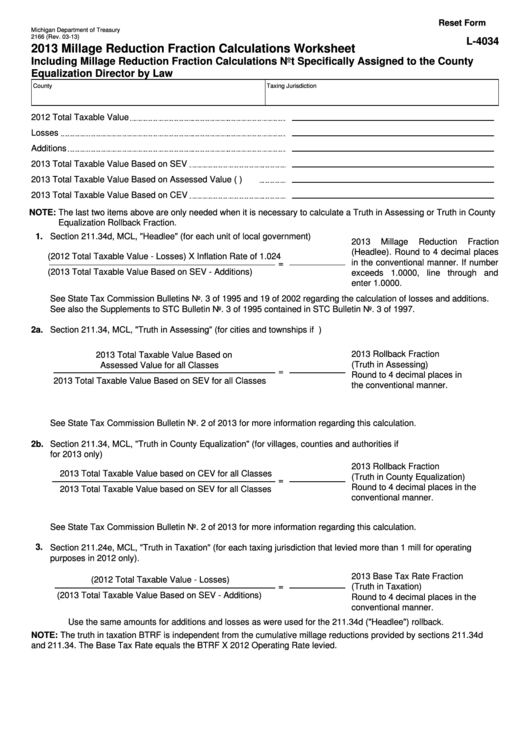

Reset Form

Michigan Department of Treasury

2166 (Rev. 03-13)

L-4034

2013 Millage Reduction Fraction Calculations Worksheet

Including Millage Reduction Fraction Calculations Not Specifically Assigned to the County

Equalization Director by Law

County

Taxing Jurisdiction

2012 Total Taxable Value

Losses

Additions

2013 Total Taxable Value Based on SEV

2013 Total Taxable Value Based on Assessed Value (A.V.)

2013 Total Taxable Value Based on CEV

NOTE: The last two items above are only needed when it is necessary to calculate a Truth in Assessing or Truth in County

Equalization Rollback Fraction.

1.

Section 211.34d, MCL, "Headlee" (for each unit of local government)

2013

Millage

Reduction

Fraction

(Headlee). Round to 4 decimal places

(2012 Total Taxable Value - Losses) X Inflation Rate of 1.024

in the conventional manner. If number

=

(2013 Total Taxable Value Based on SEV - Additions)

exceeds 1.0000, line through and

enter 1.0000.

See State Tax Commission Bulletins No. 3 of 1995 and 19 of 2002 regarding the calculation of losses and additions.

See also the Supplements to STC Bulletin No. 3 of 1995 contained in STC Bulletin No. 3 of 1997.

2a.

Section 211.34, MCL, "Truth in Assessing" (for cities and townships if S.E.V. exceeds A.V. for 2013 only)

2013 Rollback Fraction

2013 Total Taxable Value Based on

(Truth in Assessing)

Assessed Value for all Classes

=

Round to 4 decimal places in

2013 Total Taxable Value Based on SEV for all Classes

the conventional manner.

See State Tax Commission Bulletin No. 2 of 2013 for more information regarding this calculation.

2b.

Section 211.34, MCL, "Truth in County Equalization" (for villages, counties and authorities if S.E.V. exceeds C.E.V.

for 2013 only)

2013 Rollback Fraction

2013 Total Taxable Value based on CEV for all Classes

(Truth in County Equalization)

=

Round to 4 decimal places in the

2013 Total Taxable Value based on SEV for all Classes

conventional manner.

See State Tax Commission Bulletin No. 2 of 2013 for more information regarding this calculation.

3.

Section 211.24e, MCL, "Truth in Taxation" (for each taxing jurisdiction that levied more than 1 mill for operating

purposes in 2012 only).

2013 Base Tax Rate Fraction

(2012 Total Taxable Value - Losses)

=

(Truth in Taxation)

(2013 Total Taxable Value Based on SEV - Additions)

Round to 4 decimal places in the

conventional manner.

Use the same amounts for additions and losses as were used for the 211.34d ("Headlee") rollback.

NOTE: The truth in taxation BTRF is independent from the cumulative millage reductions provided by sections 211.34d

and 211.34. The Base Tax Rate equals the BTRF X 2012 Operating Rate levied.

1

1