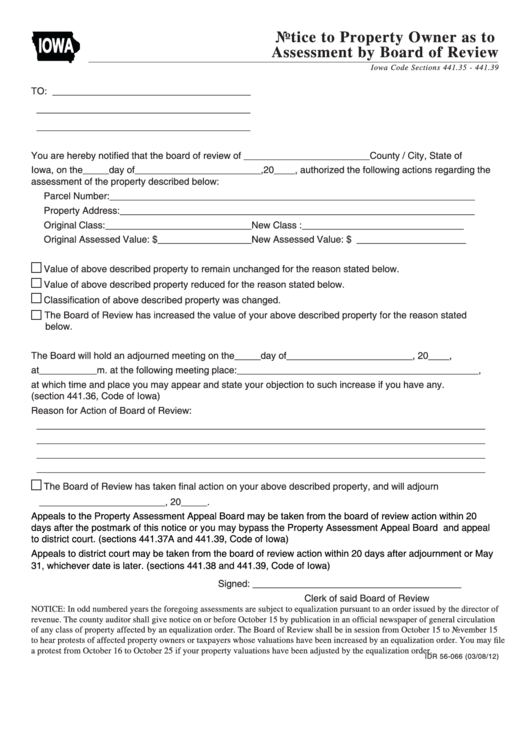

Form Idr 56-066 - Notice To Property Owner As To Assessment By Board Of Review

ADVERTISEMENT

Notice to Property Owner as to

IOWA

Assessment by Board of Review

Iowa Code Sections 441.35 - 441.39

TO: ______________________________________

_________________________________________

_________________________________________

You are hereby notified that the board of review of ________________________County / City, State of

Iowa, on the_____day of________________________,20____, authorized the following actions regarding the

assessment of the property described below:

Parcel Number: ______________________________________________________________________

Property Address: ____________________________________________________________________

Original Class: ____________________________

New Class : _______________________________

Original Assessed Value: $ __________________

New Assessed Value: $ _____________________

Value of above described property to remain unchanged for the reason stated below.

Value of above described property reduced for the reason stated below.

Classification of above described property was changed.

The Board of Review has increased the value of your above described property for the reason stated

below.

The Board will hold an adjourned meeting on the_____day of________________________, 20____,

at___________m. at the following meeting place:______________________________________________,

at which time and place you may appear and state your objection to such increase if you have any.

(section 441.36, Code of Iowa)

Reason for Action of Board of Review:

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

The Board of Review has taken final action on your above described property, and will adjourn

________________________, 20_____.

Appeals to the Property Assessment Appeal Board may be taken from the board of review action within 20

days after the postmark of this notice or you may bypass the Property Assessment Appeal Board and appeal

to district court. (sections 441.37A and 441.39, Code of Iowa)

Appeals to district court may be taken from the board of review action within 20 days after adjournment or May

31, whichever date is later. (sections 441.38 and 441.39, Code of Iowa)

Signed: ________________________________________

Clerk of said Board of Review

NOTICE: In odd numbered years the foregoing assessments are subject to equalization pursuant to an order issued by the director of

revenue. The county auditor shall give notice on or before October 15 by publication in an official newspaper of general circulation

of any class of property affected by an equalization order. The Board of Review shall be in session from October 15 to November 15

to hear protests of affected property owners or taxpayers whose valuations have been increased by an equalization order. You may file

a protest from October 16 to October 25 if your property valuations have been adjusted by the equalization order.

IDR 56-066 (03/08/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1