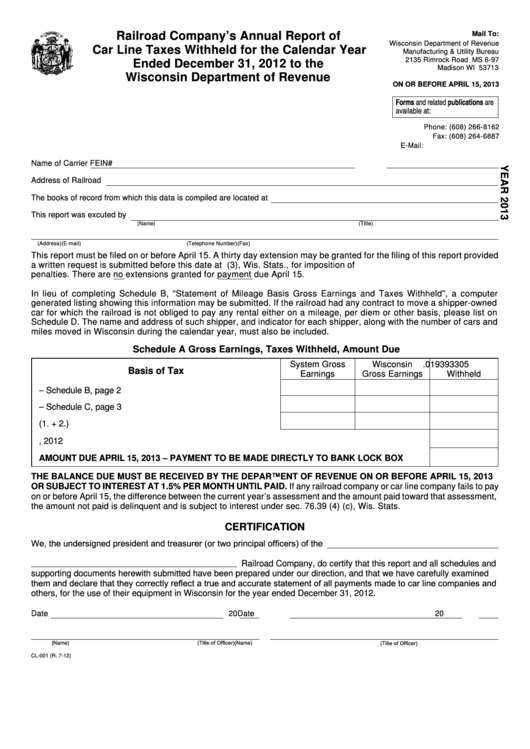

railroad Company’s Annual report of

mail to:

Wisconsin Department of Revenue

Car line taxes Withheld for the Calendar Year

Manufacturing & Utility Bureau

2135 Rimrock Road MS 6-97

ended December 31, 2012 to the

Madison WI 53713

Wisconsin Department of revenue

on or BeFore April 15, 2013

Forms and related publications are

available at:

Phone: (608) 266-8162

Fax: (608) 264-6887

E-Mail: utility@revenue.wi.gov

Name of Carrier

FEIN#

Address of Railroad

The books of record from which this data is compiled are located at

This report was excuted by

(Name)

(Title)

(Address)

(E-mail)

(Telephone Number)

(Fax)

This report must be filed on or before April 15. A thirty day extension may be granted for the filing of this report provided

a written request is submitted before this date at . See sec. 76.39(3), Wis. Stats., for imposition of

penalties. There are no extensions granted for payment due April 15.

In lieu of completing Schedule B, “Statement of Mileage Basis Gross Earnings and Taxes Withheld”, a computer

generated listing showing this information may be submitted. If the railroad had any contract to move a shipper-owned

car for which the railroad is not obliged to pay any rental either on a mileage, per diem or other basis, please list on

Schedule D. The name and address of such shipper, and indicator for each shipper, along with the number of cars and

miles moved in Wisconsin during the calendar year, must also be included.

schedule A Gross earnings, taxes Withheld, Amount Due

System Gross

Wisconsin

.019393305

Basis of tax

Earnings

Gross Earnings

Withheld

1. Mileage basis earnings – Schedule B, page 2 ....................

2. Non-mileage basis earnings – Schedule C, page 3 ............

3. Total Car Line Gross Earnings and Tax (1. + 2.) .................

4. Less Installment Payment September 10, 2012 ...............................................................................

Amount Due April 15, 2013 – pAYment to Be mADe DireCtlY to BAnK loCK BoX ........

the BAlAnCe Due must Be reCeiveD BY the DepArtment oF revenue on or BeFore April 15, 2013

or suBjeCt to interest At 1.5% per month until pAiD. If any railroad company or car line company fails to pay

on or before April 15, the difference between the current year’s assessment and the amount paid toward that assessment,

the amount not paid is delinquent and is subject to interest under sec. 76.39 (4) (c), Wis. Stats.

CertiFiCAtion

We, the undersigned president and treasurer (or two principal officers) of the

Railroad Company, do certify that this report and all schedules and

supporting documents herewith submitted have been prepared under our direction, and that we have carefully examined

them and declare that they correctly reflect a true and accurate statement of all payments made to car line companies and

others, for the use of their equipment in Wisconsin for the year ended December 31, 2012.

Date

20

Date

20

(Title of Officer)

(Title of Officer)

(Name)

(Name)

CL-001 (R. 7-12)

1

1 2

2 3

3 4

4