Form Gro 216 - Application For Registration - Gross Receipts Tax On Vending Machines Operated For The Benefit Of A Non-Profit Charitable Organization

ADVERTISEMENT

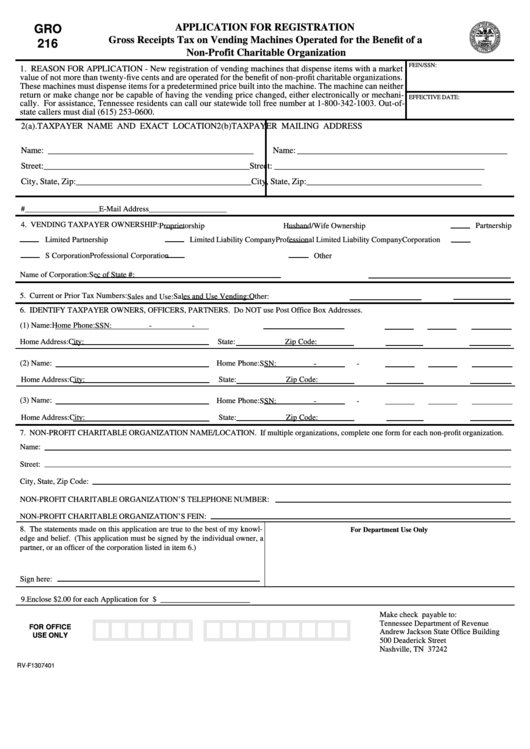

APPLICATION FOR REGISTRATION

GRO

Gross Receipts Tax on Vending Machines Operated for the Benefit of a

216

Non-Profit Charitable Organization

FEIN/SSN:

1. REASON FOR APPLICATION - New registration of vending machines that dispense items with a market

value of not more than twenty-five cents and are operated for the benefit of non-profit charitable organizations.

These machines must dispense items for a predetermined price built into the machine. The machine can neither

return or make change nor be capable of having the vending price changed, either electronically or mechani-

EFFECTIVE DATE:

cally. For assistance, Tennessee residents can call our statewide toll free number at 1-800-342-1003. Out-of-

state callers must dial (615) 253-0600.

2(a). TAXPAYER NAME AND EXACT LOCATION

2(b) TAXPAYER MAILING ADDRESS

Name: _______________________________________________

Name: ________________________________________________

Street: _______________________________________________

Street: ________________________________________________

City, State, Zip: ________________________________________

City, State, Zip: ________________________________________

3. TAXPAYER TELEPHONE NUMBER

__________________

Fax # ___________________ E-Mail Address ____________________

4. VENDING TAXPAYER OWNERSHIP:

Husband/Wife Ownership

Partnership

Proprietorship

Limited Partnership

Limited Liability Company

Professional Limited Liability Company

Corporation

S Corporation

Professional Corporation

Other

Name of Corporation:

Sec of State #:

5. Current or Prior Tax Numbers: Sales and Use:

Sales and Use Vending:

Other:

6. IDENTIFY TAXPAYER OWNERS, OFFICERS, PARTNERS. Do NOT use Post Office Box Addresses.

(1) Name:

Home Phone:

SSN:

-

-

City:

State:

Zip Code:

Home Address:

(2) Name:

Home Phone:

SSN:

-

-

Home Address:

City:

State:

Zip Code:

(3) Name:

Home Phone:

SSN:

-

-

Home Address:

City:

State:

Zip Code:

7. NON-PROFIT CHARITABLE ORGANIZATION NAME/LOCATION. If multiple organizations, complete one form for each non-profit organization.

Name:

Street:

City, State, Zip Code:

NON-PROFIT CHARITABLE ORGANIZATION’S TELEPHONE NUMBER:

NON-PROFIT CHARITABLE ORGANIZATION’S FEIN:

8. The statements made on this application are true to the best of my knowl-

For Department Use Only

edge and belief. (This application must be signed by the individual owner, a

partner, or an officer of the corporation listed in item 6.)

Sign here:

9. Enclose $2.00 for each Application for Registration ............................................................................................................ $ _______________________

Make check payable to:

Tennessee Department of Revenue

FOR OFFICE

Andrew Jackson State Office Building

USE ONLY

500 Deaderick Street

Nashville, TN 37242

RV-F1307401

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1