Clear Form

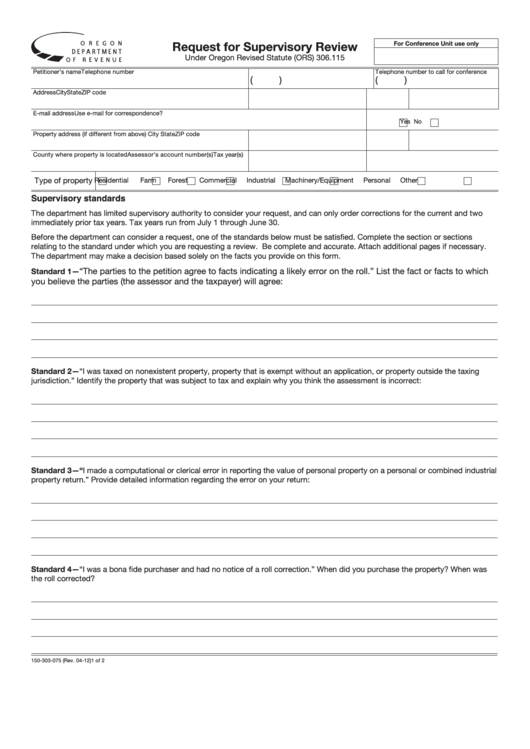

Request for Supervisory Review

For Conference Unit use only

Under Oregon Revised Statute (ORS) 306.115

Petitioner’s name

Telephone number

Telephone number to call for conference

(

)

(

)

Address

City

State

ZIP code

E-mail address

Use e-mail for correspondence?

Yes

No

Property address (if different from above)

City

State

ZIP code

County where property is located

Assessor’s account number(s)

Tax year(s)

Type of property

Residential

Farm

Forest

Commercial

Industrial

Machinery/Equipment

Personal

Other

Supervisory standards

The department has limited supervisory authority to consider your request, and can only order corrections for the current and two

immediately prior tax years. Tax years run from July 1 through June 30.

Before the department can consider a request, one of the standards below must be satisfied. Complete the section or sections

relating to the standard under which you are requesting a review. Be complete and accurate. Attach additional pages if necessary.

The department may make a decision based solely on the facts you provide on this form.

“The parties to the petition agree to facts indicating a likely error on the roll.” List the fact or facts to which

Standard 1—

you believe the parties (the assessor and the taxpayer) will agree:

Standard 2—“I was taxed on nonexistent property, property that is exempt without an application, or property outside the taxing

jurisdiction.” Identify the property that was subject to tax and explain why you think the assessment is incorrect:

Standard 3—“I made a computational or clerical error in reporting the value of personal property on a personal or combined industrial

property return.” Provide detailed information regarding the error on your return:

Standard 4—“I was a bona fide purchaser and had no notice of a roll correction.” When did you purchase the property? When was

the roll corrected?

150-303-075 (Rev. 04-12)

1 of 2

1

1 2

2