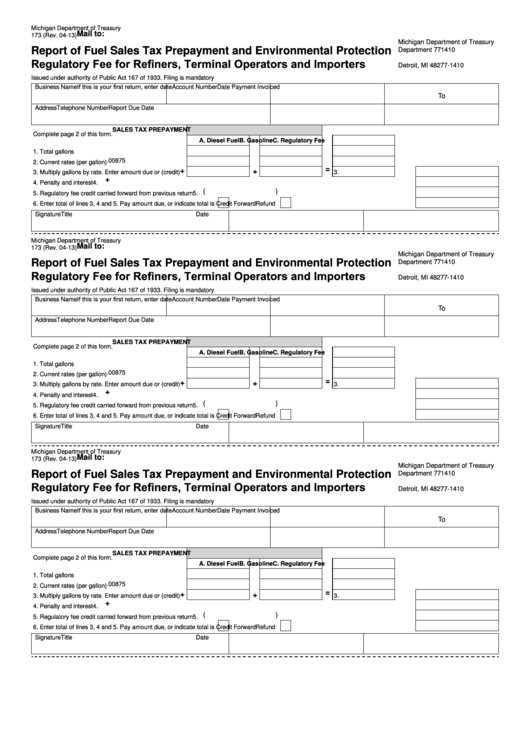

Michigan Department of Treasury

Mail to:

173 (Rev. 04-13)

Michigan Department of Treasury

Report of Fuel Sales Tax Prepayment and Environmental Protection

Department 771410

P.O. Box 77000

Regulatory Fee for Refiners, Terminal Operators and Importers

Detroit, MI 48277-1410

Issued under authority of Public Act 167 of 1933. Filing is mandatory

If this is your first return, enter date

Business Name

Account Number

Date Payment Invoiced

To

Address

Telephone Number

Report Due Date

SALES TAX PREPAYMENT

Complete page 2 of this form.

A. Diesel Fuel

B. Gasoline

C. Regulatory Fee

1. Total gallons ................................................................

.00875

2. Current rates (per gallon) ...........................................

=

+

+

3. Multiply gallons by rate. Enter amount due or (credit)

3.

+

4. Penalty and interest ...............................................................................................................................................................................

4.

(

)

5. Regulatory fee credit carried forward from previous return ...................................................................................................................

5.

6. Enter total of lines 3, 4 and 5. Pay amount due, or indicate total is

Credit Forward

Refund ............................................

6.

Signature

Title

Date

Michigan Department of Treasury

Mail to:

173 (Rev. 04-13)

Michigan Department of Treasury

Report of Fuel Sales Tax Prepayment and Environmental Protection

Department 771410

P.O. Box 77000

Regulatory Fee for Refiners, Terminal Operators and Importers

Detroit, MI 48277-1410

Issued under authority of Public Act 167 of 1933. Filing is mandatory

If this is your first return, enter date

Business Name

Account Number

Date Payment Invoiced

To

Address

Telephone Number

Report Due Date

SALES TAX PREPAYMENT

Complete page 2 of this form.

A. Diesel Fuel

B. Gasoline

C. Regulatory Fee

1. Total gallons ................................................................

.00875

2. Current rates (per gallon) ...........................................

=

+

+

3. Multiply gallons by rate. Enter amount due or (credit)

3.

+

4. Penalty and interest ...............................................................................................................................................................................

4.

(

)

5. Regulatory fee credit carried forward from previous return ...................................................................................................................

5.

6. Enter total of lines 3, 4 and 5. Pay amount due, or indicate total is

Credit Forward

Refund ............................................

6.

Signature

Title

Date

Michigan Department of Treasury

Mail to:

173 (Rev. 04-13)

Michigan Department of Treasury

Report of Fuel Sales Tax Prepayment and Environmental Protection

Department 771410

P.O. Box 77000

Regulatory Fee for Refiners, Terminal Operators and Importers

Detroit, MI 48277-1410

Issued under authority of Public Act 167 of 1933. Filing is mandatory

If this is your first return, enter date

Business Name

Account Number

Date Payment Invoiced

To

Address

Telephone Number

Report Due Date

SALES TAX PREPAYMENT

Complete page 2 of this form.

A. Diesel Fuel

B. Gasoline

C. Regulatory Fee

1. Total gallons ................................................................

.00875

2. Current rates (per gallon) ...........................................

=

+

+

3. Multiply gallons by rate. Enter amount due or (credit)

3.

+

4. Penalty and interest ...............................................................................................................................................................................

4.

(

)

5. Regulatory fee credit carried forward from previous return ...................................................................................................................

5.

6. Enter total of lines 3, 4 and 5. Pay amount due, or indicate total is

Credit Forward

Refund ............................................

6.

Signature

Title

Date

1

1 2

2 3

3