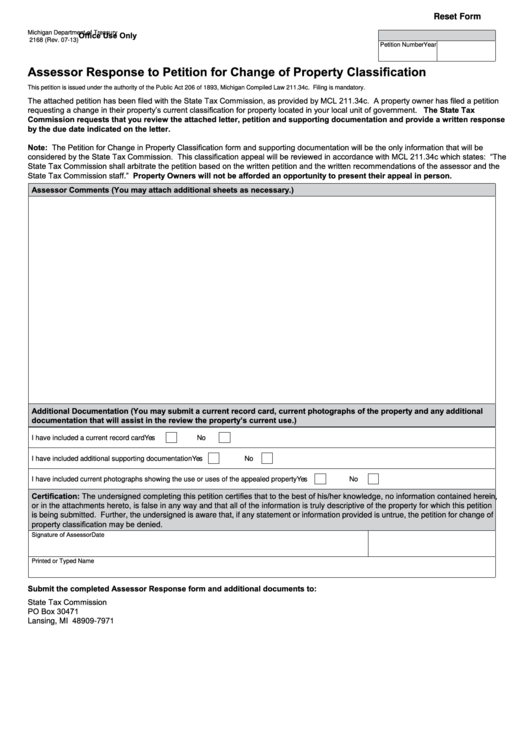

Reset Form

Michigan Department of Treasury

Office Use Only

2168 (Rev. 07-13)

Petition Number

Year

Assessor Response to Petition for Change of Property Classification

This petition is issued under the authority of the Public Act 206 of 1893, Michigan Compiled Law 211.34c. Filing is mandatory.

The attached petition has been filed with the State Tax Commission, as provided by MCL 211.34c. A property owner has filed a petition

requesting a change in their property’s current classification for property located in your local unit of government.

The State Tax

Commission requests that you review the attached letter, petition and supporting documentation and provide a written response

by the due date indicated on the letter.

Note: The Petition for Change in Property Classification form and supporting documentation will be the only information that will be

considered by the State Tax Commission. This classification appeal will be reviewed in accordance with MCL 211.34c which states: “The

State Tax Commission shall arbitrate the petition based on the written petition and the written recommendations of the assessor and the

State Tax Commission staff.” Property Owners will not be afforded an opportunity to present their appeal in person.

Assessor Comments (You may attach additional sheets as necessary.)

Additional Documentation (You may submit a current record card, current photographs of the property and any additional

documentation that will assist in the review the property’s current use.)

I have included a current record card

Yes

No

I have included additional supporting documentation

Yes

No

I have included current photographs showing the use or uses of the appealed property

Yes

No

Certification: The undersigned completing this petition certifies that to the best of his/her knowledge, no information contained herein,

or in the attachments hereto, is false in any way and that all of the information is truly descriptive of the property for which this petition

is being submitted. Further, the undersigned is aware that, if any statement or information provided is untrue, the petition for change of

property classification may be denied.

Signature of Assessor

Date

Printed or Typed Name

Submit the completed Assessor Response form and additional documents to:

State Tax Commission

PO Box 30471

Lansing, MI 48909-7971

1

1