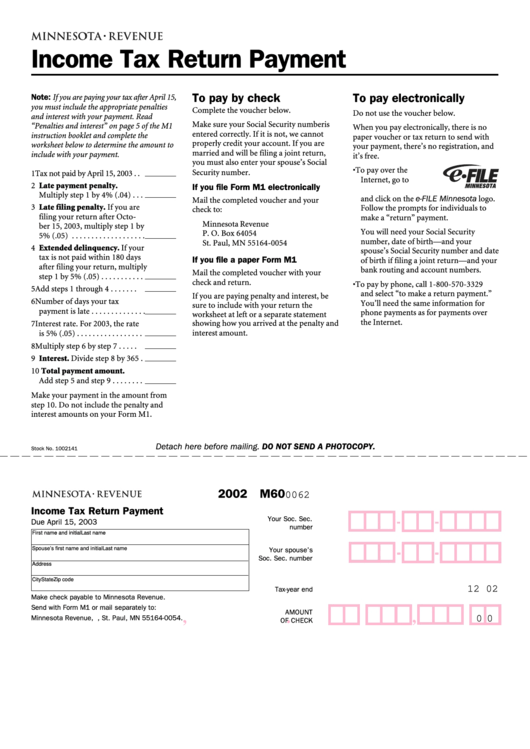

Form M60 - Income Tax Return Payment - Minnesota Department Of Revenue - 2002

ADVERTISEMENT

Income Tax Return Payment

Note: If you are paying your tax after April 15,

To pay by check

To pay electronically

you must include the appropriate penalties

Complete the voucher below.

Do not use the voucher below.

and interest with your payment. Read

Make sure your Social Security number is

“Penalties and interest” on page 5 of the M1

When you pay electronically, there is no

entered correctly. If it is not, we cannot

instruction booklet and complete the

paper voucher or tax return to send with

properly credit your account. If you are

worksheet below to determine the amount to

your payment, there’s no registration, and

married and will be filing a joint return,

include with your payment.

it’s free.

you must also enter your spouse’s Social

• To pay over the

Security number.

1 Tax not paid by April 15, 2003 . .

Internet, go to

2 Late payment penalty.

If you file Form M1 electronically

Multiply step 1 by 4% (.04) . . .

and click on the e-FILE Minnesota logo.

Mail the completed voucher and your

3 Late filing penalty. If you are

Follow the prompts for individuals to

check to:

filing your return after Octo-

make a “return” payment.

Minnesota Revenue

ber 15, 2003, multiply step 1 by

You will need your Social Security

P. O. Box 64054

5% (.05) . . . . . . . . . . . . . . . . . . .

number, date of birth—and your

St. Paul, MN 55164-0054

4 Extended delinquency. If your

spouse’s Social Security number and date

tax is not paid within 180 days

If you file a paper Form M1

of birth if filing a joint return—and your

after filing your return, multiply

bank routing and account numbers.

Mail the completed voucher with your

step 1 by 5% (.05) . . . . . . . . . . .

check and return.

• To pay by phone, call 1-800-570-3329

5 Add steps 1 through 4 . . . . . . .

and select “to make a return payment.”

If you are paying penalty and interest, be

6 Number of days your tax

You’ll need the same information for

sure to include with your return the

payment is late . . . . . . . . . . . . . .

phone payments as for payments over

worksheet at left or a separate statement

the Internet.

showing how you arrived at the penalty and

7 Interest rate. For 2003, the rate

interest amount.

is 5% (.05) . . . . . . . . . . . . . . . . .

8 Multiply step 6 by step 7 . . . . .

9 Interest. Divide step 8 by 365 .

10 Total payment amount.

Add step 5 and step 9 . . . . . . . .

Make your payment in the amount from

step 10. Do not include the penalty and

interest amounts on your Form M1.

Detach here before mailing. DO NOT SEND A PHOTOCOPY.

Stock No. 1002141

2002 M60

0062

Income Tax Return Payment

Your Soc. Sec.

Due April 15, 2003

number

First name and initial

Last name

Spouse’s first name and initial

Last name

Your spouse’s

Soc. Sec. number

Address

City

State

Zip code

12 02

Tax-year end

Make check payable to Minnesota Revenue.

Send with Form M1 or mail separately to:

AMOUNT

.

,

,

0 0

Minnesota Revenue, P.O. Box 64054, St. Paul, MN 55164-0054.

OF CHECK

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1