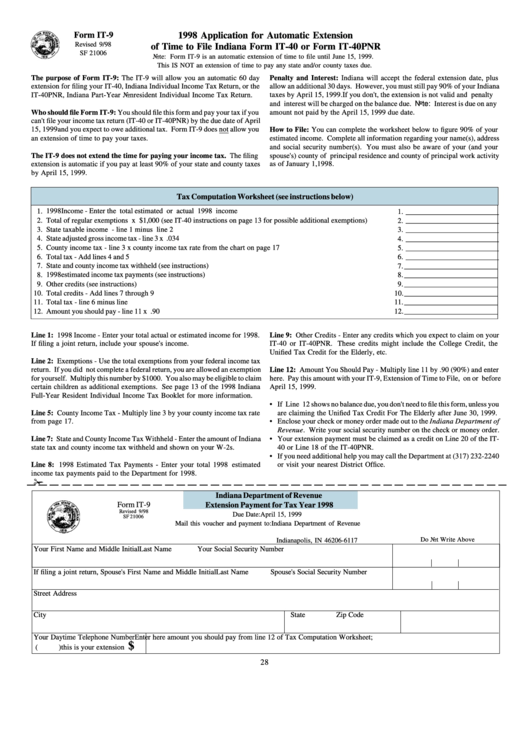

Tax Computation Worksheet (see instructions below)

1.

1998 Income - Enter the total estimated or actual 1998 income ..................................................................................

1.

_________________________

2.

Total of regular exemptions x $1,000 (see IT-40 instructions on page 13 for possible additional exemptions) .............

2.

_________________________

3.

State taxable income - line 1 minus line 2 ....................................................................................................................

3.

_________________________

4.

State adjusted gross income tax - line 3 x .034 ..................................................................................................................

4.

_________________________

5.

County income tax - line 3 x county income tax rate from the chart on page 17 ...........................................................

5.

_________________________

6.

Total tax - Add lines 4 and 5 ............................................................................................................................................

6.

_________________________

7.

State and county income tax withheld (see instructions) ..................................................................................................

7.

_________________________

8.

1998 estimated income tax payments (see instructions) ...................................................................................................

8.

_________________________

9.

Other credits (see instructions) ........................................................................................................................................

9.

_________________________

10.

Total credits - Add lines 7 through 9 ...............................................................................................................................

_________________________

10.

11.

Total tax - line 6 minus line 10.........................................................................................................................................

11.

_________________________

12.

Amount you should pay - line 11 x .90 ............................................................................................................................

12.

_________________________

Line 1: 1998 Income - Enter your total actual or estimated income for 1998.

Line 9: Other Credits - Enter any credits which you expect to claim on your

If filing a joint return, include your spouse's income.

IT-40 or IT-40PNR. These credits might include the College Credit, the

Unified Tax Credit for the Elderly, etc.

Line 2: Exemptions - Use the total exemptions from your federal income tax

return. If you did not complete a federal return, you are allowed an exemption

Line 12: Amount You Should Pay - Multiply line 11 by .90 (90%) and enter

for yourself. Multiply this number by $1000. You also may be eligible to claim

here. Pay this amount with your IT-9, Extension of Time to File, on or before

certain children as additional exemptions. See page 13 of the 1998 Indiana

April 15, 1999.

Full-Year Resident Individual Income Tax Booklet for more information.

• If Line 12 shows no balance due, you don't need to file this form, unless you

Line 5: County Income Tax - Multiply line 3 by your county income tax rate

are claiming the Unified Tax Credit For The Elderly after June 30, 1999.

from page 17.

• Enclose your check or money order made out to the Indiana Department of

Revenue. Write your social security number on the check or money order.

Line 7: State and County Income Tax Withheld - Enter the amount of Indiana

• Your extension payment must be claimed as a credit on Line 20 of the IT-

state tax and county income tax withheld and shown on your W-2s.

40 or Line 18 of the IT-40PNR.

• If you need additional help you may call the Department at (317) 232-2240

Line 8: 1998 Estimated Tax Payments - Enter your total 1998 estimated

or visit your nearest District Office.

income tax payments paid to the Department for 1998.

Indiana Department of Revenue

Form IT-9

Extension Payment for Tax Year 1998

Revised 9/98

Due Date: April 15, 1999

SF 21006

Mail this voucher and payment to: Indiana Department of Revenue

P.O. Box 6117

Do Not Write Above

Indianapolis, IN 46206-6117

Your First Name and Middle Initial

Last Name

Your Social Security Number

If filing a joint return, Spouse's First Name and Middle Initial

Last Name

Spouse's Social Security Number

Street Address

City

State

Zip Code

Your Daytime Telephone Number

Enter here amount you should pay from line 12 of Tax Computation Worksheet;

$

(

)

this is your extension payment...............................................................................

28

1

1