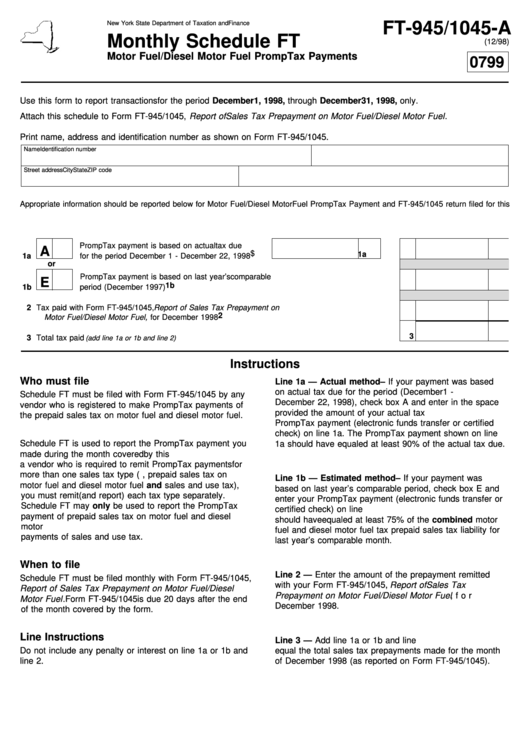

New York State Department of Taxation and Finance

FT-945/1045-A

Monthly Schedule FT

(12/98)

Motor Fuel/Diesel Motor Fuel PrompTax Payments

0799

Use this form to report transactions for the period December 1, 1998, through December 31, 1998, only.

Attach this schedule to Form FT-945/1045, Report of Sales Tax Prepayment on Motor Fuel/Diesel Motor Fuel .

Print name, address and identification number as shown on Form FT-945/1045.

Name

Identification number

Street address

City

State

ZIP code

Appropriate information should be reported below for Motor Fuel/Diesel Motor Fuel PrompTax Payment and FT-945/1045 return filed for this

period. Please read instructions below before completing.

PrompTax payment is based on actual tax due

A

for the period December 1 - December 22, 1998 . . . . . . $

1a

. . . .

1a

or

PrompTax payment is based on last year’s comparable

E

1b

1b

period (December 1997). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Tax paid with Form FT-945/1045, Report of Sales Tax Prepayment on

2

Motor Fuel/Diesel Motor Fuel, for December 1998 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Total tax paid

(add line 1a or 1b and line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Instructions

Who must file

Line 1a — Actual method – If your payment was based

on actual tax due for the period (December 1 -

Schedule FT must be filed with Form FT-945/1045 by any

December 22, 1998), check box A and enter in the space

vendor who is registered to make PrompTax payments of

provided the amount of your actual tax due. Enter your

the prepaid sales tax on motor fuel and diesel motor fuel.

PrompTax payment (electronic funds transfer or certified

check) on line 1a. The PrompTax payment shown on line

Schedule FT is used to report the PrompTax payment you

1a should have equaled at least 90% of the actual tax due.

made during the month covered by this schedule. If you are

a vendor who is required to remit PrompTax payments for

more than one sales tax type (i.e., prepaid sales tax on

Line 1b — Estimated method – If your payment was

motor fuel and diesel motor fuel and sales and use tax),

based on last year’s comparable period, check box E and

you must remit (and report) each tax type separately.

enter your PrompTax payment (electronic funds transfer or

Schedule FT may only be used to report the PrompTax

certified check) on line 1b. The PrompTax payment shown

payment of prepaid sales tax on motor fuel and diesel

should have equaled at least 75% of the combined motor

motor fuel. Use Schedule P for reporting PrompTax

fuel and diesel motor fuel tax prepaid sales tax liability for

payments of sales and use tax.

last year’s comparable month.

When to file

Line 2 — Enter the amount of the prepayment remitted

Schedule FT must be filed monthly with Form FT-945/1045,

with your Form FT-945/1045, Report of Sales Tax

Report of Sales Tax Prepayment on Motor Fuel/Diesel

Prepayment on Motor Fuel/Diesel Motor Fuel , for

Motor Fuel . Form FT-945/1045 is due 20 days after the end

December 1998.

of the month covered by the form.

Line Instructions

Line 3 — Add line 1a or 1b and line 2. This amount should

Do not include any penalty or interest on line 1a or 1b and

equal the total sales tax prepayments made for the month

line 2.

of December 1998 (as reported on Form FT-945/1045).

1

1