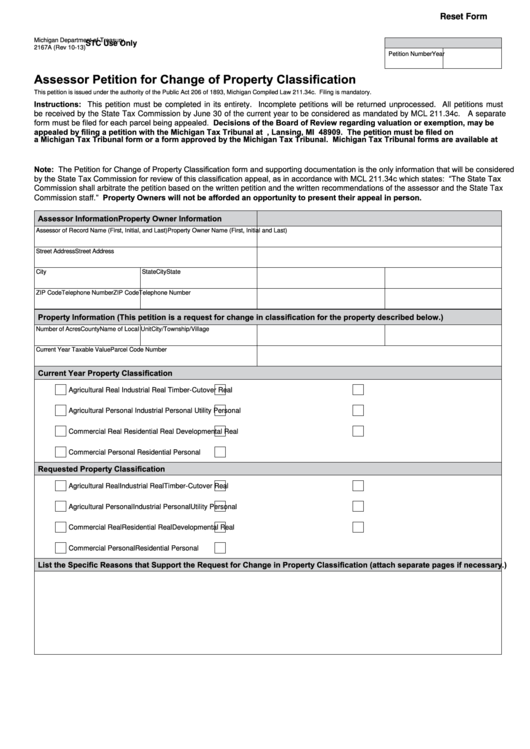

Reset Form

Michigan Department of Treasury

STC Use Only

2167A (Rev 10-13)

Petition Number

Year

Assessor Petition for Change of Property Classification

This petition is issued under the authority of the Public Act 206 of 1893, Michigan Compiled Law 211.34c. Filing is mandatory.

Instructions: This petition must be completed in its entirety. Incomplete petitions will be returned unprocessed. All petitions must

be received by the State Tax Commission by June 30 of the current year to be considered as mandated by MCL 211.34c. A separate

form must be filed for each parcel being appealed. Decisions of the Board of Review regarding valuation or exemption, may be

appealed by filing a petition with the Michigan Tax Tribunal at P.O. Box 30232, Lansing, MI 48909. The petition must be filed on

a Michigan Tax Tribunal form or a form approved by the Michigan Tax Tribunal. Michigan Tax Tribunal forms are available at

Note: The Petition for Change of Property Classification form and supporting documentation is the only information that will be considered

by the State Tax Commission for review of this classification appeal, as in accordance with MCL 211.34c which states: “The State Tax

Commission shall arbitrate the petition based on the written petition and the written recommendations of the assessor and the State Tax

Commission staff.” Property Owners will not be afforded an opportunity to present their appeal in person.

Assessor Information

Property Owner Information

Assessor of Record Name (First, Initial, and Last)

Property Owner Name (First, Initial and Last)

Street Address

Street Address

City

State

City

State

ZIP Code

Telephone Number

ZIP Code

Telephone Number

Property Information (This petition is a request for change in classification for the property described below.)

Number of Acres

County

Name of Local Unit

City/Township/Village

Current Year Taxable Value

Parcel Code Number

Current Year Property Classification

Agricultural Real

Industrial Real

Timber-Cutover Real

Agricultural Personal

Industrial Personal

Utility Personal

Commercial Real

Residential Real

Developmental Real

Commercial Personal

Residential Personal

Requested Property Classification

Agricultural Real

Industrial Real

Timber-Cutover Real

Agricultural Personal

Industrial Personal

Utility Personal

Commercial Real

Residential Real

Developmental Real

Commercial Personal

Residential Personal

List the Specific Reasons that Support the Request for Change in Property Classification (attach separate pages if necessary.)

1

1 2

2